Travel stock Flight Centre Travel [ASX:FLT] rose on Monday after upgrading its FY22 market guidance.

FLT now expects to record an underlying FY22 EBITDA loss of between $180 million and $190 million, a ‘material improvement’ on Flight Centre’s FY21 underlying EBITDA loss of $337.9 million.

FLT noted an acceleration in travel demand, with the scale of the business’s recovery exceeding FLT’s initial expectations.

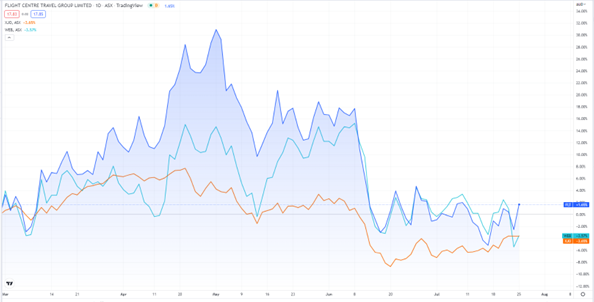

FLT shares are up 20% over the past 12 months, although the travel stock is trading 30% below its 52-week high.

www.tradingview.com

FLT: Losses slide, transactions rise

Due to better-than-expected travel demand and rising ticket prices, Flight Centre has upgraded its FY22 guidance on the back of a strong recovery in total transaction value (TTV).

FLT now expects underlying EBITDA losses in FY22 to fall to between $180 million and $190 million.

The company said underlying EBITDA loss of around $185 million demonstrates an 11.9% improvement on initial guidance between $195–225 million, as well as a material improvement on FY21’s underlying EBITDA loss of $337.9 million.

In fact, Flight Centre expects to break even in the second half of FY22 on an underlying EBITDA basis.

FLT expects its FY22 TTV to hit $10 billion, well above the $3.95 billion recorded in FY21.

On a monthly basis, FLT’s TTV was ‘tracking near or above pre-COVID levels in a number of businesses by year-end.’

Flight Centre managing director, Graham Turner, said the early results are pointing to a ‘healthy fourth quarter profit (underlying EBITDA).’

Flight Centre attributed its guidance upgrade to improving market conditions:

‘Demand accelerated after concerns about the Omicron strain abated and as governments globally relaxed or removed the restrictions that had grounded most non-essential travel since the start of the pandemic.’

FLT enters a new travel era

FLT’s managing director, Graham Turner, commented on the positive market update:

‘After an incredibly challenging period, we were pleased to achieve our goal of returning to monthly underlying EBITDA profitability in both the corporate and leisure sectors late in the year…

‘In the corporate sector, we are gaining market-share globally through high customer retention rates and a multi-billion-dollar pipeline of new accounts won across our Corporate Traveller and FCM brands during the pandemic.

‘Wins range from start-ups and small to medium-sized businesses in Corporate Traveller to enterprise-level global accounts like Shell and other high-profile companies are moving to FCM from competitors.

‘In the leisure sector, our success is built on having strong brands and sales channels that are resonating with customers in what is now a more complex travel environment.’

But Turner is aware th travel sector still has plenty of challenges to deal with:

‘ There will inevitably be ongoing challenges for the industry over the next six to twelve months as new strains of the virus emerge, airline capacity returns and as we rebuild staff numbers to required levels, but we feel that we are well placed to overcome these concerns given our corporate business’s continued rise and our leisure business’s ongoing strength.’

How to survive…and thrive…during a bear market

With the ASX 200 down 10% year to date, plenty of investors are nursing paper losses and wondering what to do next.

Will stocks fall further? Or have we bottomed?

Should you stick with cash or buy the dip?

These are common questions in today’s market.

And if you’re looking for answers, I recommend reading the latest ‘Bear Market Survival Guide’ from our very own editorial director, Greg Canavan.

As Greg notes in his report:

‘What you decide to do in the next few weeks will determine the success of your portfolio in the next few years.’

If you’re feeling a bit at sea in the current market and are wondering how to protect your portfolio, click here to access Greg’s latest report — ‘Your Bear Market Survival Guide’.

Regards,

Kiryll Prakapenka