In today’s Money Morning…Warren Buffett and business moats…why bother with moats?…‘competition is for losers’…identifying business moats…and more…

Despite a strong rally last week — Wall Street notched its best week in 18 months last Friday — markets are not exactly exuberant.

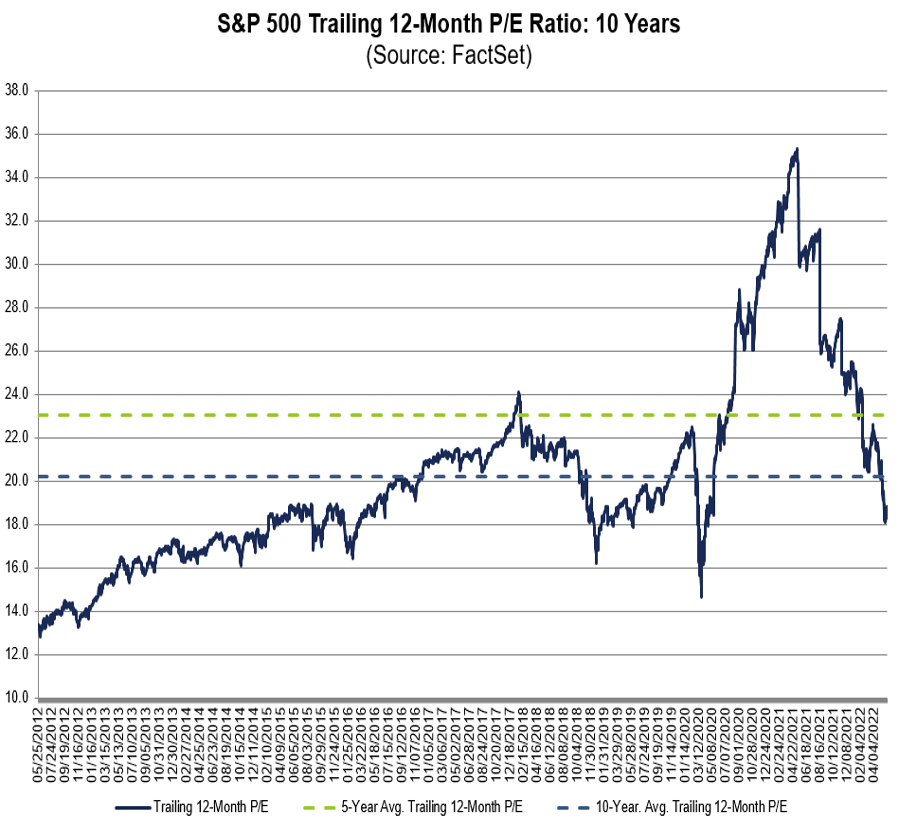

FactSet reported that the trailing 12-month P/E ratio for the bellwether S&P 500 is 18.8, below the five-year average (23.1) and below the 10-year average (20.2).

And according to Morgan Stanley’s investment chief Lisa Shalett, we’re not necessarily done with the selling yet.

With the real threat of recession, Shalett said in a note that corporate earnings could shrink, leading stocks further down:

‘Ultimately, we estimate that stock market indexes could suffer another 5% to 10% downside from this resetting of earnings expectations.’

In a climate where investors are less willing to pay for distant or prospective profits — with growth and concept stocks some of the harshest punished — attention is turning back to quality, here and now.

Quality stocks are more resistant to broader macroeconomic woes.

Especially stocks that possess what Warren Buffett popularised as business moats.

Business moats are competitive advantages that allow a company to maintain a healthy profit even as new rivals emerge.

The presence of these moats is often a sign of a great business.

And since great businesses — at great prices — are the holy grail of investing, learning to analyse business moats is a crucial skill for investors.

|

|

| Source: FactSet |

Warren Buffett and business moats

Given that Buffett has done much via his writings and investments to popularise the concept, let’s turn to the Oracle of Omaha for his views on business moats.

What famed strategy thinker Michael Porter would label a sustained competitive advantage, Buffett and his partner Charlie Munger would label a moat.

Like a physical moat protects a castle from attack, a business moat protects a company from the profit-eroding effects of competition.

If you possess a moat, you are less concerned with new entrants than someone with no sustained competitive advantage.

As Buffett once noted:

‘The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.

‘The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors.’

And what does Buffett look for when contemplating moats?

‘We are trying to figure out — why is that castle still standing? And what’s going to keep it standing or cause it not to be standing five, 10, 20 years from now.

‘What are the key factors? And how permanent are they? How much do they depend on the genius of the lord in the castle?’

Why bother with moats?

The importance of business moats stems from the cut-throat nature of free markets.

A profitable enterprise is both a blessing and a curse in a competitive system. Why?

While profits are attractive, they also attract.

If people notice that a particular industry or idea is generating outsized profit, they enter that industry or capitalise on that idea.

The inevitable growth in competition leads to an equally inevitable reduction in profit.

Michael Mauboussin, in an excellent essay on competitive advantage, put it thus:

‘Companies generating high economic returns will attract competitors willing to take a lesser, albeit still attractive return, which will drive aggregate industry returns to opportunity cost of capital.’

Buffett’s mentor Benjamin Graham made a similar point in his seminal book, Security Analysis:

‘A business that sells at a premium does so because it earns a large return upon its capital; this large return attracts competition, and, generally speaking, it is not likely to continue indefinitely.’

Unless, of course, the business has a durable competitive advantage.

Durability is very important.

As Buffett explained (emphasis added):

‘You have to understand when competitive advantages are durable and when they are fleeting. I mean, you have to learn the difference between a hula hoop company, you know, and Coca-Cola.’

That’s why Buffett also famously said that time is the friend of the wonderful company and enemy of the mediocre.

Time is no friend to a business with a fleeting competitive advantage. A business first to manufacture fidget spinners will enjoy the first year but is unlikely to enjoy the next five.

‘Competition is for losers’

The importance of competitive advantage led billionaire tech entrepreneur and venture capitalist Peter Thiel to argue entrepreneurs should avoid competition altogether.

Competition, argues Thiel, is unattractive. In fact, ‘competition is for losers’.

In a Wall Street Journal editorial, Thiel laid out his reasons:

‘Tolstoy famously opens Anna Karenina by observing: “All happy families are alike; each unhappy family is unhappy in its own way.”

‘Business is the opposite.

‘All happy companies are different: Each one earns a monopoly by solving a unique problem. All failed companies are the same: They failed to escape competition.’

For Thiel, nothing is worse for a business owner than finding themselves in a competitive industry.

The cure is to become a ‘creative monopolist’ who offers what no one else can.

Likely influenced by the quintessentially entrepreneurial spirit, Thiel considers competition a failure of imagination.

If a business has competitors, it hasn’t tried hard enough to create a unique product, says Thiel:

‘Every business is successful exactly to the extent that it does something others cannot.

‘Monopoly is therefore not a pathology or an exception.

‘Monopoly is the condition of every successful business.’

Identifying business moats

In Why Moats Matter, investment research firm Morningstar describes how it defines and identifies business moats.

While the analysis is detailed, it revolves around two key questions.

First, are the company’s returns on invested capital likely to exceed its weighted average cost of capital in the future?

And two, does the company possess any sustainable competitive advantages (cost advantage, network effect, economies of scale, etc.)?

The approach isn’t unique.

For instance, Tren Griffin — author of Charlie Munger: Complete Investor — uses the following test to assess the existence of a moat:

‘If a business has not earned returns on capital that substantially exceed the opportunity cost of capital for three to five years, it does not have a moat.’

The two questions serve as useful guides.

But it’s important to note that while the first is quantitative, the second is not.

And that qualitative nature makes all the difference.

The question of a company’s ROIC versus its WACC is clearly delineated; it lends itself well to formulas.

But the question of sustainable competitive advantage does not appeal to formulaic answers.

As Griffin further noted:

‘As for the qualitative side of this topic, there are no formulas or recipes that govern the creation and sustainability of moats, but there is enough commonality that you can get better at understanding how they are created and whether they can be maintained over time.

‘Charlie Munger told Howard Marks once: “It’s not supposed to be easy. Anyone who finds it easy is stupid. There are many layers to this and you just have to think well.”’

So what are these layers?

What are the common durable competitive advantages? What governs the creation and permanence of business moats?

In Part II, we’ll explore these questions in depth and consider some examples: stocks with durable competitive advantage…and stocks without.

Look out for that next Tuesday!

Regards,

Kiryll Prakapenka,

For Money Morning