The US Fed has walked the market back from the edge of the cliff, but the cliff remains.

After three months of selling, the S&P 500 was oversold and looking for an excuse to kick off a short squeeze.

Last week I said the time had past for entering short positions because the risk of a short squeeze was rising. The S&P 500 had hit my initial target, the midpoint of the correction from last year.

The odds of prices heading up or down from that level in the short term are around 50%, which is why I use the point of control (midpoint) of a wave or range as a spot to take some profits off the table.

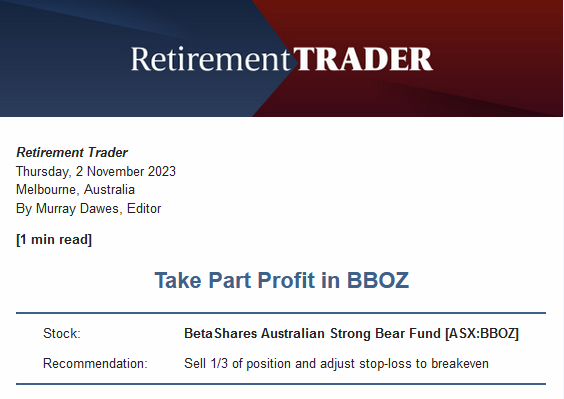

That’s what we did on Thursday in my conservative trading service Retirement Trader.

After seeing the markets’ reaction to the FOMC meeting, with bonds and stocks rallying, I bit the bullet and told members to sell a third of their position.

Time to ring the cash register

|

|

|

Source: Retirement Trader |

I’m showing you the trade alert because I know how sceptical we can be when someone makes claims about what they’ve done in the markets.

Now that we have sold a third and adjusted the stop loss to a level that will ensure the capital invested is safe, we stand in a great position to see what comes next.

If the S&P 500 turns down again in the short term and falls below last weeks low, it could fall 10-15% quickly.

But now that a short squeeze is under way, the S&P 500 could rally for weeks.

After taking part profits the outcome for the trade will either be no loss or a win that could be substantial.

I’d take a bet like that every day.

In today’s Closing Bell video I show you how powerful the weekly trend can be in the S&P 500.

While the trend remains down, I will view the rally as a short squeeze that could find stiff selling pressure at some point.

If a Santa rally does take hold it could flip the charts from bearish to bullish, so I show you what I need to see to shift my bearish stance in the video above.

If you are enjoying these videos I would love it if you could take the time to ‘like’ the video on YouTube.

Regards,

|

Murray Dawes,

Editor, Fat Tail Daily