In 1995, Bill Gates released the first edition of The Road Ahead, his take on the implications of personal computing.

The implications were so drastic that Gates revised the book a mere year later, admitting he ‘vastly underestimated how important and how quickly the internet would come to prominence’.

Humbled, Bill Gates came to a generalisation:

‘We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Don’t let yourself be lulled into inaction.’

Gates wasn’t the first to realise people overestimate short-term potential while underestimating long-term potential.

In 1995, the journal Massachusetts Review pinned the genesis of the idea to sci-fi author Arthur C Clarke:

‘Arthur Clarke has noted that we tend to overestimate what we can do in the near future and grossly underestimate what can be done in the distant future. This is because the human imagination extrapolates in a straight line, while real world events develop exponentially like compound interest.’

The perils of extrapolating in a straight line is something my colleague Ryan Dinse has written about a lot.

In fact, he even wrote a book about the benefits of exponential investing. As he explained in his book:

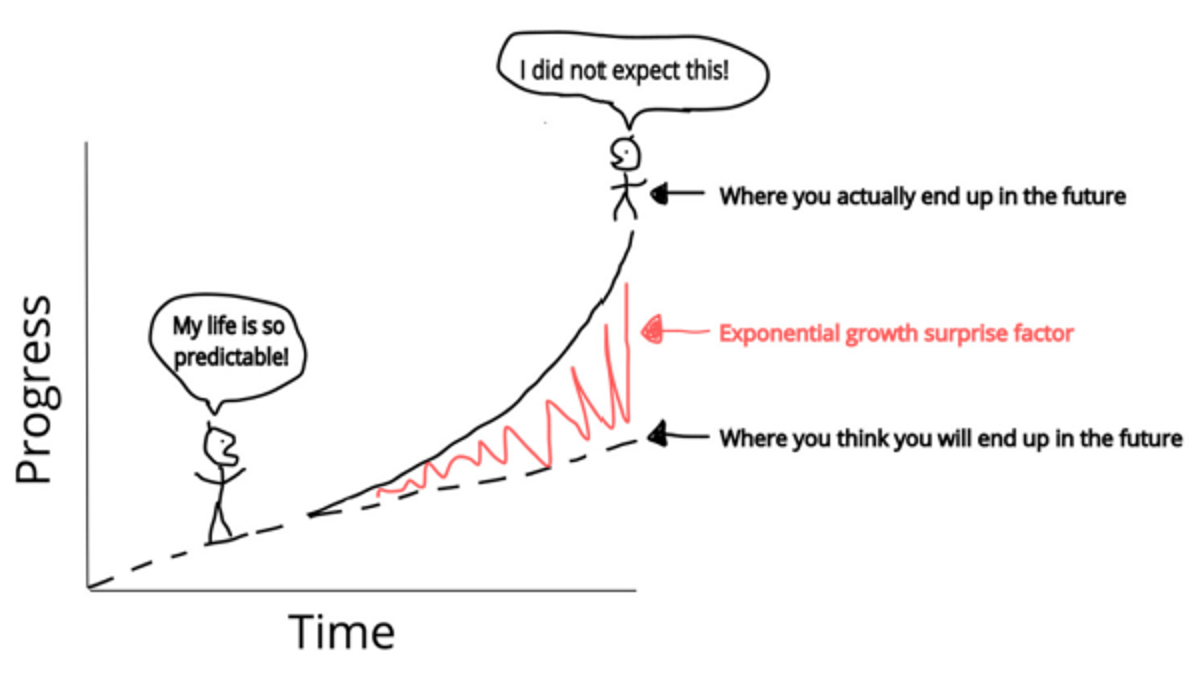

‘Us humans aren’t used to thinking exponentially. We usually think linearly, in the sense that small incremental changes follow a linear path of change.

‘That’s why exponential trends shock us with their impact.

‘This funny little graphic explains it well:’

|

|

|

Source: Ryan Dinse |

Can we use our historical underestimation of the future to improve our forecasts?

Maybe. But even if we couldn’t, guessing the future has merit.

As novelist Nevil Shute noted:

‘No man can see into the future, but unless somebody makes a guess from time to time and publishes it to stimulate discussion it seems to me that we are drifting in the dark, not knowing where we want to go or how to get there.’

So let’s dispel the dark we’re drifting in and ask where crypto is headed.

What will Bitcoin [BTC] and crypto look like in 2030 and beyond?

What if we decentralise everything?

Well, not everything, but what would the 2030s look like if the world took on a great decentralisation project?

While many think of bitcoin as nothing but a currency, bitcoin’s protocol and the underlying blockchain technology have much wider implications.

Princeton computer science professor Arvind Narayanan wrote that bitcoin’s underlying technology may cause a rethink on centralised institutions:

‘Bitcoin’s apparent success at decentralising currency may cause a rethinking of other centralised institutions—ones dealing with stocks, bonds, property titles, and more. Can block chain technology be applied to decentralise them as well? And if decentralisation is technically possible, is it also financially sensible and beneficial to society?’

Blockchain technology can be applied far and wide.

In 2030, you might even find yourself buying a smart car using the blockchain without even needing to meet the seller.

As Narayanan writes:

‘Consider the situation where Alice owns a smart car and wants to sell it to Bob. The ability to transfer control digitally opens up interesting possibilities. For example, Alice might be travelling overseas, and to fund further travel expenses might want to sell her car, which is physically parked in her driveway back home. With an Internet connection, Bob could pay Alice for the car with Bitcoin, Alice can remotely transfer ownership to Bob with the block chain used by the car, and Bob can drive away with his new car.

‘As long as the currency used for payment and the car ownership coexist on the same block chain, Alice and Bob can form a single atomic transaction that simultaneously transfers ownership of the car and the payment for the car. Specifically, the transaction would specify two inputs: Alice’s ownership and Bob’s payment; and specify two outputs: the ownership to Bob and the payment to Alice.’

Like with smart car sales, blockchain technology may also change the way we conduct real estate transactions.

Real estate, cars, assets — blockchain can change the way we conduct sales via what’s known as smart property.

Smart property is an asset that has access to the blockchain…and can be controlled via the blockchain, be that by means of transactions, transfers, or contracts.

If we can connect property to the blockchain, we are one step closer to making real the promise of the Internet of Things (IoT):

As researchers Konstantinos Christidis and Michael Devetsikiotis noted in a paper on blockchains and the IoT (emphasis added):

‘The combination of blockchains and IoT can be pretty powerful. Blockchains give us resilient, truly distributed peer-to-peer systems and the ability to interact with peers in a trustless, auditable manner. Smart contracts allow us to automate complex multi-step processes.

‘The devices in the IoT ecosystem are the points of contact with the physical world.

‘We believe that the continued integration of blockchains in the IoT domain will cause significant transformations across several industries, bringing about new business models and having us reconsider how existing systems and processes are implemented.’

Bitcoin and quantum computing

Now, on to something less upbeat for crypto’s future…the threat posed by quantum computing.

As a piece in the New Scientist explains (emphasis added):

‘The bitcoin network is kept secure by computers known as miners that use a cryptographic algorithm called SHA-256, which was created by the US National Security Agency. Breaking this code is essentially impossible for ordinary computers, but quantum computers, which can exploit the properties of quantum physics to speed up some calculations, could theoretically crack it open.’

Of course, quantum computing is not just a threat to crypto. Quantum computing poses a threat to cryptography in general.

As computer scientist Mark Webber wrote in a recent paper:

‘Although bitcoin is secure for the foreseeable future, there are concerns about other encrypted data with a much wider window of vulnerability. An encrypted email sent today can be harvested, stored and decrypted in the future once a quantum computer is available — a so-called “harvest now, decrypt later” attack, which some security experts believe is already happening.’

Now, what does ‘bitcoin is secure for the foreseeable future’ mean exactly?

It means that while quantum computing can, in theory, pose a serious risk to bitcoin’s protocol, the quantum computing power required to be a viable threat does not exist today.

Webber calculated that breaking bitcoin’s encryption in a 10-minute window would require 1.9 billion qubits or quantum bits (equivalent to standard computing bits). Breaking the encryption in an hour requires about 320 million qubits, which drops all the way to 13 million qubits if breaking the encryption in a day.

Currently, the most powerful quantum computers have about 130 qubits, well below the threshold.

But let’s remember Bill Gates’s adage about underestimating the future.

As Webber elaborated (emphasis added):

‘This large physical qubit requirement implies that the Bitcoin network will be secure from quantum computing attacks for many years (potentially over a decade). The Bitcoin network could nullify this threat by performing a soft fork onto an encryption method that is quantum secure, but there may be serious scaling concerns associated with the switch.’

Secure for many years, but not inherently immune.

Developments in quantum computing are definitely something to monitor.

Questions for the future

No one can see the future, but it’s worthwhile sometimes to venture guesses.

With that in mind, here are some questions I have about the future of crypto.

Thinking about them may give us glimpses of the future.

In 10 years, how many people will own bitcoin? Will it be 10% of the global population? 30%?

In 10 years, will we use bitcoin predominantly to transact — buy and sell goods and services — or will we store bitcoin as investments?

Will bitcoin remain the dominant cryptocurrency in 2030?

Will the blockchain have a wide, mainstream application by 2030? In what sector? Healthcare, smart contracts, real estate?

Now, there are many other questions we can pose. I’m sure you have plenty.

If you’re interested in crypto, the blockchain, and bitcoin, then I highly recommend you check out the upcoming seminar hosted by Ryan, our veteran crypto expert.

To register, for free, to attend ‘The Great Crypto Lock-Up Seminar’ this Thursday…just go here.

Regards,

Kiryll Prakapenka,

For Money Morning