It’s not every day that I find myself aligning with the views of Stephen ‘The Kouk’ Koukoulas.

He is a bit of a legend in the Australian economics scene, having worked for the Commonwealth Bank, TD Securities, and Citibank, among other big-name institutions.

He also worked as an economic advisor to former Prime Minister Julia Gillard.

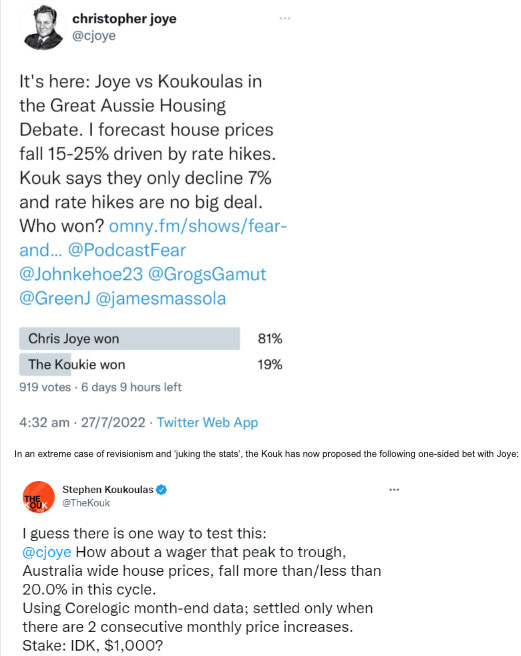

Late last year, he took part in ‘The Great Housing Debate’ with Coolabah Capital’s Chris Joye.

During the debate, The Kouk forecast that Australian dwelling values would only decline 7% peak-to-trough on the back of a lift in Australia’s official cash rate to 3%:

‘Peak to trough is minus 7%…That assumes 300 basis points of rate hikes from the RBA…So a 7% decline…My 7% fall is basically linked to Sydney and Melbourne doing a little worse than the average…So minus 7%. It will probably occur in the middle parts of 2023 to the latter part of 2023.’

Joye, on the other hand, laid out one of the most extreme bear cases for the property market that was published in 2022…

‘We believe that after the first 100 basis points of RBA rate hikes…we forecast that house prices nationally would fall 15% to 25%. And I guess in contrast to Kouky, in our analysis and all of our research, by far the dominant influence on house prices is mortgage rates and purchasing power.’

Shortly following the debate, the property bears on Twitter hailed Joye as the winner.

|

|

| Source: Twitter |

Kouk’s response may have been a little extreme, but I would have sided with his bet at the time.

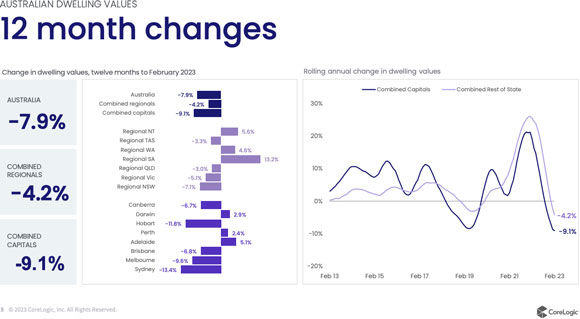

This is where things sit currently (to the end of February 2023):

|

|

| Source: CoreLogic |

The official cash rate is now 3.6%. Nationally, values are down 7.9% — with the most extreme falls felt in Sydney, where the median has fallen just more than 13.4%.

That’s a sharp downturn, although it’s worth noting at this point that Perth, Adelaide, and Darwin are still firmly in positive territory! When I talk to agents on the ground in WA, they ask me, ‘what downturn!?’

Still, The Kouk (and everyone else on the East coast) is asking whether or not the bottom is in.

Well, The Kouk certainly thinks so.

A couple of weeks ago he penned an article entitled, ‘The fall in house prices is coming to an end.’

Here’s what he said:

‘….when account is taken of auction clearance rates, the extreme tightness in the rental market and a rise in household incomes, it is…a clear signal that the housing market is in for a period of relative stability after the falls in 2022.

‘After what looks like being a peak-to-trough fall in Australia-wide prices of around 9-10 per cent from April 2022, prices in the next few months are likely to experience a period of consolidation. That means a few small ups and downs, from city to city and region to region, but overall, not much change.

‘From the latter part of 2023 and into 2024, when the rampant surge in Australia’s population feeds extensively into demand for housing at a time when supply growth is moderate, prices are likely to be skewed higher. Price rises averaging around 0.5-1 per cent per quarter for the second half of 2023 are a reasonable expectation.’

According to CoreLogic, the national index only declined by 0.14% over February.

It’s the smallest monthly fall since May 2022 (minus 0.13%), when the rate hiking cycle started.

Further, Sydney has turned the corner.

A swing into the positive of 0.3% in Sydney’s dwelling values drove the national deceleration in the median. And unless supply increases substantially over the next few months, that trend is likely to continue.

Needless to say, it certainly doesn’t look like we’re going to see a peak-to-trough decline in the national median of 15–25%.

Granted, it’s early days. But right now, I’d say The Kouk is the winner of ‘The Great Housing Debate.’

With this in mind, I invited The Kouk to join me at Land Cycle Investor for an interview to discuss his views on the property market and why he thinks the market could continue to head into positive territory through 2023.

Included in the interview is:

- The Kouk’s forecast on where the cash rate and property prices will trend over the years ahead to the peal of this cycle in 2026

- The difference between the East and West coast markets

- His opinion on state and federal national policies affecting the property market

- We also touch on land taxation, as promoted in ‘The Henry Review of Australia’s tax system in 2010’ and the legacy of Henry George

All this and so much more!

I hope you enjoy the chat as much as I did.

Best Wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments