I was chatting with a friend of mine yesterday.

He rumbled about the worries we all know about in the market: rising interest rates, a possible US recession, and high oil prices.

‘Yes, those things are true,’ I conceded. ‘But lately a few recommendations of mine have been on a good roll anyway.’

Later, at home, I looked up the results from the last six monthly issues for my service, Australian Small-Cap Investigator.

Check them out as of last week’s close:

|

|

That’s not bad going in a pretty tough environment.

That’s why I say many of the things that worry investors (you?) are built into prices now…and some of the more positive developments are lost in the noise.

Take that October recommendation I allude to above. That’s a company called SiteMinder [ASX:SDR].

SDR works within the travel industry, using software to monetise the hotel industry.

Travel stocks are firing lately (Qantas, Webjet) on the news that Chinese travellers are on the move again.

The Sydney Morning Herald reported last week:

‘Flight Centre’s head of global air Greg Parker told this masthead China’s reopening is the best news the Australia’s tourism industry has received in the last three years and expects increased pressure on Australia’s carriers to increase their services and lower airfares.’

SiteMinder, in particular, is a global business and will benefit from this in a major way.

I don’t think it’s a coincidence that its share price began moving as this news on China broke.

SiteMinder also has a high revenue growth rate…something not so easy to find with the economy slowing down.

Here’s the other thing…

When I was researching SiteMinder, I noticed the company had hit its targets in its 2022 financial year results.

I found that impressive…but also noticed that the share price had been dumped anyway…down 50%.

Here’s what I liked…you didn’t have to look too far ahead to see that Chinese travellers would come back eventually.

I concluded that October issue and SiteMinder recommendation this way…

‘The big daddy of the travel world is China. Pre-COVID, this was on track to be one the biggest trends of the next 20 years as rising incomes in China flood the world with spending and visits.

‘Xi Jinping’s “zero-COVID” policy is locking down millions of potential travellers. We don’t know when it will end either.

‘However, at some point it will, and Chinese tourists will roar back into the skies. This could be a huge uplift for the travel industry when it comes, including SiteMinder.

‘I hope you can see why this opportunity is so compelling.’

This is the kind of situation that bear markets, like we saw in 2022, create.

Investors stop focusing on the future potential of stocks in general and just want to get their money back.

The result is that good stocks get sold down alongside the genuinely troubled (Magellan, for example).

To me, there are cheap stocks like this all over the market.

I just found another company where its results last year were great…and yep, the share price has been dumped anyway.

These kinds of situations are the ones I love as an investor.

It’s much less risky, to me, to buy shares in a company that’s doing well of its own accord but sold down because of the ‘macro’ background.

Eventually, the macro issues sort themselves out, one way or another. But the good business remains.

I’ve been doing this a long time.

Remember Chinese ghost cities? Remember Donald Trump’s trade war? Remember the COVID lockdowns?

All these issues that seemed — and were — so acute when they happened, have now faded in importance. Last year’s surprise inflation breakout will go the same way, in my view.

But now you have the chance to build your portfolio up while prices are still down…

See the table above for the potential results.

I expect them to be even better in six months’ time.

What more can I say?

Here’s a final thought…

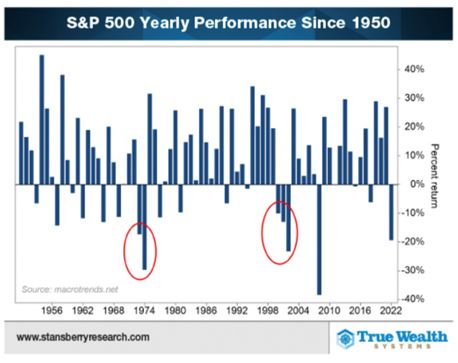

2022 was a dud year for the stock market.

However, it’s highly unusual for the stock market to have two bad years in a row.

My colleagues in the US created the following table to show that US stocks have only had two instances of consecutive negative years since 1950:

|

|

| Source: Stansberry Research |

I don’t see why 2023 should add to these two, in particular.

The odds tell me stocks go on to make new highs.

Intrigued? Pumped to make some gains? Join me on my small-cap hunting journey here.

Of course, if you’re more after a strategy purely designed for safeguarding your wealth, I’m not the man for you. Thankfully, the diversity of our team here at The Daily Reckoning Australia means we cover all bases when it comes to investing approaches.

Starting today, Vern Gowdie and Bill Bonner are hosting a four-day strategy session aimed at wealth protection during these sensitive markets, including a low-risk way to get into markets once the dust settles. Get your spot now for free by clicking here.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia