The rhythm of life is as old as time itself.

‘About 900 years ago a text called The Yoga Spandakarika was written by an Indian philosopher and scholar named Vasagupta.

‘In Sanskrit the word “spanda” can be translated as vibration or tremor and refers to the pulsation of life that exists within each of us.

‘The Yoga Spandakarika teaches that everything in our world IS vibration, pulsing at different levels of frequency.

‘Our bodies are a perfect repository for this never-ending throb of life force. Every time it beats, your heart contracts, causing a wave of pressure that pushes fresh blood into your arteries. Between these contractions it briefly expands to allow more blood to come in.

‘As long as you’re alive, this pattern never changes.’

Contraction and Expansion — The Rhythm of Life

Down through the ages, the competing forces of…

…too much, too little…

…too high, too low…

…too fast, too slow…

…too restrictive, too lax…

…have been working towards achieving…

Balance. Equilibrium. Equality. Happy medium.

We live in a world constantly working towards maintaining a sense of balance.

The always and forever pulsing beat of life.

The pendulum never stops swinging.

Life, and its many moving parts, is a continual process of Yin and Yang.

When something gets out of balance, invariably there’s a corrective process.

Some imbalances are corrected immediately. Others can take years, even decades, for the pendulum to move in the opposite direction.

We know, accept, and recognise the need for the principle of balance in our lives.

If you’ve lived long enough, you know excesses always have consequences.

Yet, when it comes to investment markets — be it shares, property, bonds, or cryptos — we somehow want an exclusion zone to be applied to this principle.

Expansion should be followed by more expansion and then, even further expansion.

Asset prices should never pause to contract.

Of course, that does not happen.

That’s not how life works.

Even in our living memory, the market’s expansionary phases do contract…dotcom bubble, followed by the tech wreck and the US housing bubble, followed by the GFC.

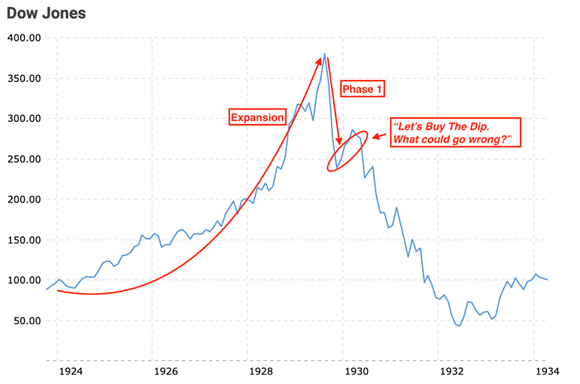

The parabolic rise of the everything bubble created the most expansionary bull market in history…leaving the infamous Roaring Twenties and dotcom bubble in its wake.

|

|

| Source: Macro Trends |

The expansion of the everything bubble suffered a momentary contraction in March 2020.

But, courtesy of the Fed’s overly generous stimulus measures, Wall Street found another gear. In the space of 21 months (from April 2020 to December 2021), the S&P 500 increased by more than 80%…and this pricing madness occurred during a global pandemic.

Many could see no end to this expansionary trend…it would continue pushing on without pausing to catch its breath.

And I can understand why.

A 25-year-old in 2009 wouldn’t have been overly affected by the contracting forces of the GFC.

That same person is now 39.

All they’ve ever seen in their adult life is rising markets…shares, property, and cryptos. Anything you threw a dollar at went up.

You can appreciate why a whole generation of investors believed the Fed was omnipotent.

In their investing lifetime, the Fed (appeared to have) rendered market cycles redundant. Any dip in market trajectory was quickly countered by a more aggressive stimulus response.

The equalising forces of Risk On and Risk Off were rendered obsolete.

A relic of an era that (in the minds of many) no longer exists.

In January 2022, with the Fed moving to ‘normalise’ interest rates, the market pendulum began to arc back…from expansion to contraction.

In recent months, market participants have been pushing back against the pendulum…creating the impression there’ll be a resumption in expansion.

Don’t be fooled.

Buy the dip is an all-too-common reaction after the first phase down in a bear market:

|

|

| Source: Macro Trends |

What could go wrong?

Between late 1929 and mid-1932, the Dow Jones contracted by almost 90%.

The same ‘buy the dip, what could go wrong?’ mentality prevailed in the bubble busts of 2000 and 2008.

It’s human nature.

Pavlovian investor responses are a product of conditioning from the good times.

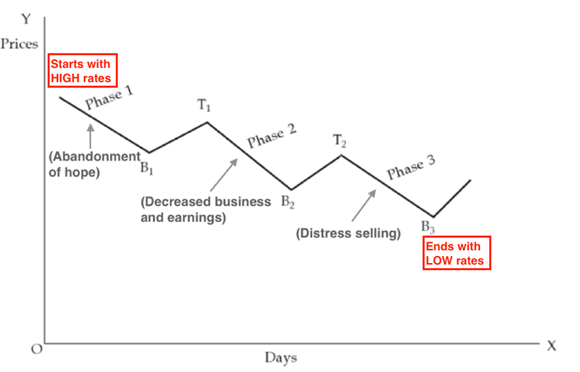

In 1934, Robert Rhea produced this graph on the three phases of a bear market.

What transpired in 1929/30s, still applies today.

Also, contrary to what the punters believe, bear markets start with high rates and end with low rates.

So those expecting a resumption of bull market conditions when rates start falling should take a look at the history of market and interest rate cycles:

|

|

| Source: Security Analysis and Portfolio Management |

Yes, while the US experienced the most speculative asset bubble in history, the Aussie market was more subdued in its growth.

But, as they say, ‘when Wall Street sneezes, the rest of the world catches cold’. If/when Phase Two gets underway on US markets, we’ll be dragged along for the ride.

That ‘steady-as-she-goes’ balanced super fund the majority are invested in — with a 65%-plus exposure to Australian and international shares — will be influenced by the actions of punters half a world away.

Everything in markets is connected

A flurry of activity by an overly excited OR panicky few, has pushed the market’s valuation pendulum from one extreme to the other for more than a century.

Market pricing ALWAYS happens at the margin.

On any given day, less than 0.5% of shares are traded. That wafer thin trading activity sets the price for the remaining ‘buy and hold’ at 99.5%.

Double the trading volume — due to a wave of rampant speculation or panicked selling — and you get violent price swings.

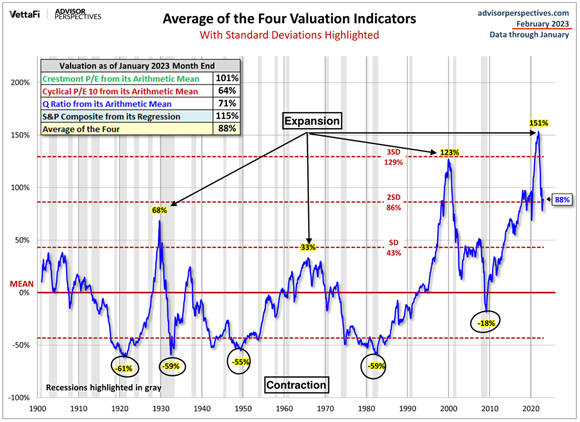

This chart — dating back to 1900 — shows how the Average of Four Long-Term Valuation Indicators pendulum has swung above and below the MEAN.

Periods of excessive exuberance have all been countered by an equal and opposite force of fearful selling.

Balance, in due course, is always being restored…and the cycle starts again.

|

|

| Source: Advisor Perspectives |

After 1990, you can see the Fed’s fingers on the market’s scales of balance.

The excesses — dotcom boom, US housing bubble, and the everything bubble — have been more excessive and the corrective forces, less corrective.

Look at the momentum behind the everything bubble pendulum…taking valuation metrics well-beyond 1929 and the dotcom peaks.

The most recent reading of the Four Valuation Indicators shows the process of restoring balance has begun…but still has a long way to go.

How far will it go?

Perhaps to the depths plumbed prior to 1990…into the sub-MINUS 50% range?

Or maybe valuations will ONLY contract to the more modest level in 2009.

Either way, the contraction experienced in any of these periods was not good for those who bought into the half-truth of ‘shares for the long term’.

Recovering from a period of excessive expansion can take decades.

If you think balance will never, ever be restored, leaving the valuation pendulum in a permanent state of elevation and suspension, then remain fully invested in shares.

In my opinion, that thinking not only violates the laws of physics, but also of life.

The reason for my defensive approach is based on simple physics…‘the higher you climb, the harder you fall’.

By any measurement, the everything bubble was THE GREATEST BUBBLE in HISTORY…take another look at the chart on Four Valuation Indicators.

How on Earth can we have a soft landing from such a lofty perch?

Will the Fed reverse its higher rate and QT (quantitative tightening) stance and go all COVID-stimulus again?

Quite possibly.

But that can only be effective if the punters still want to punt.

What if Phase 2 — like that experienced after Lehman Brothers went bust — scares the living daylights out of investors?

What if the downside momentum — fuelled by fast fingered, indebted, and panicked sellers — takes hold?

Wall Street could contract by 50%, 60%, or more.

If that happens (and I personally think this is what we’re confronting in the next year or two) the Aussie market will not swim against this tide of negative sentiment.

I know what I’ve outlines sounds totally impossible…bordering on derangement.

The consensus view remains, ‘the Fed won’t let that happen’.

We’ll see.

The Fed’s policies have worked in an environment where the social mood has been decidedly upbeat.

When the psychology of the mob switches from positive to negative, the pendulum on the Fed’s powers will swing from omnipotent to impotent.

The absolute certainty of market expansion and contraction can be found in The Yoga Spandakarika…

As long as you’re alive, this pattern never changes.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia