Yesterday, well, I’m sure you know what happened.

The state of Victoria is back to square one again.

And today, the Big Four announced that they would extend the six-month repayment holiday by a further four months.

The Big Four Aussie banks are doing their best to pitch this as an act of beneficence.

Australian Banking Association (ABA) Chief Executive, Anna Bligh, said:

‘This new phase of support turns a cliff into manageable steps for Australians to get back on track and repaying their home loans and business loans.’

She also said:

‘Repaying a home loan is in the DNA of every Australian.’

After the Banking Royal Commission, the Big Four made a concerted effort to patch things up.

An intricately choreographed PR dance designed to help Australians forget.

As for the second comment?

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

$260 billion in loans needs to find its way onto the books somehow

It reveals the unfortunate reality for many property owners.

The banking oligopoly has for years thrived off Australians being shackled to their home loans.

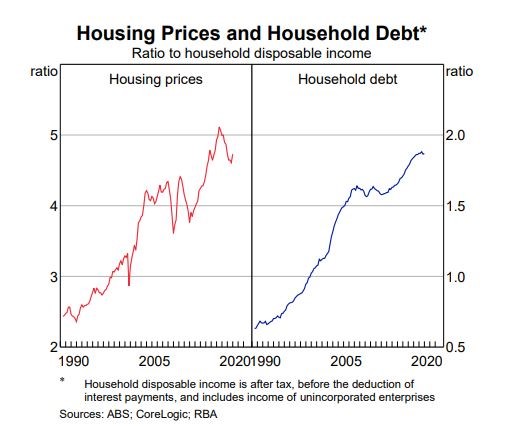

It’s a familiar chart, but one worth revisiting:

|

|

|

Source: RBA |

So, what to make of the move by the Big Four to extend their repayment holiday?

It’s certainly not generosity.

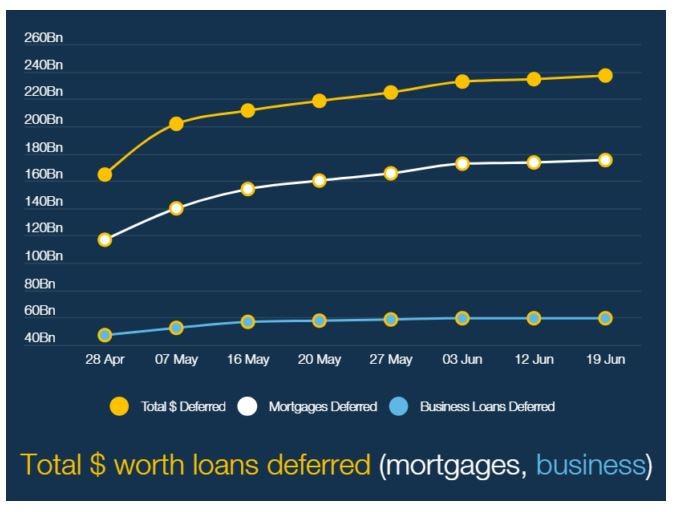

The banks have 800,000 customers who collectively deferred $260 billion of loans back in March.

If the banks did not extend the repayment holiday, inevitably a portion of these loans would go on the books as defaults.

Moody’s recently found that the 30-day delinquency rate for Australia’s prime residential mortgage-backed securities (RMBS) was up 1.79% in the three months ending 31 March.

This data was from before the repayment holiday.

And as you can see, it’s largely mortgages that are deferred:

|

|

|

Source: Macro Business |

APRA is promising more regulatory relief for the Big Four.

Without delving too far into the complex world of capital ratios, I suspect the real story here is how new assessments of these deferred loans get treated on the books.

Holding back a flood of negative headlines

The banks are backed into a corner, really.

They could’ve jumped off the ‘cliff’ and told people to start paying up.

Instead, they’ve pushed back the day of reckoning.

Jumping off the cliff might have led to a massive uptick in bad debt on the books.

This isn’t accounting trickery, or even a PR tactic.

It’s more a way of avoiding a flood of bad numbers hitting the headlines.

Commonwealth Bank CEO Matt Comyn, hints at this when he said (emphasis added):

‘From a prudential banking perspective, it’s important to understand whether a customer will be able to repay at a later date. For customers who are directly impacted and you can assess that to be temporary, then it is reasonably easy to determine they will be able to make those payments.’

How these deferred loans are assessed will be crucial to the performance of bank shares in the coming months too.

Implications for the Big Four bank stocks…

One colleague recently suggested that as a 10-year ‘buy and hold’ strategy, the Big Four bank stocks had immense appeal.

I’m not so sure.

The need to look further afield is increasingly important, and in this environment, I would favour a well-run speculative fintech over an aging dinosaur (Big Four bank).

Since May the shares of these companies are registering a significant uptick.

This could reverse sharply in the coming months.

If you think of the Big Four banks’ shares as a catchment for macroeconomic sentiment, the picture looks increasingly grim.

At some point repayments need to resume or prudential concerns will come to the fore.

And when the million question marks become answers, the oligopoly may face its greatest challenge yet.

Regards,

Lachlann Tierney,

For Money Morning

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.