The Fatfish Blockchain Ltd [ASX:FFG] has acquired BNPL Next Ltd for $4.14 million and enters early wage access market in Southeast Asia.

Fatfish Blockchain Ltd [ASX:FFG] share price rose as much as 30% in early trade before simmering down at the time of writing, still up 15%.

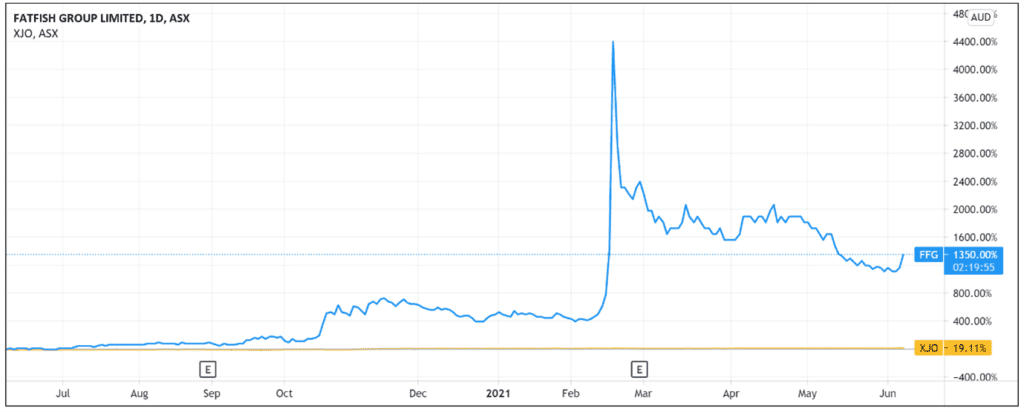

The small-cap tech venture firm has been on a tear this year, with the FFG stock up 140% year-to-date and up 1,100% over the last 12 months.

Source: Tradingview.com

Introducing Fatfish Group

Fatfish is a tech venture firm with business interests in Southeast Asia and the Nordic European region.

FFG focuses on emerging global technology trends, especially in video games, e-sports, fintech, and consumer internet technologies.

It started as a Singapore government partnered incubator before expanding.

Fatfish aims to build tech businesses with the ‘potential to scale regionally or globally through its unique “Seed-to-Exit” approach.’

You can think of Fatfish as operating similarly to Strategic Elements Ltd [ASX:SOR]. SOR is a pooled development fund focused on investing in technology and resource sectors.

These five AI stocks could potentially follow in the footsteps of BrainChip’s meteoric 3,133% price spike. Click here to learn why.

Fatfish acquires BNPL Next

FFG today disclosed it entered an agreement to acquire 100% of Australian incorporated company BNPL Next for a consideration of $4.14 million.

The consideration will be satisfied entirely in FFG shares.

According to Fatfish, BNPL Next aims to bring ‘next-generation digital functioning platforms to the growth markets of Southeast Asia.’

Notably, the acquisition target has a 60% stake in Circopay, a leading earned wage access (EWA) solutions provider in the region.

It is this stake in Circopay that has Fatfish excited.

Earned wage access

Circopay’s employee financial benefit platform offers earned wage access (EWA) solutions, which allow workers to access wages to meet any short-term financial obligations that fall between pay cheques.

EWA allows employees to meet unexpected obligations without turning to credit cards, personal loans or payday loans.

In other words, EWA allows workers to receive their earned wages early (maybe the term should have been Early Wage Access).

How does the process work?

Let’s say an employee requests — at any time before their payday — to make a withdrawal.

Upon receiving the request, Circopay pays the employee the requested amount, subtracting a ‘tiered fixed processing fee which is deducted upfront.’

Circopay then recoups the total amount paid to the employee from the employer, plus a ‘processing fee.’

FFG cited research commissioned by Visa, showing that many workers were living pay cheque to pay cheque even before the pandemic.

44% of employees surveyed in the US have less than US$500 saved for unexpected expenses.

Unfortunately, the COVID-19 pandemic only exacerbated the precarious financial position of many.

Fatfish reported that with ‘more than 90% of hourly workers reporting that access to their pay before payday would be helpful, EWA programs are poised to see robust adoption moving forward.’

Fatfish Group outlook

Fatfish explained that a big reason for acquiring BNPL Next and its stake in Circopay is the early mover advantage gained by the deal.

In FFG’s view, Circopay is an EWA ‘pioneer’ poised to capitalise in a region where a ‘large proportion of the working population have comparatively lower income as well as limited access to financial services.’

While the EWA market looks like it can grow into a big market with lots of opportunities for first movers and adopters, it should be noted that, in the short term, Circopay is well and truly in the early growth phase.

FFG itself disclosed that Circopay could not ‘quantify the revenue income for FFG as a (proposed) 60% shareholder of Circopay (via BNPL Next) at this time.’

Fatfish noted further disclosures to the market would follow once the revenue impact on FFG can be ‘responsibly determined.’

If you’re keen on investing in promising fintech stocks, check out our latest report.

The report analyses three companies that every small-cap investor should have on their watchlist.

Regards,

Lachlann Tierney,

For Money Morning.

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here