Content-filtering, location-sharing and safety app developer Family Zone Cyber Safety [ASX:FZO] announced the successful completion of a new fully-paid ordinary share capital raising to around $20 million.

The company launched the offer to professional and wholesale investors for growth and boosting its cash flow run rate in FY23.

The company now says it is in the position to attract a mix of debt and equity to lower its capital costs in growth and future investing.

Subsequently, Family Zone plummeted by more than 8% by the afternoon on Thursday, hours after celebrating its higher capital position.

FZO was trading at 19 cents at the time of writing. It plunged by 43% since last Mach and by 23% in the last month alone:

www.tradingview.com

Family Zone raises $20.0 million for growth strategies

Thanks to its most recent placement of fully paid ordinary shares (new shares) to its professional and wholesale investors, the cyber safety and children’s monitoring online developer Family Zone has managed to raise $20 million.

The group intends to use the new funds to leverage its expected cash flow annual run rate to break even this current financial year, as well as to help it grow and manage its costs.

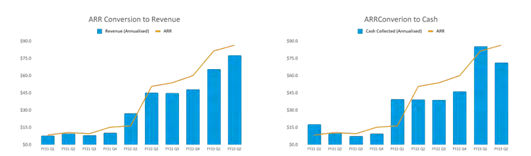

Family Zone revealed that at its upcoming inflection point, the group’s annual recurring revenue (ARR) is approaching $100 million on a company scale.

Now the company is better positioned to mix debt and equity, lowering its capital costs for growth and any future investments it decides to take part in going forward.

FZO will use its new-found funds to pad out its balance sheet to support additional growth and corporate opportunities and repay drawn-down debt incurred via the North City working capital facility.

Family Zone drew attention to its integrated capital strategy, which it says is made up of three parts; capital raising. I.e., the recent $20 million placements and an extra $5 million in working capital to be converted to equity — the goal to be fully funded and to make good use of debt funding.

The safety-app developer hopes to get itself to fully funded status through cash flow break-even to profitability, with a buffer and plenty of flexibility.

As for its debt funding, Family Zone hopes to advance existing discussions, with a conclusion expected sometime this year.

The company commented in its update on Thursday:

‘With a strengthened balance sheet the Company expects to be able to direct the market’s attention to the quality and potential of its underlying business which is experiencing tremendous growth and expeditiously unlock value for shareholders.’

New shares under the offer will be issued at a price of 18 cents a share, a 14.3% discount to the last closing price for FZO shares on 6 March and a 1.9% discount to the five-day VWAP up to and including that date.

The offer comprises a two-trance placement of approximately 105 million new securities, and the allocation of these placement offer shares is to happen on 4 May:

Source: FZO

Callum’s bargain stocks

The war in Ukraine, inflation, continually rising rates, and floods — this is an accumulative list of challenges putting pressure on households and businesses alike.

Many companies have had to lay off workers and use slimming-down strategies to weather the storm.

Tech stocks have been particularly hard-hit with a tidal wave of redundancies affecting companies like Zero, Nimble, Amazon, Meta, and even Twitter.

It’s bad news for them, but it’s not forever – and it’s times like these that some real ASX stock bargains can emerge…if you know where to look.

Our small caps expert Callum Newman has done the hard work for you.

He’s found five of what he calls ‘the best stocks to own in Australia’ right now.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Mahlia Stewart,

For Money Morning