Earlier this week, electric vehicle giant Tesla surprised the market with an 83% spike in global deliveries in the second quarter.

The surge was attributable to steep discounts as the carmaker pivoted towards a volume strategy to chase growth and market consolidation.

Back in April, chief executive Elon Musk said of the new strategy:

‘We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here, versus a lower volume and higher margin.’

Tesla shares have more than doubled in the first six months of 2023, rebounding after a tough 2022.

The carmaker is the most visible firm associated with the transition to EVs and the green energy transition more broadly.

And its success has spurred the entry of competitors the world over.

If EVs are the future…and if renewable energy tech is the future…then let’s get in early, the thinking goes.

Just imagine the expanding massive market in the years to come. Snaring even a fraction of that pie will be more than enough, the thinking goes.

But that’s what I want to discuss today — the perilous reliance on big markets to evaluate a stock’s potential.

Big market, big dreams

Let’s assume, arguendo, that every internal-combustion engine is replaced by an EV counterpart in the next 25 years.

Let’s also assume the use of renewable energy technology jumps 20 times by 2050.

In this scenario, the total addressable market for EVs and renewable energy tech is vast.

Riches galore!

Enough pie for everyone!

But is that true?

Does the existence of a large market necessarily confer value to a stock participating in that market?

Coffee is a big market.

But if I take out a loan and open a café in my neighbourhood, I’m not necessarily destined to take on Starbucks. I might not even be able to take on the rival café around the corner.

Yet the size of the market is a big consideration for many investors.

Here’s the legendary founder of Sequoia, Don Valentine:

‘Our objective is always to build big companies — if you don’t attack a big market, you’re highly unlikely to build a big company.’

Valentine made a good point. How can you grow into a big company in a small market? But we should qualify his claim.

If you don’t attack a big market, you’re unlikely to build a big company. But just because you do attack a big market doesn’t mean you’ll succeed.

The size of the market caps success but doesn’t guarantee it.

Big markets, big delusions: ASX lithium stocks

The idea of a ‘big market delusion’ was popularised first by finance professor Aswath Damodaran in a 2019 paper and then a few years later by Rob Arnott of giant investment strategy firm Research Affiliates.

Damodaran explained the delusion this way (my emphasis):

‘The peril of a big market, though, especially in its early stages, is that the entrepreneurs it attracts and the investors who provide funding are often so enthused about their prospects for dramatic growth, that they become overconfident, leading to the businesses that will serve the new market being overpriced, at least collectively. The divergence between price and value, reflecting a more realistic assessment of the earnings that the big market can deliver, eventually leads to a correction.’

Lithium stocks are a good example.

The adoption of EVs is expanding the market for lithium. Investors and miners alike latched on to this quickly.

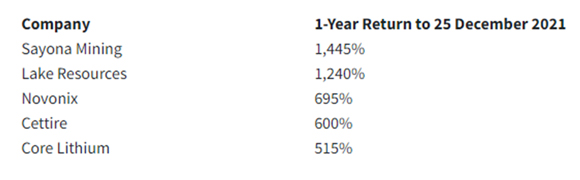

In 2021/22 there was a lithium frenzy as explorers with nothing but a dream and a drilling permit rose by 500–1000% in less than a year.

Three of the top five best-performing stocks on the All Ords in 2021 were lithium developers and another — Novonix [ASX:NVX] — is involved in lithium-ion battery technology.

|

|

|

Source: Money Morning |

Many of these lithium juniors were trading well above net present values espoused in pre-feasibility or definitive feasibility studies.

Then came the correction.

Investors realised the ‘new market [was] being overpriced, at least collectively’.

From their all-time highs:

- Sayona Mining [ASX:SYA] is down by 45%

- Lake Resources NL [ASX:LKE] is down by 85%

- Core Lithium [ASX:CXO] is down by 45%

- Novonix is down by 90%

The big market delusion may also apply to EVs themselves, not just the lithium that fuels them.

Evs and the big market delusion

Big market delusions usually stem from innovation or sudden disruption.

But the excitement of fresh vistas clouds investors’ judgement of who will flourish in the new landscape.

Rob Arnott explained (my emphasis):

‘The hallmark of a big market delusion is when all the firms in the evolving industry rise together even though they are often direct competitors. Investors become so enthusiastic that each firm is priced as if it will be a major winner in the evolving big market despite the fact this is a fallacy of composition: the sum of the parts cannot be greater than the whole.’

Big markets invite hungry entrants, punters, and entrepreneurial chancers. This competition ensures there will be winners and losers.

Instead of everyone getting a piece of the growing pie, some leave with eggs on their face.

As Bloomberg’s John Authers noted a year ago:

‘The bottom line is that the most enthusiastic backers of Evs can be completely right (just as those predicting the internet would change our lives 20 years ago were right), and yet the market can still have it totally wrong. Arnott offers airlines, an exciting industry that proved to have no barriers to entry as an example. Dot-coms were another; you were sure one online retailer would make it big, but didn’t know which, so you bought them all. This would have been fine, except they were all priced as though they would be the ultimate winner.’

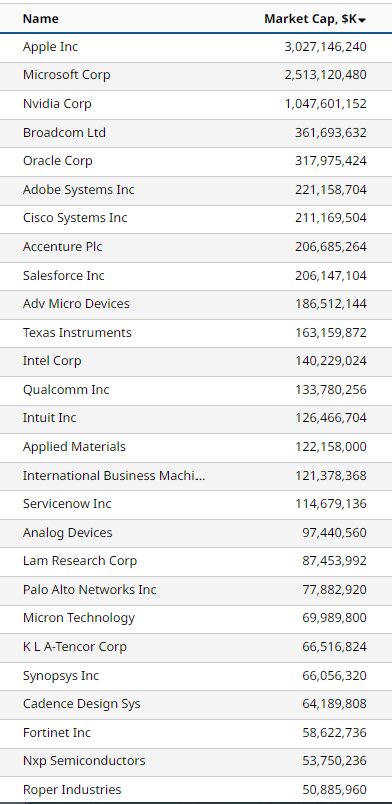

Authers offered a great illustration by pointing out the thirty largest stocks in the S&P 500 Information Technology sector 22 years ago, ‘right at the top of the bubble’:

|

|

|

Source: Bloomberg |

Many of these stocks — bid up as if they were the new winners of the huge market spawned by the Internet — either don’t exist today or are trading well below their zenith.

Here’s the list of the top thirty SP500 Information Technology stocks today:

|

|

|

Source: Barchart.com |

Evs are the future. But not every EV maker will be a winner. Remember, the sum of the parts cannot be greater than the whole.

Swap big market excitement for boring old income stocks

Do you know who doesn’t harbour any delusions about the market? Who eschews big market hype and focuses on finding undervalued companies?

Our editorial director, Greg Canavan.

This year, he’s been actively researching dividend stocks.

But not the ones you’ll see in traditional income portfolios.

Greg is on the hunt for dividends and capital appreciation — stocks that are growing and offering a healthy dividend along the way.

Greg just published a report detailing the fruit of his research — six stocks he thinks are the top dividend picks on the ASX right now.

It’s a great read, and I highly recommend it!

Regards,

|

Kiryll Prakapenka,

Editor, Fat Tail Commodities