I just returned from my trip to Singapore and Sydney. It was a whirlwind of a fortnight as we visited relatives, caught up with a few friends, tasted different foods and bought back a suitcase and a half of local foods, clothing and new shoes.

It was quite different to last year’s trip to Hong Kong where I felt the pinch of our weakening Australian dollar and a jump in the cost of living over there. Almost a year later, the property prices in Hong Kong dropped by double digit percentages from its peak and inflation appears to have slowed as many flock across the Chinese border to shop and dine in Mainland China.

Oh, incidentally, one thing that didn’t escape my attention was the number of crypto exchange kiosks in the streets. These kiosks cater to people wanting to swap their cryptos for cash, and vice versa.

Contrary to the belief that the Chinese authorities are clamping down on cryptos, it seems like there’s sufficient demand for digital currencies.

I’d go so far to say that the lucky adopters of cryptos in recent years would probably not feel the pinch that many locals are experiencing! And I suspect that more people could shift out of fiat currencies to prevent their wealth from silently evaporating as they continue to debase.

So if you’re planning to travel somewhere in the coming months, consider Hong Kong as your destination!

Something else helped us loosen our purse strings this time. It was the ‘wealth effect’.

Exactly what am I talking about?

Here’s a clue, it has to do with what’s happening to gold stocks…

Gold stocks rally turning into a bull rush

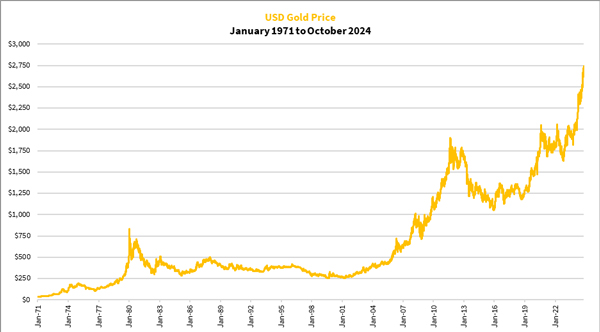

It’s not often you see an asset go vertical. We’re seeing it now.

Gold’s run has been nothing short of breathtaking. It’s doubled in just five years, and is now on a path to have its best year in the last forty years:

| |

| Source: Refinitiv Eikon |

While gold is flying up, gold stocks lagged behind for most of 2021-24, until now.

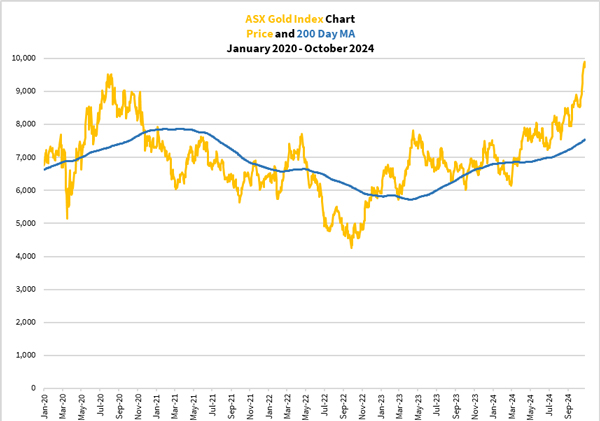

Let me show you this figure below of how the ASX Gold Index [ASX:XGD], which tracks the prices of established gold producers and late-stage developers, is faring:

| |

| Source: Refinitiv Eikon |

Gold stocks bottomed in September 2022 before recovering. However, it’s this month that they’ve shifted to top gear.

It’s for this reason many gold stock investors, myself included, who had suffered an extended period of disappointing returns are now enjoying big gains like that in 2014-15 and 2019-20. There have been opportunities to take some profits and enjoy the fruits of our patience during these gruelling four years.

If you think that these opportunities I’m talking about are behind you, I’ve got good news for you.

It’s not over yet.

Ride this if you dare, for potentially

HUGE results…

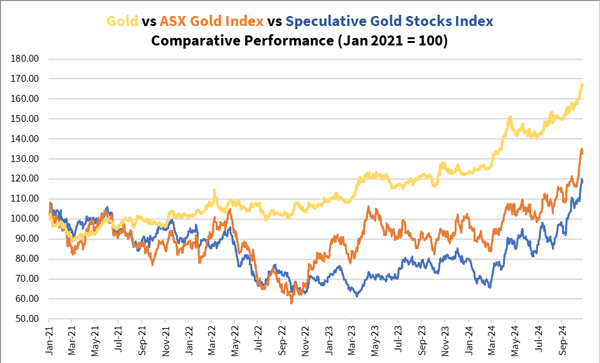

Maybe you’ve missed the best gains for the larger gold producers. But that’s not the case for certain smaller gold stocks.

I’ve tracked over 70 such companies and created my own Speculative Gold Stocks Index. As you can see below, the index is now doing the same thing as gold and the ASX Gold Index:

| |

| Source: GoldHub Australia |

But don’t just jump yet to buy any old gold microcap covered in the latest article on Small Caps, Stockhead or a stock discussion forum; slow down and let me tell you more.

Yes it’s true that gold explorers and early-stage developers could offer immense potential right now.

However, don’t count on randomly buying these companies to help you turn around massive profits. It’s quite the opposite.

Without knowing the backstory of each company and where these companies are in the bull market phase, you could end up watching your portfolio bubble and burst.

Charts and momentum indicators can shake you out or give you false signals. Investor sentiment can distort everything in the manic phase of the bull market.

Believe me, I’ve seen it all in the gold space.

When playing in this space, the key to success is knowing the company’s assets, the potential for the company to develop these and the quality of the management team.

This is how you can secure triple digit or even quadruple digit gains from these companies.

Some companies do keep their gains because they’re progressing their properties but most end up getting sold down as the bubble pops.

You’ve seen that happen with lithium, nickel, copper, rare-earth elements and iron ore stocks in the last three years. Gold stocks won’t be an exception.

Don’t miss out on this offer…

closes at midnight

Last Thursday evening, we launched our The Goldmine Summit. Some of you may’ve watched that and decided that the time is right for you to join us on the journey to make potentially outsized gains buying certain gold explorers and early-stage developers.

Well done to you if you did!

If you haven’t, find out how in the previous bull market some of the best performers delivered as much as 2,000-4,000%+ in the space of 6-8 months. Of course, we don’t know what will happen this time around, but these aren’t returns you can get buying gold or even the largest gold producers.

As I wrote today, general investors are moving into gold stocks now, snapping up the larger gold producers. A few smaller ones have taken off, with many likely to follow.

If you are wondering whether to take part, do it now. We’ve got a special offer for you.

Learn about my unique method, our successes so far and our strategy designed to capitalise on this not-to-be-missed opportunity. I have three stocks you can buy now if you sign up.

Seize this opportunity now as our offer closes at midnight… click here now!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments