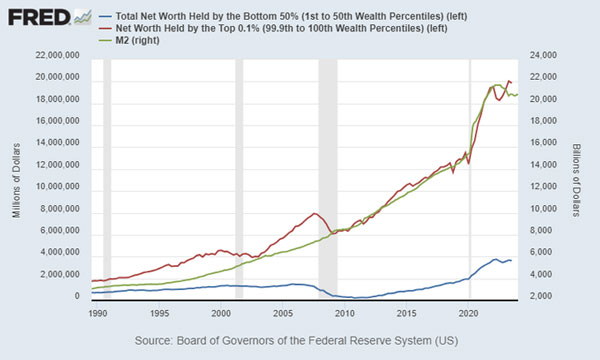

Check out this extraordinary chart:

|

|

|

Source: Board of Governors of the Federal Reserve System |

The red line shows the net wealth of the top 0.1%. The blue line shows the bottom 50%. And the green line shows the supply of money (M2).

It doesn’t take an economics PhD to see something seriously disturbing here.

There’s a clear link between the mega-rich getting richer and growth in the money supply.

This isn’t a new phenomenon.

18th-century economist Richard Cantillon first observed this almost 300 years ago.

As the Mises Institute explains:

‘One of Cantillon’s greatest insights involved the uneven effects of monetary expansion. New money enters the economy at a particular point—the first spender of new money acquires goods from the market, and those sellers may now use the money to increase their demands for goods, and so on.

‘The money ripples out from its origin, providing real benefits to those closest to the center.

‘In our modern world with fiat money and central banking, the government, banks, and privileged financial institutions are at the center.

‘Those on fixed incomes and those who don’t have assets to sell to those earlier in the spending chain are on the outskirts. Money printing creates winners and losers, and perpetual money printing creates big winners and big losers.’

Sure, you may have even inadvertently benefitted from this process too — usually through property or share ownership — but it’s no wonder the ruling classes can’t stop printing money.

Because they always benefit the most!

That’s what the chart at the start shows, clear as daylight.

Which brings me to the latest example of this phenomenon…

Thieves in the Night

At 2:00am on Saturday morning, the US Senate passed a US$1.2 trillion ‘omnibus’ spending bill.

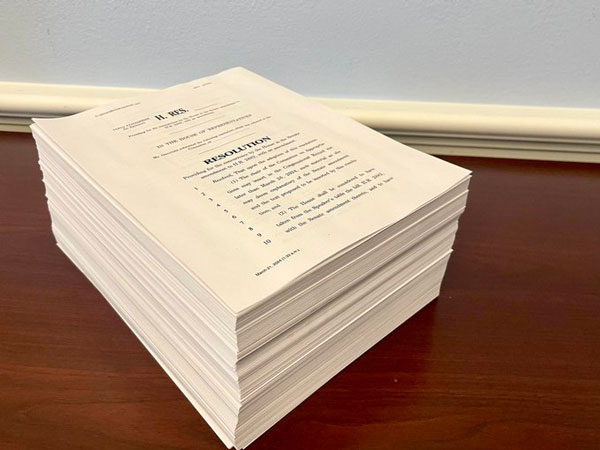

This is what it looked like:

|

|

|

Source: x.com |

That’s 1,012 pages stuffed full of spending demands from special interests in just one bill.

As one commentator noted:

‘The Omnibus bill just passed. This is not how our country was supposed to work…

‘There are supposed to be individual bills for each department of government. Not one giant bill stuffed with lobbyist demands forced through in 24 hours.

‘We pay taxes and they literally rob us.’

It may not be supposed to work this way, but as the chart at the start showed, it’s clear why it does work like that.

The ‘Cantillon effect’ is as real now as it was three centuries ago.

However, this time, the power of money is wielded at the stroke of a pen.

You don’t need to find gold or do anything else to inject money into the system.

The Fed’s Neel Kashkari said as much during the Covid crisis stating on 60 Minutes that the Fed has ‘an INFINITE amount of cash’.

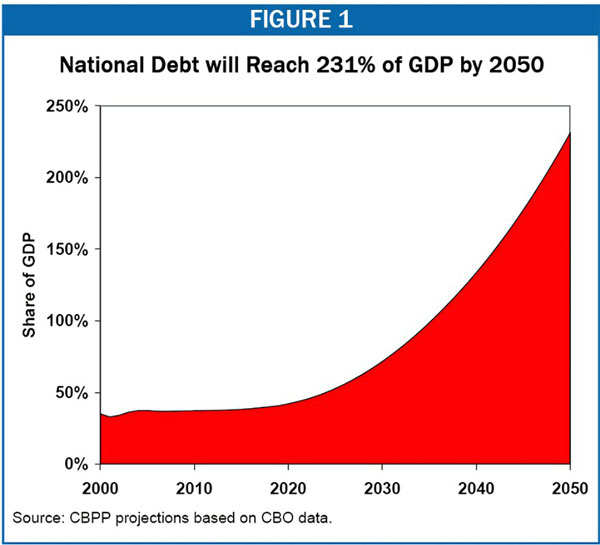

The politicians clearly think the same — just look at this chart:

|

|

|

Source: CBPP based on CBO data |

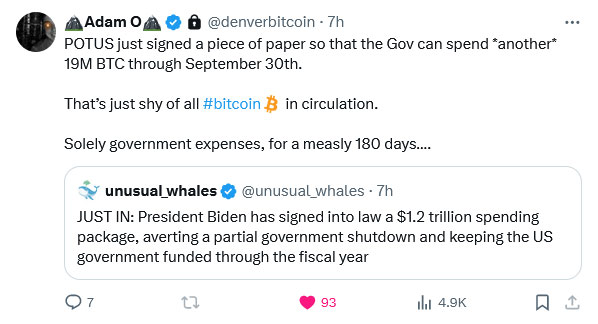

To put things in context, that one new spending bill represented almost the entire market cap of Bitcoin!

As this tweet put it:

|

|

|

Source: X.com |

No wonder most politicians hate Bitcoin.

I mean, if they ever lose control of the money printer, the gravy train they have created for themselves ends.

You simply can’t print ‘Bitcoin’ out of thin air like you can dollars. It destroys their grift.

Anyway, I won’t try to convince you to buy Bitcoin today.

I merely wanted to point out the comparison.

What I do want to draw your attention to today, though, are the latest investing moves of what could be the world’s ‘best investor’ in this corrupted system…

If You Can’t Beat Them…

Nancy Pelosi.

Not a renowned investing name, but a pretty famous politician.

As a former House speaker, she holds enormous sway over policy decisions within the Biden administration.

Like helping direct where US$1.2 trillion of new money might go, for example.

But here’s the thing…

The 83-year-old Democrat powerbroker is also a very, very ‘good’ investor.

According to Finbold, she’s made an average yearly return of 31% on her stock portfolio.

That’s better than Warren Buffett!

In fact, she’s ‘nailed’ so many calls on the market in recent years that there’s now a tracker that follows her stock trades (which she has to disclose legally) so us plebs can copy her.

So, what has the ‘investing genius’ been up to lately?

Well, in early March she bought into California-based cybersecurity firm Palo Alto Networks [NASDAQ:PANW].

The stock jumped 9% when it became public knowledge Pelosi was invested…the corruption of markets isn’t even a secret these days!

But the ever-busy Pelosi wasn’t finished there.

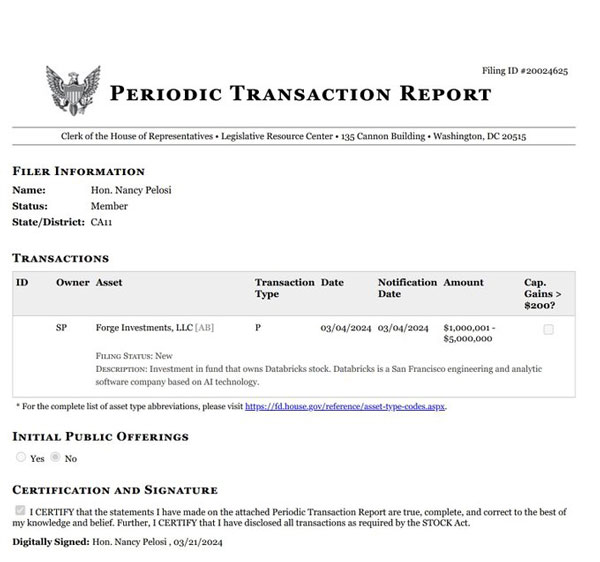

Staying on the tech theme she just put $3 million into a private company called Databricks.

|

|

|

Source: House of Representatives |

Databricks is an analytics company that uses AI (artificial intelligence) to help companies make the most of their data.

It is a very ‘on-trend’ investment.

Putting my cynicism aside for a moment, these investments align with our current strategy at Alpha Tech Trader.

And we’re actually about to release a new stock pick for our CORE portfolio that’s also in the business of cybersecurity and its intersection with AI.

If we’re right about its technology, we’re talking a paradigm-shifting play here!

But that’s exclusively for Alpha Tech Trader subscribers.

My broader point is…

Pelosi’s moves perversely give me comfort that we’re on the right track investment wise…but at the same time makes me realise what a shocking state of affairs ‘free market’ capitalism is in.

To sum up…

The End of Google?

The monetary system is corrupt to its core.

It rewards the elite while debasing money for the rest of us.

Longer-term, Bitcoin can help solve this (and you should support it if you want a fairer system).

But as it stands, we’re all forced to become professional investors like Warren Buffett (or even better, the ultimate ‘Cantillon insider’, Nancy Pelosi!) in an attempt to maintain our wealth over time.

Right now, Pelosi’s investing heavily in AI tech companies, and I certainly agree with that strategy.

We’re already seeing headlines like this:

|

|

|

Source: New York Times |

If we’re right, the next year or two will see the emergence of a new era of tech giants.

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader