Travel stock Flight Centre [ASX:FLT] is seeing business conditions improve but remains cautious about FY23, arguing it is ‘too early to provide full year guidance’, citing uncertainty about the industry’s recovery trajectory.

Flight Centre is targeting underlying EBITDA of $70–90 million in 1H23. In 1H22, FLT recorded an underlying EBITDA loss of $184 million.

FLT shares were down 3% late on Monday. FLT shares are down 15% year to date.

Source: Trading View

Flight Centre’s 2022 highlights

As part of its 2022 AGM presentation, Flight Centre rehashed its FY22 highlights:

- ‘$183.1m underlying EBITDA loss ($180m-$190m FY22 target in place)

- ‘Revenue increased 155% during FY22 to $1billion, compared to $396million during FY21

- ‘Both corporate & leisure businesses returned to profit

- ‘Corporate & EMEA businesses profitable (underlying EBITDA) for year; Americas segment profitable during 2H, & ANZ segment profitable over the final 4-months of the year

- ‘Accelerated leisure & corporate sales growth driven by higher airfares & demand

- ‘4Q TTV alone exceeded FY21 TTV’ (up 184% with $2.6 billion, and $10.3billion for FY22, up 162% on FY21 but ‘below the record $23.7billion result achieved during FY19’)

- ‘Underlying costs over FY22 reached $1.4billion, circa 50% lower than FY19

- ‘Operating cash flow positive since March 22’ ($700 million)

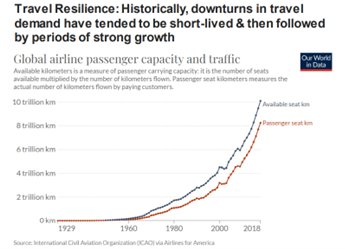

Flight Centre noted several improvements in business conditions but commented that ‘it would be incorrect to assume that the market has fully rebounded’.

Chairman Gary Smith commented:

‘These improved conditions have, of course, been fuelled predominantly by the removal of most travel restrictions throughout the world, which has allowed international and domestic travel to reawaken after an unprecedented and very painful period of enforced hibernation.

‘Sales accelerated immediately, the company returned to profit on an underlying EBITDA basis the following month and more and more of our businesses followed suit as the year progressed – providing solid momentum for the 2023 fiscal year (FY23).’

Source: FLT

FLT’s outlook

Flight Centre said it will be targeting $70–$90 million underlying EBITDA profit for the first half of FY23.

FLT is wary of ‘ongoing uncertainty around industry recovery’ and yet expects recovery to progress within the year, ultimately anticipating 60–70% of profits to be generated in the second half of the year.

This prediction is based off incoming seasonal peak periods, more stability in the supply chain, enhancements to operations, and higher top-line growth.

With Chinese air carriers being removed from the field, air fares have been driven higher, however, FLT revealed a possible increase in available carrier capacity.

FLT is also focused on growing its business once more, recruiting 300–400 people to fill leisure, corporate, and support vacancies as demand returns once more to the travel sector.

Is there an energy boom heading for Australia?

These past two years have been hard.

After the worst of COVID, there was a brief reprieve before everyone started running around in a panic about the war, inflation, falling property stocks, bonds, and cyprocurrencies.

But as we have seen from FLT’s update, people want to get out there again, up in the air, to travel.

And to do that, we’re going to need energy — the right sort of energy — to power that travel.

This is why our experts believe another commodities boom is coming.

Our in-house energy expert James Cooper says ‘the gears are in motion for another multi-year boom in commodities’.

And the best part is, Aussie companies and ASX stocks are standing to benefit in a big way.

To get attend James’ free event, and get a copy of his report, click here.

Regards,

Kiryll Prakapenka