Movements on the S&P 500 [SPX] and the ASX 200 [XJO] continue to confound.

Monday’s headline warned of up to a 10% fall this week in a worst-case scenario.

That’s if the stock market doomsday preppers are right.

But today’s piece is all about finding the real winners in this rollercoaster market.

Today, I want to take you through the companies whose share prices are benefitting during the pandemic, while highlighting the disconnect between economies and markets.

At some point you would think the two would connect.

Not for now though.

At time of writing, the S&P 500 closed up 1.54%, and the ASX is on course to move up today (if ever so marginally).

Things are delicately poised.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

If you look at the S&P 500, it’s now trading at the same level it was at in early November of 2019:

|

|

|

Source: tradingview.com |

Does that mean the world is exactly as it was in November 2019?

Of course not, things are far worse.

Such is the tsunami of cheap money entering the system.

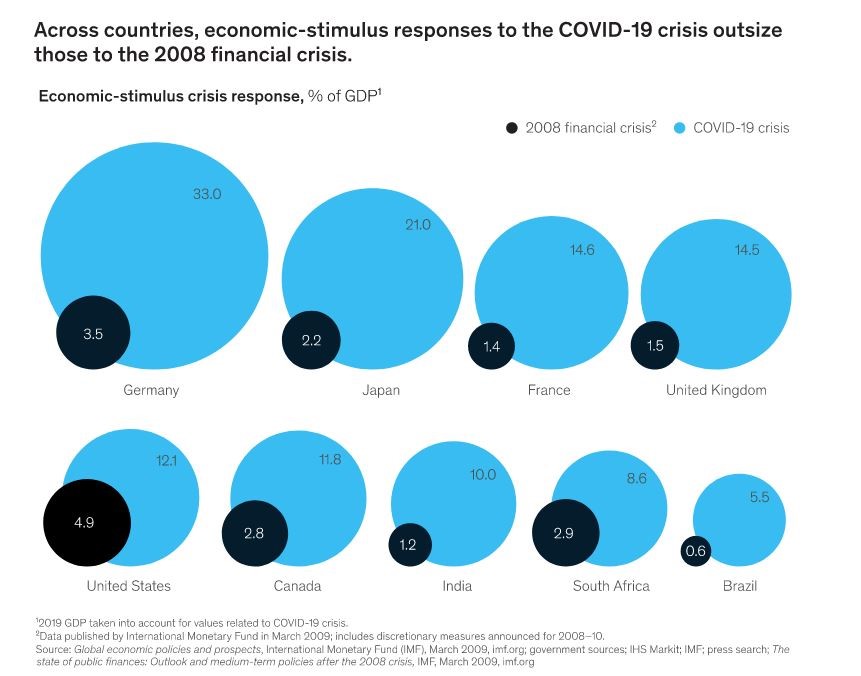

In fact, across major economies, the percentage of stimulus to GDP is nearly 10–1 compared to the GFC:

|

|

|

Source: McKinsey |

At some point, you would think this deluge of money would unwind in some sort of financial crisis in the coming few quarters…

The contrarian in me wants to say the run will go on for years, to the dismay of the naysayers…

The realist in me thinks that there will be some repercussions from this move by central banks and governments.

The need to pick the right companies, not the right index, is really important in these circumstances.

Which drives us towards a crucial point: Which kinds of companies are taking off in a three-month window?

Mining companies are leading the charge from March lows

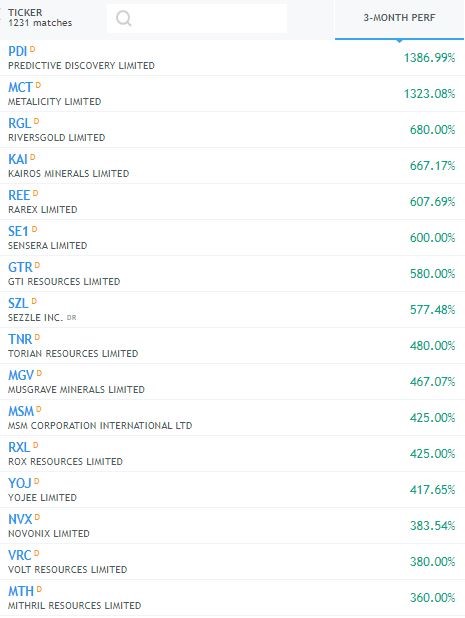

Take for instance the following list of the best performing stocks on the ASX in the last three months:

|

|

|

Source: tradingview.com |

The three-month period corresponds to just after the market lows in March.

You can see plenty of mining companies on the list. This matches up well with recent data in a previous article on mining’s remarkable resilience in this downturn.

A fintech, Sezzle Inc [ASX:SZL] pops up as well.

Does this mean all of these companies are winners?

Not necessarily the case, trying to pick the bottom on speculative mining companies can be a risky business.

So let’s take a look at bigger companies…

E-commerce thriving

While we highlighted Kogan.com Ltd’s [ASX:KGN] massive rise up the charts on Monday, there are more too.

For starters, there’s Redbubble Ltd [ASX:RBL].

The company was beaten up in the headlines.

Of note, it was missing its prospectus revenue forecast for 2017, as well as a disappointing trading update late in 2019.

Here’s what they do:

- Online marketplace

- High-quality goods

- Apparel, wall art, crafts

Think of it as similar to Etsy, with an added emphasis on intellectual property (IP).

If Spotify managed to convince many people to stop downloading music illegally, then Redbubble may be able to do something similar with fan-generated entertainment merchandise.

The RBL share price is in the process of going through the roof, just off an all-time high and up more than 470% from March bottom to its recent peak.

Then there’s Temple & Webster Group Ltd [ASX:TPW], which does online sales of furniture and homewares.

Check out the chart below:

|

|

|

Source: tradingview.com |

Up more than 300% from the March low.

And then there is the perhaps unfairly maligned Marley Spoon AG [ASX:MMM].

Up a mammoth ~700% from the same period.

Turns out, in lockdown people want meal kits.

The divide between economies and markets

The point I’m trying to make is that money doesn’t disappear from the system.

It just goes to places you might not initially expect.

In a crash, people go to cash — but the capital is still there.

Then central banks try and jolt this cash out of the woodwork with low rates and asset purchases.

All of a sudden, blue chips start rising even when they are expected to take significant hits to their earnings.

This is a dangerous game.

Who honestly thinks the Big Four banks will not take a significant hit to their profitability?

The trick, I think, is to pick the companies that will sink or swim on their own merits.

Companies, that don’t have macroeconomic headwinds.

Or even better, are well placed to get macroeconomic tailwinds like some of the companies I’ve shown you today.

Someday soon, we may see a reckoning between economies and markets.

And when we do, you are going to want to be behind companies that don’t rely on central banks and fiscal stimulus to prop them up.

Regards,

Lachlann Tierney,

For Money Morning

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.