Fenix Resources Ltd [ASX:FEX] shipped 341,000t in the September quarter, generating $25 million of net operating cash flow.

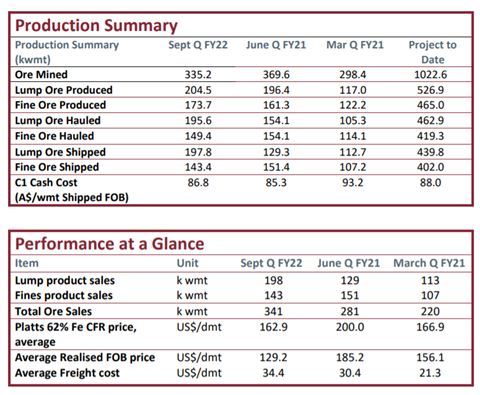

Fenix noted six shipments of iron ore from its Iron Ridge Project in Western Australia were sold during the quarter, comprising 197,848 wet metric tonnes (wmt) of lump and 143,422 wmt of fines.

The quarterly update helped the Fenix Resources Ltd [ASX:FEX] share price to rise 8.5% (at time of writing).

Fenix, like its bigger iron ore peers, rode strong momentum earlier in the year as iron ore prices surged, reaching a 52-week high of 45.5 cents in July.

However, a correction in the spot price of iron ore in recent months saw FEX slide, with shares down 12% in the last month.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Fenix’s September quarter

Six ships were loaded in the September quarter, with completion dates of 15 July, 3 August, 9 August, 27 August, 8 September, and 22 September 2021.

Fenix said shipping in July was impacted by sea surge and swell conditions, leading to multiday closures of the Geraldton Port.

The average grade shipped was 62.2% Fe for fines (previous quarter was 61.5%) and 64.8% Fe for lump product (previous quarter registered 64.3%).

The average price received was US$129.23 per dry metric tonne (dmt) FOB, equivalent to US$163.61 per dmt CFR.

As to cost, Fenix reported C1 FOB cash costs for the quarter of $86.77 per wmt shipped and $87.98 per wmt from project inception to date.

FEX has now shipped 841,813 tonnes of product from its Iron Ridge Project.

Financial overview

FEX’s Net Operating Cash flow was $25.4 million and Free Cash flow was $23.8 million for the period.

Unaudited C1 cash costs for the quarter stood at $86.77 per wmt shipped.

Capital expenditure for the September quarter was $1.5 million, dragging the total project capital expenditure to $16.7 million.

Most of the capital expenditure for this quarter was linked to scheduled year-1 road upgrade works on the Shire of Cue Road network.

What’s next for the FEX Share Price?

Fenix Managing Director Rob Brierley said:

‘We finished the quarter in a very strong position with net cash of A$93m, equal to 19.7c a share, highlighting the enviable cash generating capacity of the Iron Ridge Project.

‘Subsequent to the end of the quarter, we were delighted to pay our maiden fully-franked dividend for FY21 of 5.25c a share, representing a total payout of A$24.8m.

‘Given the current circumstances in the iron ore industry, this is a strong result which saw Fenix generate substantial free cashflow as increased production and a lower Australian dollar helped offset reduced iron ore prices.’

On Monday, the spot price of iron ore jumped 9.4% to US$135.03 a tonne, taking gains in the past three weeks to 45%, according to Fastmarkets MB.

But commodity strategists warn the rally may be short term, driven by restocking demand.

‘It’s being driven partly by restocking from the National Day holidays and so the question mark is how long that continues for,’ commented Lachlan Shaw, co-head of mining research at UBS.

‘Underlying demand is still not that strong, and we don’t have conviction yet as to how long the current rally can endure.’

Be it the iron ore industry or the lithium industry, volatility can eat your gains if you don’t have a solid strategy.

That’s why I suggest checking out this report on technical analysis by our trading veteran, Murray Dawes.

He unveils his unique strategy that can help you in a volatile market.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here