Global stocks are selling off.

But despite that, US tech’s Mag-7 remains priced to perfection. Any gains from here remain a speculative throw of the dice.

That’s why if you want to capture long-term growth from this pullback, your focus shouldn’t be on these futuristic mega-caps but on the old economy — commodities!

This is a classic value investors’ market, if you’re willing to look at the right areas.

But even amongst this ‘cheap’ sector, there are certain stocks offering even greater value.

They’re what I’ve dubbed ‘Mining’s Suicide Seven!’

Stocks that have caused massive heartache for investors over the last couple of years…earnings downgrades, poorly timed acquisitions, operational challenges.

Importantly though, throughout these difficulties, their underlying asset remains sound.

Now, I’m not saying you should rush out and buy these stocks; these are NOT currently recommendations for my paid readership group.

However, each one holds an element of ‘turn-around’ potential…seven miners with interesting contrarian flavours.

But if you do look at these stocks, tread carefully. All investing carries risks and these are no exception. Perhaps look at applying a tight stop loss (a fixed exit price).

These are not stocks for the faint-hearted.

So, here goes…

Throughout March, I’ll be detailing seven stocks that could undergo a major rebound in 2025. We’ll start with two of those today:

#1: Fortescue Metals [ASX:FMG]

This $52 billion major is not a speculative resource play, but given the company’s price action over the last 12 months, it may as well be!

After topping out in February 2024, this iron ore major plummeted over 45% last year and has continued to troll multi-year lows.

While FMG did have a spark of optimism earlier in the year, those gains evaporated after its woeful earnings report last month.

First-half profit plunged by 53 per cent, forcing Fortescue to slice its dividend payout by more than 50 per cent.

But despite the pessimism and earnings drop, Fortescue is still hovering just above its major low from mid-2024:

| |

| Source: TradingView |

That trough marked a period of peak pessimism in China’s economic outlook, which offers a clear line in the sand for FMG investors.

A break below signals major price weakness, but if FMG consolidates around these levels, that could offer a foundation for a recovery.

So, what might spark a turnaround in 2025?

As you know, China’s economic outlook is key to the future of iron ore miners.

FMG could rally if China follows through with its promise to take ‘whatever means necessary’ to counter the impacts of Trump’s tariffs this year.

In other words, stimulus.

For the moment, the market is not willing to price any uplift from these stimulus promises. But that’s the opportunity here.

Full disclosure: I added FMG shares to my Super Fund last week. But as I detailed above, I’ll keep a tight stop on this one.

#2: Boss Energy [ASX:BOE]

Next on our Mining’s Suicide Seven list comes the South Australian uranium miner Boss Energy.

Like many of the stocks on this list, Boss was a former market darling who turned ugly.

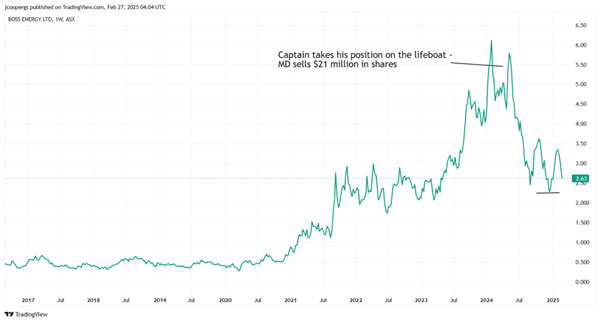

Shareholders remain sour over the MD’s infamous decision to sell over $21 million shares in early 2024.

That was when BOE traded at a near-all-time highs:

| |

| Source: TradingView |

Since then, the stock has plummeted by over 50%.

A sinking uranium spot price and operation hurdles also contributed to Bosses’ recent demise.

But sitting on the sidelines, watching BOE’s precipitous rise and heavy falls last year, means you’ve potentially sidestepped the miners’ volatile transition phase from developer to miner.

From here on, conditions could be far more stable.

Boss continues to ramp up its Honeymoon operation in South Australia.

The company drummed 226,600 pounds (lbs) of triuranium octoxide during the half-year ending December 31, an increase of over 190,000 lbs compared to the half-year ending June 30, 2024.

As of 31 December 2024, Boss has no debt and $251.6 million of liquid assets.

In my mind, this has the hallmarks of a turnaround.

By the way, if you’re interested in learning more, my colleague Nick Hubble and I recorded a video on the uranium market last week.

Hit play on the thumbnail to watch the video.

Stay tuned; next time, I’ll reveal the next stocks in this list!

Until then,

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments