The Fortescue Metals Group Ltd [ASX:FMG] shipped 45.6 million tonnes in the September quarter, a record for a first quarter.

The shipments were also up 3% on Q1 FY21.

Fortescue Metals Group Ltd [ASX:FMG] share price was relatively flat on the news, exchanging hands for $14.05 per share at time of writing, up 0.5%.

After a surge in iron ore prices earlier in the year saw FMG shares reach an all-time high of $26.58, the iron ore pure play stock has shed 45% as the spot price of iron ore plunged on waning demand from China, Evergrande worries, and the prospect of more supply from Brazil.

Fortescue’s September quarter in numbers

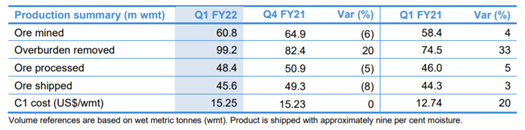

Fortescue was quick to note that Q1 FY22’s shipments were a record for a first quarter, notching a 3% gain on Q1 FY21.

However, the September quarter’s shipments were down 8% on Q4 FY21, when FMG managed to ship 49.3 million wmt as opposed to Q1 FY22’s 45.6 million wmt.

FMG’s average revenue was US$118/dmt, a revenue realisation of 73% of the average Platts 62% CFR Index.

The miner’s average revenue for FY21 was US$135/dmt, with an 88% average revenue realisation.

The miner’s C1 cost in Q1 FY22 of US$15.25 was in line with the previous quarter but came in a whole 20% higher than Q1 FY21 (US$12.74/wmt).

Source: Fortescue presentation

Source: Fortescue presentation

Fortescue attributed the elevated C1 costs relative to Q1 FY21 to the appreciation of the AUD:USD exchange rate, inflation in key input costs like diesel and labour, and integration of the new mining hub at Eliwana.

FMG management commented:

‘In a strong start to FY22, mining, processing, rail and shipping combined for record first quarter shipments of 45.6mt, three per cent higher than the prior comparable period. Ore processed and railed also achieved record first quarter volumes, reflecting strong operational performance across the supply chain and expanded system capacity following the ramp up of Eliwana.’

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

FMG’s FY22 guidance

Fortescue provided the market with the following FY22 guidance.

- Iron ore shipments of 180–185mt

- C1 cost of US$15.00–15.50/wmt

- Capital expenditure (excluding Fortescue Future Industries) of US$2.8–3.2 billion

For reference, FMG’s FY21 production results included shipping 182.2mt at C1 cost of US$13.93/wmt.

In a sign of the greener times, Fortescue also mentioned its renewable energy plans.

FMG said its Fortescue Future Industries arm is taking a ‘global leadership position’ with a vision to make green hydrogen the most globally traded seaborne commodity in the world.

Fortescue noted that FFI is a key enabler of Fortescue’s decarbonisation strategy, including its recently announced target to achieve net-zero Scope 3 emissions by 2040.

Fortescue Chief Executive Officer Elizabeth Gaines said:

‘Fortescue’s strategy to diversify continues to gain momentum with Fortescue Future Industries’ (FFI) recent announcement to develop a renewable energy and green hydrogen manufacturing center at Gladstone, Queensland as well as agreements with Incitec Pivot and Plug Power.

‘We are committed to working with our customers, suppliers and other industry participants to facilitate the reduction of emissions, including technology development and the supply of green hydrogen and ammonia through FFI, with these initiatives enabling our commitment to achieve net zero Scope 3 emissions by 2040.’

However, when it comes to Fortescue, the outlook for iron ore demand is front and centre.

But what often goes unremarked is the impact a falling iron ore price will have — not only on the big miners — but on our economy as a whole.

What will the Reserve Bank do? Will it keep rates low for longer if Australia’s terms of trade are hurt by a depressed iron ore price? And what will this mean for the markets?

How should investors position themselves?

Our Editorial Director Greg Canavan just recently released a research report on this very issue. I think it is worth your while to give it a read.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here