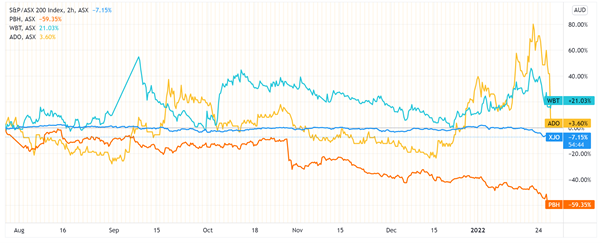

We examine the latest updates from Pointsbet Holdings Ltd [ASX:PBH], Weebit Nano Ltd [ASX:WBT], and AnteoTech Ltd [ASX:ADO].

Pointsbet shares fall after recording $51.75 million operating loss

Pointsbet, the wagering company that reached a peak of $17.60 a share in early 2021, continued its slide after reporting further losses in the December quarter.

PBH is down a significant 70% off its peak as investors continue to re-evaluate the stock and its cash flows.

Today, Pointsbet released its December quarter results.

It was a familiar story of overall growth in turnover — the dollar amount wagered by clients before any winnings are paid out or losses incurred — accompanied by substantial cash burn.

PBH’s turnover hit $1.33 billion in Q2 FY22, up 11% on the prior corresponding period.

However, the overall growth in turnover hid the fact that all the growth came from Pointsbet’s Australia segment.

PBH’s Australia segment saw turnover rise 34% to $727 million on the prior corresponding period (PCP).

Worryingly, though, the turnover of PBH’s lucrative US segment actually fell 9% on PCP in the December quarter to $598.9 million.

In a positive, Pointsbet’s US segment turnover did rise 72% quarter-on-quarter.

The overall growth in turnover was not enough to offset PBH’s losses.

Pointsbet recorded a net cash loss from operating activities of $51.75 million on customer receipts of $90.40 million.

Marketing and advertising accounted for 72% of PBH’s customer receipts, coming in at $65.65 million.

Cost of sales came in at $44.82 million.

Year to date (six months), Pointsbet has accumulated a net cash loss from operating activities worth $78.31 million.

Weebit shares rise 5% as WBT ‘executes ReRAM commercialisation plans’

Weebit Nano, the developer of semiconductor memory technology, today released its December quarterly report.

As a pre-revenue company heavily in the research and development stage, Weebit unsurprisingly registered a loss from its operating activities.

In the December quarter, Weebit posted a net cash loss from operating activities totalling $13.18 million.

WBT spent $11.77 million on R&D.

Having started the quarter with $18.99 million in cash, the operating loss would have been worrying were it not for the capital injections undertaken in the December quarter.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Weebit recorded $35.18 million from capital raisings and $7.20 million from the exercise of options.

Meaning that at quarter’s end, Weebit had cash and cash equivalents of $47.66 million.

Based on its December quarterly cash burn, WBT has about four quarters of funding available.

So I won’t be surprised if we see further capital raises in 2022.

WBT also laid out some goals it’s focused on achieving by the end of calendar 2022.

Weebit hopes to demonstrate the functionality and performance of its embedded ReRAM module by the end of the year while also signing new licensing agreements with ‘partners and customers.’

For those interested in the science behind Weebit’s memory chip technology, the company announced in today’s quarterly report that it had published a research paper in Applied Physics Letters.

The paper was a team effort between researchers from IIT Delhi, CEA-Leti, and Weebit itself.

As Weebit wrote:

‘The paper leverages multiple state-of-the-art concepts to realise energy efficient edge-AI hardware, including low-precision Binary Neural Networks (BNNs) for computer vision.’

The paper is available at https://doi.org/10.1063/5.0073284

AnteoTech shares tumble as TGA requests further information on ADO’s EuGeni reader

ADO shares fell 25% in Friday afternoon trading after providing an update on its communication with the Therapeutic Goods Administration regarding ADO’s COVID-19 rapid diagnostic test submission.

AnteoTech today said that following an information request last week, TGA has contacted AnteoTech again this week for further information.

As ADO writes in today’s ASX release:

‘The most recent request primarily relates to the collation of additional clinical data, together with other aspects of information. The TGA continues to work collaboratively with AnteoTech to work through the specifics of the request and how best to address the clinical data requirements. This will allow the Company to determine the expected timeframe needed to gather the additional information and fulfil the conditions of the TGA’s guidelines.’

ADO is currently conducting a prospective clinical trial to evaluate the clinical performance of its EuGeni SARS-CoV-2 rapid diagnostic test.

AnteoTech anticipates that this trial will ‘provide any further data that may be required to meet the clinical data requirements set by the TGA.’

ADO did issue a warning.

AnteoTech admitted that the current Omicron wave and the associated strain on the health system is ‘impacting the timeline of the study.’

The company was not able to provide specific dates or timelines, saying only that it will update the market ‘when more details and the required data gathering plans have been established.’

Decarbonisation and the future of commodities

Now, here at Money Morning we like to keep abreast of emerging trends set to shake up landscape.

One of the biggest such trends is decarbonisation.

The world is going green and is setting ambitious targets to curb greenhouse gas emissions.

But a green future has its costs.

The road to a sustainable world will be paved with commodities like lithium, nickel, and copper.

The prices for these commodities have already shot up in 2021…but can the run continue in 2022 and beyond?

We address these, and other, questions in a few recent research reports.

If you want extra information on lithium — especially evaluating and comparing lithium miners — I suggest reading our comprehensive lithium guide.

It’s thorough and takes you through vital factors to consider when pondering the lithium sector and individual lithium stocks.

And if you’re interested in seeing where the demand for copper and nickel is heading, I suggest checking out our latest nickel and copper guide.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here