‘In any economy, money dominates.’

That’s how economics professor Steve Hanke likes to sum things up in the financial world.

The same is true of the stock market. Abundant liquidity drives asset prices up, and tight money drives them down.

We got a hint of what’s happening here via the recent data on margin debt on the ASX.

This is credit that investors borrow to buy stocks…or ‘leverage’, as the Americans say.

The Australian Financial Review reports:

‘The total value of margin lending has fallen by 23 per cent, or $4.9 billion, since its most recent peak in June last year, according to official statistics from the Reserve Bank of Australia.’

You can guess the reasons. Leveraged investors jump out when shares fall. And higher interest rates make it harder to make the maths work.

However, you and I can take this as a positive sign. The less margin debt in the market, the less vulnerable it is to a big collapse.

Margin debt can bid up stocks way beyond any rational estimate of fair value.

It’s no coincidence that the peak in margin lending on the ASX was before the global financial crisis in 2008.

The same dynamic played out in 1929 too.

The fact that margin debt is falling in Australia makes me, somewhat paradoxically, bullish on the market in the years ahead.

There’s still scope for aggressive buying to come back.

Are there other reasons to be hopeful?

According to investment advisor Ken Fisher, the answer is yes!

He writes in The Australian:

‘Recession likely isn’t nearby. Why? Lending overall remains really robust globally — fuel for investment and incongruent with deep recession. Businesses and households generally don’t borrow money to sit on it.

‘They spend it soon. Global loan growth has accelerated every month since March, reaching 9.3 per cent year-over-year in September.’

Go back to the Steve Hanke quote I began this article with.

Money dominates!

What do these two men mean?

More lending is bullish for the world economy because it involves credit creation.

Also note those lending figures are rising despite central banks raising rates.

Why then all the fuss about recession and slow growth in 2023?

Well, the inverted yield curve is one thing to give us pause. Over in the US, short-term rates are above long-term ones.

This is often flagged as a reliable recession indicator. And it has been.

But could it be, dare I say it, ‘different this time’?

The men and women at Quay Global think so.

It’s making the case that long-term rates are not pricing in a recession as much as lower interest rates in the future.

Most commentators refer to the ‘70s when thinking about the latest outbreak of inflation.

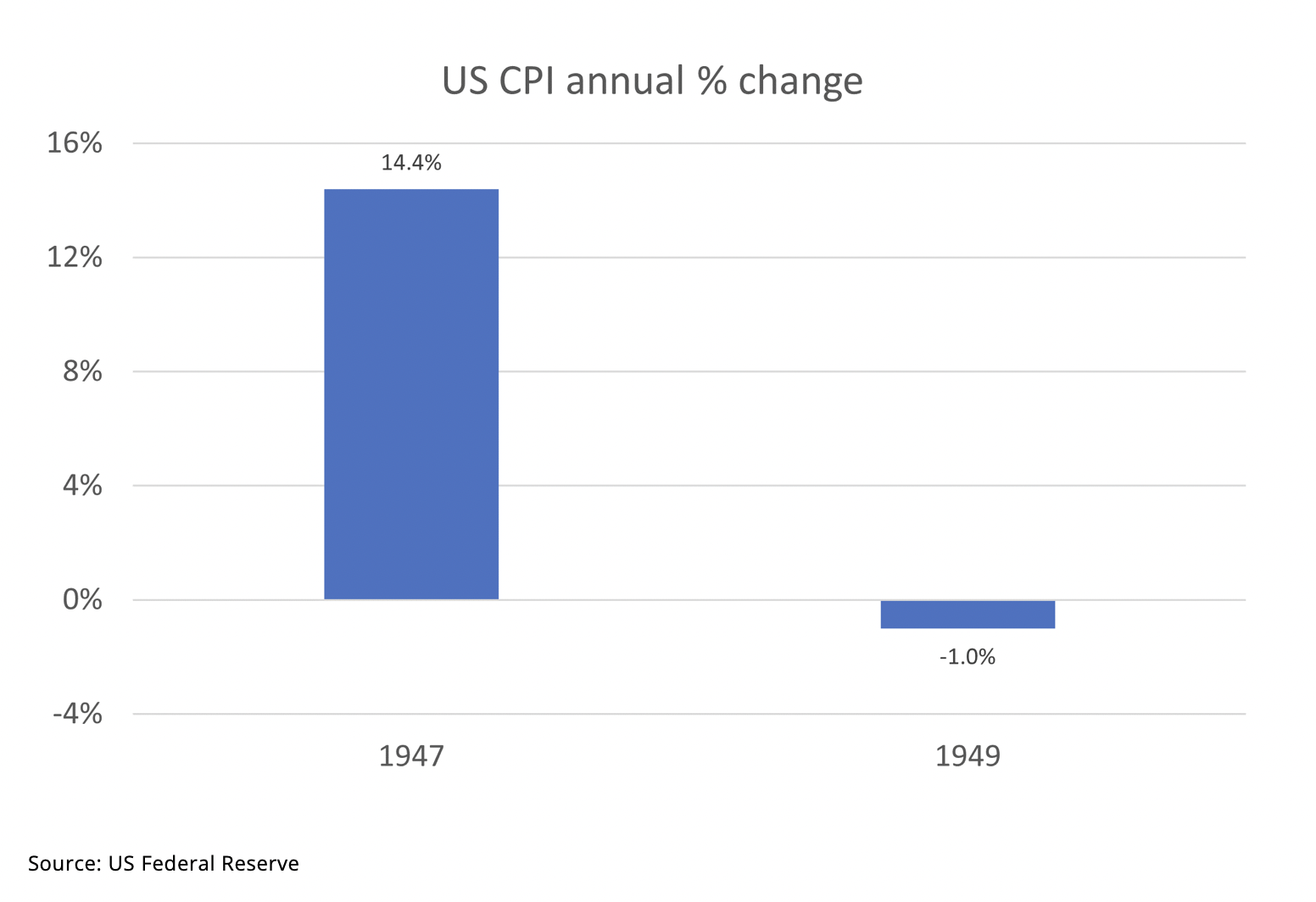

Quay don’t think that’s the right comparable. Rather, they think the 1940s is the better pick.

Here’s what happened back then:

|

|

| Source: US Federal Reserve |

This could be what bond investors are seeing right now in 2024.

That doesn’t mean the US has to be in recession. It could just take a ‘normalisation’ of supply chains, monetary policy, and wage growth to make it happen.

Of course, your crystal ball is as good as mine.

All we need to know today is that holding off investing in shares because the US may be in recession is not necessarily the best strategy.

It’s certainly not mine.

In fact, I’ve maxed out my self-managed super fund buying shares in this downturn. I don’t know what 2023 will bring.

But I’m willing to back good companies to create value in the years ahead.

And one dud year in stocks doesn’t change the outstanding track record of the share market to create wealth over time.

You’re supposed to accumulate in bear markets…that’s when you get the best prices!

Officially, I should say, the ASX 200 is not in a bear market. It’s only down about 5% for the year.

But this is misleading. Most of the smaller stocks on the ASX have been crushed in the last 12 months.

And there’s just little sentiment or narrative to keep them moving currently.

I remember in 2018 there was a stock I really liked called Credible Labs [ASX:CRD]. The share price was dead as a dodo for ages. I never understood why but I kept recommending it to my subscribers.

Then suddenly, out of the blue, Credible shares took off like a rocket and ended in an official takeover offer from News Corporation.

This is the kind of situation I see today. Shares with great value lying around because of poor sentiment and investor fear.

From my perspective, it’s a great time to buy because you’re not paying the premium you usually do in bull markets.

The trade-off here is you need some patience and conviction to hold on without the immediate positive feedback loops of low volatility and bullish investors bidding up prices and volume.

Big investors are beginning to move on these bargains. I can say that because I recently put five bargain share ideas down in this report.

Already, one of those suggestions is a rumoured takeover target because one investment firm is accumulating stock in the company.

More may be coming!

This opportunity won’t hang around forever. I suggest you take it while it’s there.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia