We’re told that it will cost the world $173 trillion to go carbon neutral. But the technology that they’re planning to spend all that money on only works if it can do what oil, coal and gas do now…provide cheap and efficient energy, day and night, to millions of Australians in thousands of cities, towns, and rural outposts. It can’t, currently. And it’s becoming more obvious by the day that it most likely never will.

The market as ever, is two steps ahead. Some of the wealthiest investors in the world have spent the last 18 months quietly loading up on fossil fuel stocks — for themselves and their clients.

They’ve figured out what’s coming — and later this week, so can you. Look out for NOT ZERO — a new Fat Tail Investment Research exposé that reveals an investment opportunity set to rocket up…as Net Zero comes crashing down.

All week we’re talking about what Net Zero means for you as an investor.

One of the key themes of this debate is the difference between the public perception and investment reality.

After all, consider the following…

We’re told that burning coal for electricity is terrible for the environment.

I’m sure it’s not great. But we still need power.

One solution is wind farming.

We can stick windmills the size of skyscrapers in the ocean, for example, and harvest energy that way.

Sound good?

OK.

However, there is a catch. Those giant steel windmills aren’t made of wood or plastic.

They are made of steel.

How is steel made?

By burning coal!

Instead of burning thermal coal in a power plant, we burn large amounts of coking coal alongside iron ore to cater for the massive amounts of steel demand.

Coking coal is used in the current blast furnaces to reduce the natural oxygen in iron ore.

These plants also usually need coal or natural gas for power supply, making steel a dirty business today.

This is one reason why the steel industry is on notice. It’s a big contributor to global emissions.

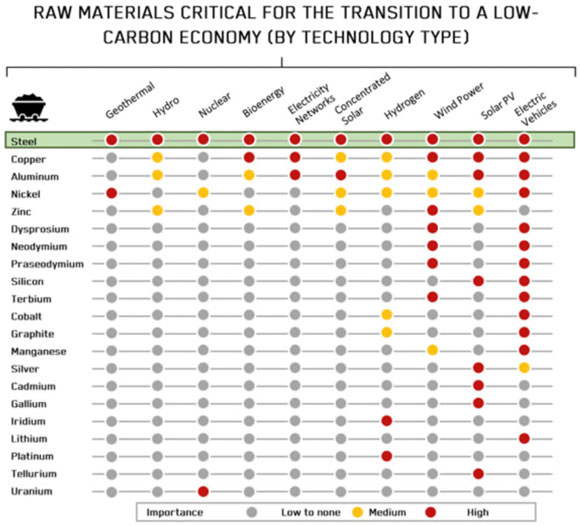

However, we don’t get an energy transition without steel…whatever your solution.

Wind farms, solar, nuclear, grids, transmission and electric vehicles all demand steel.

Or see that point visually…

|

|

| Source: Champion Iron |

Somewhere in the future we might be able to make steel without burning coal at all. (In fact, we can do it now, but it’s not economic.)

Modern life in general is very steel intensive. Right now, that demands coal.

But, hey, yeah…wind power is good!

Then we have the euphoria over the electric car industry.

Did you see this recent story?

‘China is set to become the world’s biggest car exporter this year, overtaking Japan. The watershed moment will mark the end of decades of dominance by European, American, Japanese and South Korean groups.’

China is now the leading electric car manufacturer globally.

It’s not hard to see the gameplan here. Japan became a titan of autos when it produced cheap, reliable vehicles at lower cost…and exported them globally.

China will do the same with EVs.

China has every incentive to disembowel the internal combustion engine…because it reduces the domestic economy’s reliance on imported oil.

However, the Chinese domestic electricity system still runs largely on gas and coal. All those ‘green’ EVs are fired on traditional energy…just in a roundabout way.

So the rise of EVs looks good for Net Zero targets, but the reality is more…nuanced.

(Editor’s note: It seems the mainstream media is painting a very one-sided picture of this energy transition, doesn’t it? Be sure to watch the interview at the end of this article to get to the truth of the matter.)

Then there’s an adjacent point to this.

Oil demand growth for some time has largely been pinned on China.

If that growth looks like being cut off thanks to EVs and renewable energy, oil majors have even less reason to invest in future production.

That’s a problem for a world economy that still uses 100 million barrels of oil a day.

Oil is already US$90 a barrel now. It would likely be around US$120–130 if President Joe Biden hasn’t used the emergency reserves of the United States to cool the market last year (a measure I support).

There’s nothing to say oil, absent further investment, can’t go to US$300 a barrel in the future. Don’t laugh. Newcastle coal was US$400 a tonne at one point last year.

US$300 a barrel is not a forecast. It’s a possibility that needs to be discussed.

How well do you think the global economy — and your job — would go with oil at that level?

Five years ago I was writing about the declining investment into oil.

In hindsight, it was a waste of time, both in terms of audience engagement and the investment implications, at the time.

However, the same problem is there.

Western consumers demonise the traditional energy producers at the same time we’re all dependent on them for our current standard of living.

We take cheap flying for granted as a feature of modern life. It wasn’t always this way. Flying began as a privilege of the rich. It may go back that way without cheap oil. The hardcore environmentalists would love to stick carbon taxes all over it too.

Want lower interest rates to help on your mortgage? Lower energy would bring down inflation.

Like your annual trip overseas? Bad luck on the ticket price. Diesel (jet fuel) prices are roaring currently because global refiners can’t meet the demand.

Your stock portfolio and the Aussie economy not doing much? It’s hard when Australia is no longer competitive, energy wise, and so loses investment and jobs and returns to other countries.

All this is to say that Net Zero is a complicated and difficult goal. It’s one thing to call for it when there’s little price to be paid, as was the case a few years ago when oil and coal were trading at lows and money was basically free.

Now energy is expensive and the cost of money is high. Many so called ‘green’ industries aren’t so green behind the scenes.

The metals required for batteries and EVs requires appalling amounts of mining (and money) to find the copper and other metals.

Truth be told, the mining industry hasn’t a hope of finding all the copper which the la la projections of Net Zero demand. They can barely find any now.

Make sure you start following my colleague Greg Canavan for more on this issue. Financial markets are waking up to the investment implications around all this.

Greg will show you how you can invest accordingly…to potentially build wealth now…avoid a catastrophe later…and look after your family…

Keep your eye on your inbox…

Best wishes,

|

Callum Newman,

Editor, Money Morning

PS: It’s clear we aren’t being given the full picture of what this energy transition entails…and whether it really will be the ‘green solution’ it’s painted to be…

| The Irony of Net Zero…More Costly, More Energy-Intensive — Interview with Ian Plimer |

Greg’s onto this. He’s interviewed a number of people who are sceptical of this transition recently. In this video, Greg interviews Professor Ian Plimer — Australia’s pre-eminent geologist who has long been a critic of climate alarmism…

Greg agrees with Ian that the climate debate is so one-sided in the mainstream media. Everyone is terrified of questioning the narrative for fear of being ‘cancelled’.

Here at Fat Tail, we are simply trying to get to the truth of the matter. And you generally only get there by asking tough questions.