- ‘What do you think about the outlook for inflation?’

Three people asked me that last week. It’s certainly clear this is now the defining issue for the moment.

I’ve been saying the same thing for ages.

Inflation is going higher!

Why?

The massive credit creation going on currently!

You know what the central banks are up to. But the private banks are creating lots of money too.

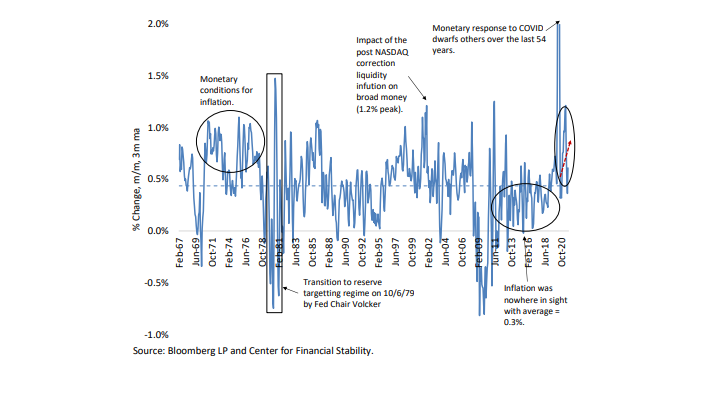

Check out the chart below to see just how big the money spurt has been lately.

A research house says it’s the biggest in half a century!

|

|

| Source: Centre for Financial Stability |

Back in July, I gave my subscribers a report explaining why inflation was likely to head much higher.

What do we see today?

Inflation has been more than 5% in the US for five months in a row.

Oh dear. Oh dear.

You didn’t believe the central banks when they said all the QE wasn’t inflationary?

Actually, it’s not quite as simple as that. Sometimes QE isn’t inflationary.

It rather depends on what the private banks are up to.

But there’s a whole lot of money rattling around the world right now.

It’s showing up in booming stock prices, roaring property markets — and now inflation readings.

But what about the gold price?

It looks like gold is beginning to sniff out what’s happening here.

The US dollar gold price has broken above US$1,800 again.

That’s taken the Aussie dollar price back to AU$2,500.

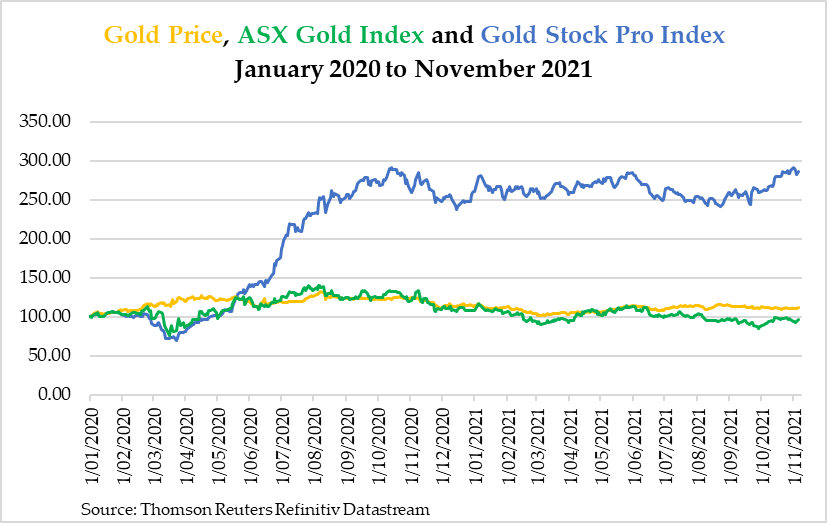

My colleague Brian Chu keeps hammering the same point: you can now buy gold stocks at incredible valuations relative to the potential upside.

Also, check out the chart he put together showing the outperformance of picks from his Gold Stock Pro service relative to the standard index:

|

|

| Source: Gold Stock Pro |

If you want to help protect your wealth — and have a chance at growing it — then check out Gold Stock Pro here.

- ‘Cannabis! Cannabis! Cannabis!’

That’s what I shouted into the microphone this morning. I was recording the introduction to my podcast this week.

Here’s why…

I’ve learnt something over the years.

When everybody is following the same story, you do well to go and look elsewhere.

An email landed in my inbox this morning. It tells me that the ASX companies of most interest to investors are related too:

- Electric vehicles

- Graphite

- Lithium

- ESG

- Uranium

Here’s the list of sectors I’m now least interested in:

- Electric vehicles

- Graphite

- Lithium

- ESG

- Uranium

OK. OK. I’m being a bit cheeky there. But I see this all the time.

One sector has a big run. Then people act as if it will go on forever.

All these stocks have already boomed. If you’re looking now, you’re late to the party…unless your time frame is unusually long.

Now…the next giant winners will be found where most of us aren’t looking.

How can it be any other way?

To my mind, that makes cannabis worth a look. There’s a big old market brewing but everybody dropped the story ages ago.

One catch with Australia is none of our cannabis stocks make big money.

But over in the US, it’s a different story. Their problem is the mishmash of regulations holding the whole thing back.

But valuations are super compelling!

That’s why I decided to get my cannabis specialist Thomas Cargoldroll on to tell us all about the story.

He’s a guest on my podcast this week.

To listen to my chat with Tom, check out my funky new podcast here. Already we’ve chatted to real estate expert Catherine Cashmore, investing legend Jim Rogers, contrarian value investor Greg Canavan, and my trading mate Murray Dawes.

Again, check it out here. It’s free!

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.