Fourth largest Iron ore giant Fortescue Metals Group [ASX:FMG] celebrates a new record across the term of six months to December, boasting its ‘best ever half year operating performance’.

‘We are now nearing the 200 million tonne annualised rate in our iron ore business even before we commission Iron Bridge’, said Fortescue’s Executive Chairman, Dr Andrew Forrest.

‘Our Company has never performed better on the mining, exploration, green hydrogen and green energy development front.’

96.9 million tonnes of iron ore was shipped from July through to December, 17% higher than the same time four years ago.

As the ASX 200 moved up 0.4% earlier today, Fortescue jumped more than 3%, though levelled by noon.

An FMG share was worth $22.27 at the time of writing, the FMG share price having intensified 11% in FY23 so far.

Source: TradingView

Fortescue Metals ships new iron ore record

Earlier today, the metals mining giant Fortescue boasts a new shipping record in the six months to July through December 2022.

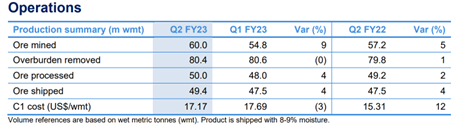

Iron ore shipments reached 49.4 mt (million tonnes) in the second quarter of FY23, adding to a grand total of 96.9 million tonnes iron ore in the half year, 4% more than last year and 17% in growth since 2018.

In terms of sales, the group recorded an average revenue of US$87 per dmt (dry metric tonne), realising 88% of the average Platts 62% CFR Index for the quarter.

The financial side was also helped by lowering 3% in C1 costs compared with the previous quarter, at US$17.7 per wmt (wet metric tonne).

Now, this has Fortescue on the right track to reach its top end of full-year export guidance.

Dr Forrest commented:

‘The Fortescue team delivered our highest ever December quarterly shipments of 49.4 million tonnes, our best ever half year, grew the mineral and green energy business globally, strengthened our balance sheet, kept costs low, all while maintaining our excellent safety performance.

‘Fortescue will step beyond fossil fuels this decade, saving shareholders approximately US$1 billion a year and setting the global stage for all environmentally responsible companies to follow.’

FMG said its costs for Iron Bridge construction are expected to approach US$3.8 billion (AU$5.3 billion).

Meanwhile, civil works in installing the solar farm for the Pilbara Energy Connect program has begun. Fiona Hick has been appointed as CEO of the core FMG group.

Source: FMG

Fortescue’s expectations seem realistic

The company reported a cash increase to US$4.0 billion (net debt of US$2.1 billion) at 31 December 2022 after capital expenditure of US$728 million was incurred in the quarter.

Guidance for FY23 shipments is maintained at 187–192mt, the higher end of annual export targets, despite shipments from Iron Bridge expected to dip to less than the previously guided 1mt mark.

Having said that, Fortescue’s other mines have a strong track record, and should offer sound support in assisting the company’s target of exporting its 187–192 million tonnes goal during FY23.

Fortescue can now boast five consecutive years of first-half export growth, a comforting indication that the metals miner has both the experience and the assets to steer itself towards meeting goals.

Guidance for FY23 C1 cost and capital expenditure remains unchanged.

An incoming boom for commodities

Our resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

Similar patterns that occurred 20 years ago are happening again.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’.

A boom where Australia (and ASX stocks) stands to benefit…

The next big mining boom is predicted to happen in the next few years.

The same investors that got rich last time are preparing to make their move — don’t let them take the monopoly again.

You can learn from James’ experiences AND access an exclusive video on his personalised ‘attack plan’ right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia