I have a mate currently living in Perth.

He travelled there from his home in Melbourne in March 2020 for a short visit to see his young daughter.

When the borders shut, he had to make a snap decision whether to stay or return to Melbourne.

Almost two years later, and he’s still there!

His mates packed up his apartment, loaded his car onto a train, and the move was made permanent.

It couldn’t have been a better decision.

Not only did he miss the long lockdowns in Melbourne, but he’s also been working in Perth’s real estate market and riding the boom in land values that promise to keep pumping for the remainder of the cycle!

Yes, Perth’s real estate market is going gang busters.

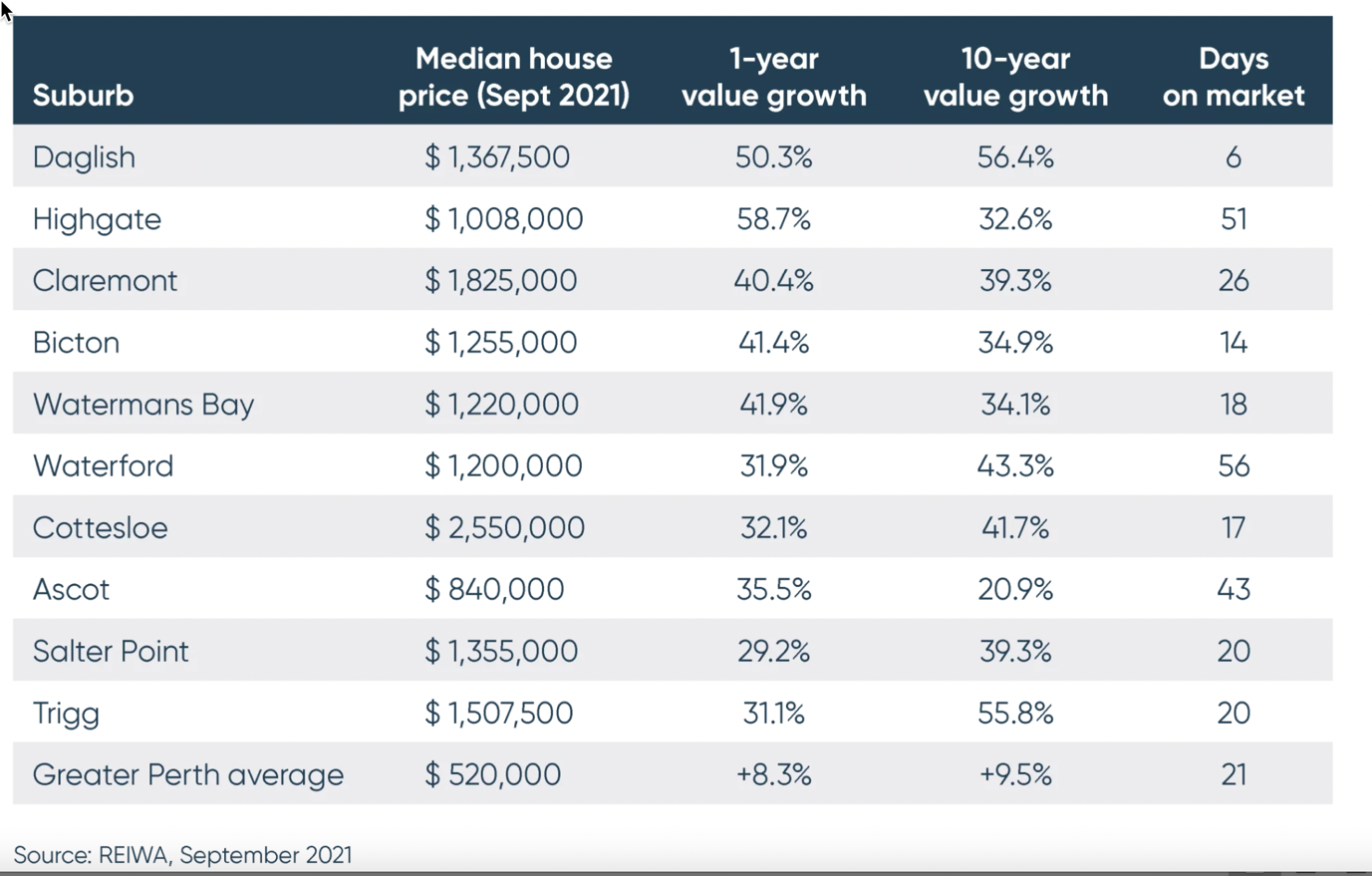

To date, the top 10 performing suburbs in Perth that have had the greatest gains are listed in the chart below.

Just take a look!

|

|

|

Source: REIWA |

Capital gains of more than 50% in some suburbs! Average ‘days on the market’ before properties are snapped up by ex-pats and investors as low as six.

As you can see from the price tag, these are all premium regions.

But be assured, neighbouring areas will start to benefit from the ripple effect as the population increases.

And I’m confident it will.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Government spending is one reason.

Premier Mark McGowan has promised to pump millions into the economy ($185 million), attracting tourists and skilled migrants — doctors, nurses, secondary teachers, backpackers, etc…

He wants to promote WA as a ‘safe and welcoming’ destination.

International students will be offered monetary support for accommodation.

Millions will be spent attracting ‘blockbuster international events’.

This will inevitably induce population growth and that will spur land values even higher.

It’s all going to feed into Perth’s property boom that we’ve been forecasting over at Cycles, Trends & Forecasts since 2019!

Yes, you read that right. Back in 2019, we saw it coming — before the COVID-panic.

At that time, real estate values in Perth had been in a depressive slump for more than a decade.

Housing prices were lower than they had been 13 years previously.

However, I maintained that there was a massive boom to come — and it would start in 2020.

Here are a few snippets from a report I wrote to subscribers toward the end of 2019:

‘Perth is now approaching the bottom of its cycle. There are several indicators that a turn is ahead.

‘It won’t be this year, but by mid-2020 we should see a change…

‘High commodity prices will create enormous wealth. And history shows it will flow into the surrounding real estate market.

‘There are also some big infrastructure projects in the pipeline, including major upgrades to the road network and airport.

‘Because Perth is coming from such a low base — the rise in capital growth in the years to come could be very positive indeed…

‘…there is potentially a massive boom ahead in WA/Perth.’

Even when writing this against the backdrop of the previous decade — it was hard to see exactly how it would play out.

But analysis of Australia’s real estate and commodity cycle showed that the forecast was indeed solid.

The 2020 pandemic and COVID migration has merely inflamed the trend — and the boom in values has only just started.

Investors that acted on the information we shared back in 2019, would have put themselves in a great position to make windfall gains.

But that doesn’t mean it’s too late to step in!

The key to all of this is to gain a true understanding of the dynamics behind the real estate cycle that we teach over at Cycles, Trends & Forecasts.

It will help you to forecast the future as confidently as we do!

Regards,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.