Australian gold stock Evolution Mining [ASX:EVN] shares were flat on the release of the company’s June quarter results, and FY22 highlights.

Like other ASX gold stocks, EVN has tumbled in recent weeks, paralleling a fall in the price of gold.

The US dollar gold price fell to its lowest level since March 2020 earlier on Thursday morning, as the strengthen of the greenback is crowding out demand for gold.

Year to date, EVN shares are down 40%.

Source:Tradingview.com

Evolution’s quarterly report

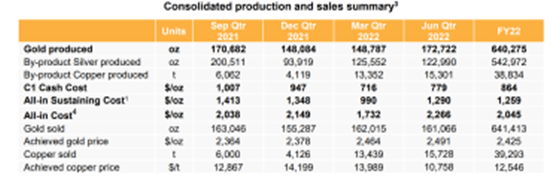

Thursday morning, Evolution presented its June quarterly report along with its FY22 highlights.

Evolution said its FY22 results were in line with its expectations outlined last month.

Here are the key highlights:

- ‘Group gold production increased 16% to 172,722 ounces in the June 2022 quarter (March quarter: 148,787oz)

- All-in Sustaining Cost (AISC) of $1,290 per ounce (US$922/oz) for the quarter

- FY22 Group gold production of 640,275 ounces

- FY22 AISC of $1,259 per ounce (US$914/oz)3 continues to place Evolution as one of the lowest cost global gold producers’

The company’s Ernest Henry mine, which the company has now owned for the past six months, has generated over $435 million in net mine cash flow, at an AISC of negative $1,680 per ounce.

At Red Lake gold, production experienced a 17% increase on the previous quarter — from March’s 33,056 ounces to 38,620 ounces.

There was also an increase of 8% in ore processed at Red Lake, 258,000 tonnes up from March’s 239,000 tonnes. The grade was also 8% higher quality at 5.11 g/t in comparison with the 4.74 g/t grading processed in March.

Evolution’s Cowal Underground has now undergone full contract completion and is scheduled to facilitate the first ore extraction by this time 2023.

Source: Evolution

EVN share price outlook

EVN generated $66.3 million during the June quarter, with cash at bank at the end of the period totalling $572.4 million.

Evolution reiterated its guidance for FY23 and outlook for FY24.

Here are the highlights:

- ‘Group gold production to grow by 25% over next two years: Guidance for FY23 is an increase of 12% to around 720,000 ounces +/- 5%, with FY24 outlook increasing a further 11% to 800,000 ounces +/- 5%

- Group AISC guidance for FY23 and outlook for FY24 at $1,240 per ounce +/- 5% (~US$870/oz2) for both years maintains Evolution’s low-cost position

- Sustaining capital guidance for FY23 and outlook for FY24 of $190 – $240 million per annum

- Major capital guidance for FY23 of $530 – $600 million and outlook for FY24 of $330 – $380 million’

How to pick winning ASX gold stocks

With the US dollar price of gold slumping further – now hovering at a level not seen since March 2021 — what’s the outlook for gold and gold stocks?

With the US dollar remaining strong, demand for gold remains subdued.

Investors are potentially seeing in the greenback a better safe-haven asset right now.

Unsurprisingly, gold stocks have been hit hard.

Now, gold may still fall further from here.

But given the growing fears of a likely recession — coupled with bets central banks won’t be able to tame inflation for a while — the safe-haven appeal of gold isn’t likely to be extinguished.

And if gold has its moment once more, what gold stocks should you look for?

How do you go about evaluating the dozens of gold stocks on the ASX?

Brian Chu recently put together a report that should help answer these questions.

In his report, Brian outlines what to look for in a winning gold stock and the types of gold stocks to consider according to your risk profile.

If you’re interested in reading Brian’s report, access it here for free.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia