In presenting its half-year report, Fisher & Paykel Healthcare Corporation [ASX:FPH] noted that while its revenue may not have reached the same heights as this time last year, it is still up by 21% on pre-pandemic levels.

FPH’s operating revenue was NZ$690.6 million for the six months ending 30 September 2022, which was above NZ$670 million, guided by the company in August.

The FPH share price surged upwards of 12% earlier this morning, boosting its value by 23% this month.

However, in the last 12 months, the healthcare corporation has been trading down by 32%.

Source: tradingview.com

How Fisher & Paykel beat its guidance

Reporting from Auckland, the healthcare group shared that while revenue was down 23% in the first half of last year, this was still a 21% increase on levels reached before pandemic distortions.

For the first half of the 2020 financial year, FPH recorded NZ$570.9 million — and for the first six months of 2022, total operating revenue came to NZ$690.6 million.

This was above the NZ$670 million set out as guidance in its August trading update.

How did FPH manage to beat its own guidance?

There is clearly still strong demand across the company’s segments.

While ‘pandemic panic’ may have increased sales volumes as hospitals cried out for much-needed equipment, this sets a precedent for future exposure and trust-in-label.

Healthcare equipment will always be vital when times are tough, and that underlying reliance isn’t disappearing overnight.

Another possibility playing into the numbers was perhaps overcompensation ahead of new waves of infection.

‘Customer stock levels of hospital consumables continued to reflect purchases of considerable amounts during our prior half, in preparation for an Omicron hospitalisation wave which proved less severe than originally anticipated,’ said FPH’s CEO, Lewis Gradon.

Mr Gradon also explained hospitals are still working through excess inventories, even as hospital consumables increased month-to-month:

‘While we believe the number of hospitals which continue to be overstocked is declining, ultimately, these stocking dynamics are short term, and the fundamentals of our sales strategy remain the same. Our teams are committed to helping improve clinical practice and ensuring the hardware our customers have purchased during the pandemic is used to benefit a broader range of patients requiring respiratory support.’

The company’s sleep apnea products have continued to provide solid revenue, boosting Homecare revenue year-on-year.

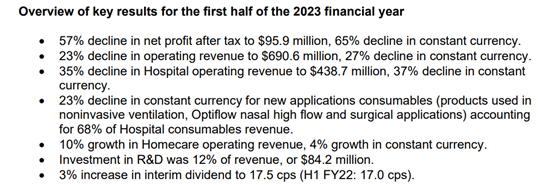

Overall highlights, represented on a year-on-year basis, were as follows:

Source: FPH

Further challenges ahead

Some challenges remain at play, with FPH’s Gross margin declining by 59.8%, down from 63.1% in the previous corresponding period, and below the company’s long-term target of 65%.

‘Although global freight rates are seeing prices soften, legs in and out of New Zealand lag this trend, which continues to weigh on margin,’ said Gradon.

‘The company has also been impacted by manufacturing inefficiencies, as it carefully balances demand fluctuations while managing manufacturing throughput and higher rates of sickness-related absenteeism in the manufacturing workforce.’

FPH said COVID-19 hospitalisation rates, the intensity of respiratory support, the Northern Hemisphere flu season and hospital staffing challenges would impact the second half.

‘Given these current uncertainties, we are not providing full-year quantitative revenue or earnings guidance at this time,’ Gradon stated. ‘However, we expect second half revenue for the 2023 financial year will be higher than in the first half.’

The company’s directors have approved an increased interim dividend of 17.5 cents per share, along with reactivating a dividend reinvestment plan that can be found on their website.

Five bargain stocks

There are a lot of macro implications dampening business sentiments right now.

And thanks to rising rates, everyone is looking to save a pretty penny where they can.

It’s in times like these some real ASX stock bargains can emerge — if you know where to look.

Our Small Caps expert Callum Newman has done the hard work for you.

He’s found five of what the calls are the ‘best stocks to own in Australia’ right now.

Click here to view the bargain stocks.

Regards,

Mahlia Stewart,

For Money Morning