In today’s Money Morning…solar frenzy means we need batteries…my kooky friend had this idea a year ago…the obvious clean energy plays bolted long ago…and more…

It’s a frantic finish to the year to be sure.

Chaos in Sydney, Bitcoin [BTC] up, US vaccine rollout underway, a new strain in the UK, a China coal ban, and a massive cyber-attack in the US.

Some days it seems like there’s just too much news to consume.

But as an investor it pays to be discerning — and it’s all about finding the news that matters the most.

Which is why today, I’m going to draw your attention to a headline that I think is indicative of where your focus should be going into 2021.

Here it is:

|

|

| Source: Australian Financial Review |

Now, who is Les Hosking?

And why is this headline so important?

To explain, let me cast your mind back to a story we covered in October.

Three Ways to Invest in the Renewable Energy Boom

Solar frenzy means we need batteries, but also this…

Two months ago, news broke that solar in WA made up half of total grid demand.

I said the following:

‘Solar is becoming so important when it’s sunny, that grid operators don’t know what to do with excess power.

‘And the fact that solar made up half of total demand in September in WA is huge.

‘But it has one consequence…

‘Excess power has to go somewhere when the sun’s out, in preparation for when the clouds come.

‘This means batteries — really, really big batteries.’

Looking back, this was largely stating the obvious.

But there’s a ‘second-order’ effect lurking in the background here.

By that I mean, a consequence of a consequence.

And in order for a legitimate clean energy market in Australia to move forward, a futures exchange is needed.

A Futures Exchange for Clean Energy Investment

In practice this would allow, ‘clean energy producers and retailers to hedge against price volatility through forward contracts tradeable on a public exchange.’

In turn, setting off a series of causally linked events which I’ll get to in a moment.

You see, Les Hosking is the former head of the Sydney Futures Exchange, and he’s looking to facilitate a ‘once in a lifetime shift’ to clean energy.

To facilitate the shift, innovation is needed (emphasis added):

‘While an energy futures market already exists in Australia, it is predominantly for contracts with traditional baseload-style energy generators.

‘Mr Hosking said the new market would open futures contracts and trading to the new generation of decentralised or smaller-scale energy generation that was often intermittent rather than baseload, as well as to the growing battery storage sector. There are also plans to include futures contracts for hydrogen, though Mr Hosking conceded that was a long way off.

‘Potential users of the exchange could range from large solar and wind farms to small businesses and households with rooftop solar and lithium-ion batteries. He said opening futures markets to this new generation of energy producers would allow them to reduce risk and gain price transparency.’

This is how Australian clean energy goes legit — with a futures market that ensures price discovery can take place.

My kooky friend had this idea a year ago…

An old university friend of mine who is an electrical engineer pitched me this very same idea a year ago.

He has a block of apartments with rooftop solar and a battery.

The power from the solar panels feeds back into the grid, providing power bill credits to him depending on how much sun there is.

His idea was to package or securitise this income stream and then create a tradeable derivative.

It was certainly a left-field idea, but to see it become a reality today is a sign of the times.

Which brings me to my final point…

The obvious clean energy plays bolted long ago

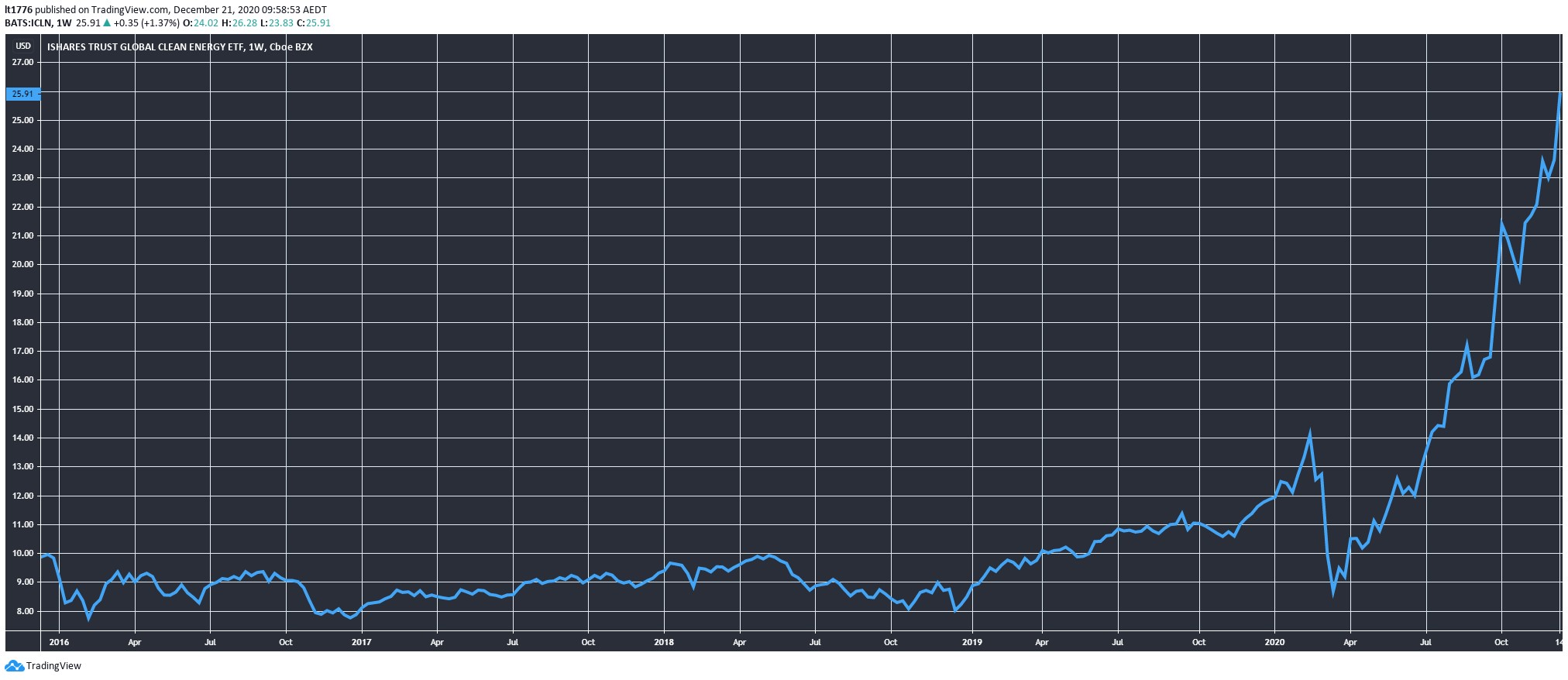

If you had the foresight, you may have jumped on a company like First Solar Inc [NASDAQ:FSLR] in March, or even iShares Global Clean Energy ETF [ICLN].

ICLN’s chart is bonkers:

|

|

| Source: Tradingview.com |

Now, if you are an ambitious investor, these types of charts can be dangerous.

In the same way you don’t want to catch a falling knife, you also shouldn’t be looking to join the bandwagon.

Which is why you need to look further ahead than others.

In this case, I’m thinking about smaller mining companies with battery metals, early-stage hydrogen developers, battery recyclers, and even nuclear.

This is what comes after the obvious winners from the clean energy revolution.

It’s a risky strategy for sure, but if your risk appetite is up to it — you should be thinking about these things right now.

You can find out all about this clean energy ‘Second Order’ right here.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

PS: Check out the links to learn everything there is to know about the clean energy market in Australia and investing in renewables.