Today, travel stock Flight Centre Travel Group [ASX:FLT] released a trading update that pointed to rebounding travel demand.

Despite Flight Centre saying that the recovery in travel is afoot in most locations worldwide, FLT shares fell on Wednesday.

At the time of writing, FLT shares are down 6%, although Flight Centre is up 20% year to date.

Source: Tradingview.com

FLT’s trading update

FLT’s trading update focused on travel recovery in the wake of COVID-19.

The company reported that EBITDA profit had returned as of March this year, with $8 million underlying EBITDA accrued.

FLT said it is close to breaking even in corporate business and leisure travel.

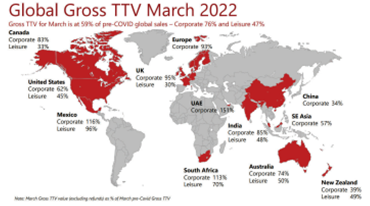

Gross TTV has risen 59%, nearly tripling pre-COVID levels, with Leisure up 47% and Corporate Business returning to its 76% pre-COVID gross global count.

However, the company also reported group revenue margins are still below pre-COVID levels.

FLT reported it is on track to repay its short-term £115 million loan from the UK by March.

Flight Centre is encouraged by an improved outlook, assuring the public there will be an increase in opportunities as the world reopens to travel.

Source: Flight Centre

FLT share price outlook

Despite FLT’s positive outlook, losses remain a sore issue as the company strives to make up for the period in which the pandemic forced operation shutdowns.

Cash costs then totalled $99 million, with $105 million in outflow.

Combined with group revenue, margins are still sitting below pre-COVID levels. With a modest net operating cash flow of $2 million, Flight Centre still has a while to go in its recovery.

That said, as travel begins to rise with international restrictions loosening and countries like Canada scrapping tests for fully-vaxed travellers altogether, the industry is rebounding with force.

Qantas this week reported that London, Los Angeles, South Africa, and Bali bookings have spiked above pre-COVID levels, while 60% of destinations in Asia have also begun to open up.

Now, with stock markets down and volatility rising due to macroeconomic uncertainty and rising interest rates, it is important to have a clear grasp of fundamentals.

That involves a sound grasp of valuations.

You cannot fully realise market opportunities — and stave off risks — without having a rational idea of the underlying value of the stocks in your portfolio or watchlist.

But how do you calculate a stock’s fair value? How can you know a stock is trading at a discount…or premium?

Download this free research report on valuing businesses to find out how you might be able to do just that!

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia