In public policy, the cycles of learning and forgetting are very long. Napoleon attacked Russia in 1812. Three years later, the empire was wrecked, and he was exiled to Elba. It took 131 years for memories of the grim war to fade. Then, in 1941, Hitler tried it again. Four years later, Russian troops were in Berlin and the Führer was nothing more than a scattering of ashes and charred teeth.

Price controls must be the economists’ equivalent of a winter campaign in Russia. Always disastrous; they are among the things that fool some of the people all the time and the rest of them occasionally. Which is more than enough for most public policies.

Emperor, Diocletian, provided a ‘teachable moment’ in 301AD. His ‘Edictum de pretiis’ showed all the world that controlling prices doesn’t work. Goods disappear — making them more valuable, not less.

And in the US, it’s been 60 years since Richard Nixon had a short and comic go at price controls. Maybe it is time to give it another try?

We take it for granted that most economists are morons, corporations are greedy, and politicians lie.

Economists have their moments of clarity. Politicians sometimes tell the truth. But businesses are always greedy. 24/7. Just like consumers. And members of Congress. But it’s not every day that the Fed adds US$8 trillion in new money to the economy…and the federal government spends US$23 trillion it doesn’t have. That’s what has happened since the 21st century began. It’s probably not a coincidence that prices are rising now.

Dishonest prices

Another thing we take for granted is that if there is anything the Argentines don’t know about political corruption or financial hanky-panky…it is probably not worth knowing. So, we cast our eyes down across the broad, dark Rio de la Plata; maybe we’ll learn something.

In an honest economy, consumer prices should go down, not up. Corporations lower prices as they become more efficient and competition becomes more intense. From Global Financial Data:

‘Amazingly enough, the Nineteenth century was a period of deflation, rather than inflation. From the end of the Napoleonic Wars in 1815 until the start of World War II in 1914, there was no inflation in most countries, and in many cases, prices were lower in 1914 than they had been in 1815.’

Businesses only raise prices when they have to…or when they can get away with it. And in an honest economy they have neither the opportunity nor the need.

But now, consumer prices are rising at a 7% rate in the US. But business costs — as measured by the Producer Price Index — are rising even faster, at almost 10%. CGTN:

‘U.S. producer prices jumped 9.7% year-on-year in December 2021, to the highest level on record, according to figures released by the Labor Department on Thursday.’

Bear in mind, these are the rates after they have been tortured by the government’s statisticians. If they calculated price increases the way they did back in the ‘80s, they would show consumer prices rising at a 15% rate…and producer prices soaring at around 20%.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

This leaves businesses with little choice. They have to raise prices or lose money.

It also leaves the deciders who run the government and print the money with a decision to make: stop inflation…or lie about it. Naturally, they choose to lie. Who’s to blame for rising prices? Not the people who control the money! No…it’s corporate greed. Supply side disruptions. COVID.

While all of these things have roles to play, they are like bit players in a bank heist. One drives the getaway car. One stands lookout. But the real work is done by the feds themselves — cracking the nation’s safe…adding trillions to the money supply…and spreading it throughout the economy via deficit spending.

Then, as prices rise, they try to ‘talk them down’ with Whip Inflation Now buttons…they accuse corporations of ‘profiteering’…and in their dumbest and most harmful move, they try to control prices directly.

Lessons from Paris, north and south

Here, as with the ‘sanitary passes’, France’s President Emmanuel Macron leads the troops into Moscow. It’s a ‘war’, says the little corporal.

Last month, he gave out the word that consumers can rest easy this winter; the government would prevent greedy energy companies from raising prices. This caused the shares of EDF, the large French electricity company, to go almost into free fall…the stock has lost a third of its value over the last month.

This too is straight out of the Pampas Playbook. Our colleague, Joel Bowman, now in Buenos Aires, comments:

‘Jeez…these people need to send a fact-finding mission to the Paris of the South!

‘Here, the populist Kirchnerista government subsidized utility prices for years as a kind of “brioche for the masses.” Unsurprisingly, their once sound infrastructure soon fell into terrible disrepair. Nobody wanted to invest, given negative returns. Ergo, no investment…

‘So, when rolling blackouts hit the city — around this time every year, as everyone cranks up the AC — the “Ks” revert to their old playbook, blaming the “evil companies” for price gouging, taking advantage of the poor.

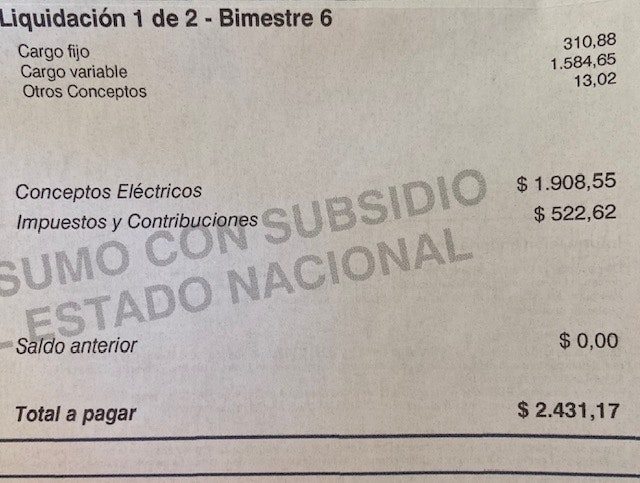

‘Here’s a photo of my bimonthly electricity bill (below), from Edenor. That’s 2,431 pesos per two months. Even at official rates, that’s about $24…total. Unofficially (exchanging dollars for pesos on the ‘blue’ — i.e. free — market) it’s half that…or about $3/month.

‘Unfortunately, as the Argentines found out after years of price controls, subsidies and neglect, in the end, you get what you pay for. “No hay almuerzo gratis,” as they say.’

|

|

| Source: Edenor. Translation: Consumo con subsidio del estado nacional — Consumption with subsidy from the national state. |

But wait. There’s a big difference between Argentina and the US. Different hemispheres. Different languages. And different money.

Maybe the financial laws that doomed Diocletian and the Argentines, don’t apply to us?

Stay tuned…

Regards,

|

Bill Bonner,

For The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.