Growth-focused global gold company Evolution Mining [ASX:EVN] released a two-part Investor Presentation earlier this morning. The company also ironed out details of its financial restructuring for the expansion of its Mungari plant.

Evolution says it has approved the expansion from 2 million tonnes to 4.2 million tonnes a year following the feasibility study’s completion.

The gold group found the study had produced some compelling results, with an internal rate of return ranging from 19–28% at $2400 an ounce.

EVN shares rose by 2.5%, worth $3.62 at the time of writing. In comparison, the gold stock has moved up 21% in the year so far, tracking down more than 4% in the last 12 months.

Compared with its sector EVN is down 2%, and compared with the wider market, down 4%:

Source: tradingview.com

Evolution talks funding and plans for Mungari

First thing earlier this morning, global gold miner Evolution Mining presented its highlights for the latest in operations, such as a capital investment of $250 million for the expansion of its 100%-owned Mungari plant.

The plant includes the White Foil open-pit mine and the Frog’s Leg Underground Mine, and a processing plant, all located in Kalgoorlie in Western Australia.

Evolution says that its Mungari plant will be expanded from 2 million tonnes to 4.2 million tonnes a year following the completion of the feasibility study, which has already demonstrated a compelling investment case, its internal rate of return ranging from 19–28% at $2,400 per ounce.

Evolution says the spot price will also be valued at $2,965 an ounce over a mine life of about 15 years and an 18% reduction in all-in sustained costs (AISC) to $1,750 per ounce.

At present, the Mungari mine life is estimated to reach 2033, although this will work with a significantly lower production rate and higher AISC in comparison with the approved expansion case.

Post commissioning, the group expects average annual gold production to churn around 200,000 ounces for the first five years, with a 50% increase from current production rates of about 135,000 ounces.

But it wasn’t all about Mungari. The gold group also reiterated its Ernest Henry mine life has extended to 2040, a 17-year trajectory, with copper and gold ore reserves more than doubling and an internal rate of return of 28% at $2,400 an ounce and $12,000 per tonne and 38% at current spot prices.

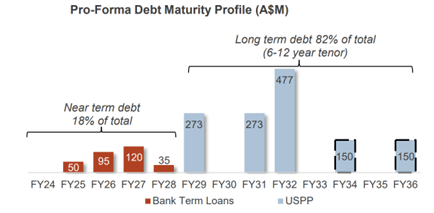

Evolution has restructured its debt profile to increase balance sheet flexibility without increasing its debt, a process which involved US$200 million ($300 million) as a US Private Placement (USPP) and a reduced $300 million four-year term loan facility.

The miner was quick to remind investors there was no increase to its overall debt level but will offer an additional $445 million of liquidity available over the next three years that was previously scheduled for term loan repayments.

Evolution’s Chief Financial Officer, Barrie van der Merwe, said:

‘We are delighted with the continued support from investors for a third US Private Placement. The placement announced today is consistent with our approach of maintaining a strong balance sheet to fund our strategy and continues to align our debt profile to our long life, high quality portfolio assets. It also maintains flexibility to continue investing in growth and provide shareholder returns.’

Source: EVN

Source: EVN

How to buy and store gold in 2023

In a world where people are feeling more pressure in their finances than ever, this makes it even more important to find ways to build and protect wealth.

How are you meant to do this with the increasing interest rates, sky-high energy bills and general dismal high cost of living environment?

Fat Tail’s gold bug Brian Chu, editor of Gold Stock Pro and host of the ‘Bullion and Bordeaux Hour’, has advice for those worried about the rapidly changing environment…and why gold just might be the answer.

Click here for Brian’s latest gold report.

Regards,

Fat Tail Commodities

Comments