West Africa-focused explorer Firefinch Ltd [ASX:FFX] today announced its intention to demerge its Goulamina Lithium Project into a separate ASX-listed entity.

The announcement comes a day after the explorer announced a 2.2-million-ounce resource estimate at its Morila Gold Mine in Mali.

The share price of FFX has risen by 2.5 cents or 11.91% at the time of writing to trade at 23.5 cents per share.

Source: Tradingview

Today’s share price action marks the fourth consecutive rise.

A trend spurred on by the rising gold price.

Firefinch shareholders to get free lithium shares

FFX is set to become a solely gold focused company, today announcing the proposed spinoff of its Goulamina Lithium Project.

The rationale for the demerging being that FFX believes Goulamina is materially undervalued in the company’s share price and requires a distinct, separate focus to release the true value of the project.

Whether or not this is the case will be decided by the company’s shareholders.

FFX intends to progress the demerger of Goulamina into a separate lithium focussed company, to be called Lithium Co, which is expected to be listed on ASX this year.

Although it is subject to shareholder approval.

Existing FFX shareholder will received free shares in the newly-formed company proportional to their existing holding.

And will own one of the world’s largest undeveloped lithium deposits, with an initial mine life of 23 years and a mineral resource of 1.57 million tonnes of lithium.

However, it’s difficult to tell whether the announced demerge or a clarification to yesterday’s release is the cause for the uptick in share price.

Yesterday, FFX announced a 2.2-million-ounce resource at its Morila Gold Mine in Mali.

A big jump from the previous estimate of 1.3 million ounces.

What to make of the Firefinch share price

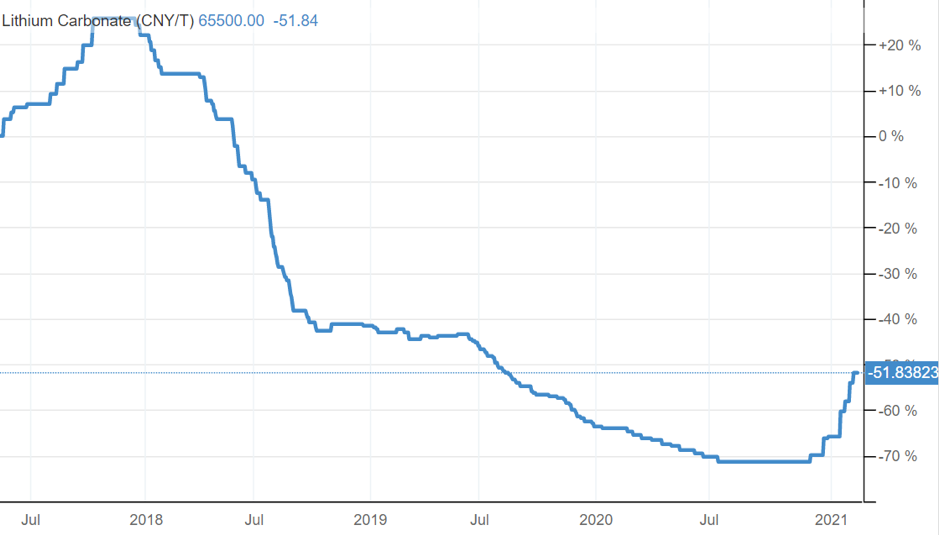

While lithium prices are still a far cry from where they were five years ago, we have seen a strong uptick for the start of 2021.

Source: Trading Economics

A trend that could continue for the medium-term with the increasing popularity of electric vehicles.

Gold prices firmed above the key US$1,830 an ounce level today, consolidating the rebound from a two-month low of $1,784 an ounce.

The open pit at the Morila project assumes a gold price of USD$1800 per ounce when assessing the economic viability of the mine.

Now, some have pointed out that this is a risky assumption because it uses a gold price inflated by the pandemic.

However, in my opinion, the USD could continue to slide thanks to the Federal Reserve’s attempt to drive inflation higher.

Meaning we could see a resurgence in the gold price over the coming months.

With the fervour returning in the gold price after, we could see stocks like FXX lift further in the coming months. Our resident gold expert Shae Russell reckons other Aussie gold stocks could be set to spike too as Australia becomes the next ‘gold epicentre’. If you want to learn more, download your free report here.

Regards,

Lachlann Tierney,

For The Daily Reckoning Australia