Treasurer Josh Frydenberg has just thrown rocket fuel under the Aussie real estate market.

Another 10,000 first home buyers will now be able to build a new home with no more than a 5% deposit.

Something that benefits no other than the big developers with large land banks. They will happily hike up land prices in new estates to absorb the benefits.

Single parents can now purchase a home with a mere 2% deposit.

The amount that can be released to buyers under the First Home Super Saver Scheme has been increased from $30,000 to $50,000.

And add to that a $15 billion spend in new infrastructure…

In short — anyone who has a couple of good properties to their name will enjoy tens of thousands of inflationary gains into their patch of land.

Probably more if we factor in the tax cuts…

Owners ‘growing richer, as it were in their sleep, without working, risking, or economizing’ as the Classical Economist John Stuart Mill quipped in the 1800s.

We crunched some numbers at Prosper Australia to give you an idea what’s to come.

It’s a conservative estimate I might add.

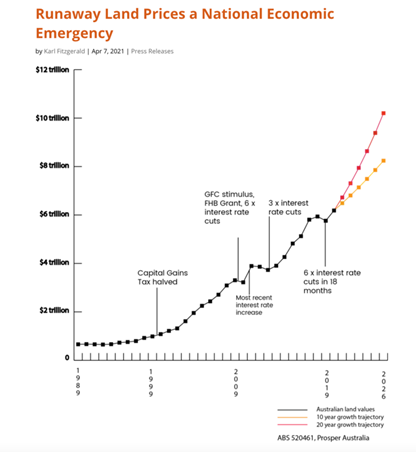

Take a look for yourself:

|

|

Source: Prosper Australia |

The figures are based on past land price growth rates extrapolated from the national accounts.

The last decade’s increase in national land values averaged at 4.9% per annum.

That means Australia’s total land values are on track to go from $6.2 trillion to $8.2 trillion in the next five years.

To put it in context — last financial year land prices increased a colossal $423 billion.

That is 20 times the total banking profits.

Expect land prices to increase by close to $600 billion this FY.

Likely it will be more.

I’ve never seen a housing market hotter than it is right now.

The mortgage market is experiencing record demand.

And even that is not picking up on the increasing number of cash buyers in the market.

I’ve serviced more cash buyers than any other year in the last few months alone.

They are a common feature of Perth’s real estate market now.

All seeking better yields.

Better to buy a house and rent it out, than keep $s in the bank at current interest rates.

None of this accounts for the massive changes coming to the financial system of course.

The removal of cash from society. (Something rather jarring for someone with the name Cashmore.)

To be replaced by Central Bank Digital Currency (CBDC).

These will be government-sanctioned blockchain protocols, administered by the banks and other authorised lenders.

That includes big tech that have been promised a banking licence as part of the WEF’s (World Economic Forum) ‘Great Reset’.

That would kick this transition to warp speed.

PayPal could be to CBDC what private banks are to physical dollars.

The company’s CEO, Dan Schulman, laid out his vision during PayPal’s investor day:

‘You think about how many [digital wallets] we’re going to have in the next two, three or five years, and we’re a perfect complement to central banks and governments to distribute those digitized forms of currency,’

These are trends you need to be on top of.

It’s why my colleagues Ryan Dinse and Greg Canavan have just launched a new service called New Money Investor.

It’s going to take you into the heart of the cryptocurrency market and discover all the implications of where this massive trend is taking us.

Ethereum’s market cap is now greater than all the largest banks in the world.

You can’t afford to sit in ignorance.

Make sure you see what Greg and Ryan are forecasting by going here now!

One thing that will be the same however — is the way it’s affecting the real estate market.

That doesn’t mean that median price gains can’t slow when current government incentives are drawn back, for example.

It’s just to evidence that there is so much fuel to this fire.

Don’t miss out.

At Cycles, Trends & Forecasts, we show how you can take advantage of all the above whether you are a trader, or property buyer.

Not only exposing all the trends behind it — but showing you how to accurately time the booms and the busts!

For now however, it’s onwards and upwards into the roaring 2020s.

Best wishes,

|

Catherine Cashmore,

For The Daily Reckoning Australia

PS: Discover what is probably the easiest way to start investing in gold in Australia. In fact, it’s as easy as buying a book on Amazon! Click here to read the FREE report.