In 2008, investors suddenly discovered what sub-prime mortgages are. But what if someone had warned you about them in 2006?

In 2000, investors suddenly discovered P/E ratios. But what if someone had pointed out the impossible valuations of tech stocks to you in 1999?

In 2010, the Troika became a household name in much of the world. But Greece’s boom and bust was perfectly predictable.

In 2016, polls predicted another Clinton would win and the UK would remain in the EU. But what if someone had explained why the polls were wrong going into the votes?

In 2017, I drove from Perth to Brisbane and heard the word ‘bitcoin’ at every stop. But what if someone had explained it to you in 2009?

Today, we turn to something you have likely never heard of. Just as you hadn’t heard of sub-prime, P/E ratios, the Troika, bitcoin, and the electoral college until after they became crucial to your investment portfolio, or until after you had missed the opportunity.

Let’s try and get one step ahead this time.

I’m going to reveal the not so wonderful world of Target2 to you. Fair warning, it is going to seem like a convoluted mess not worth getting to grips with. Just as all of the above did once. Until they mattered to you and you became interested too late to do anything about it.

So perhaps I should explain why Target2 matters first…

Well, Target2 is like watching European capital flight in a mirror. It peaks when the banking and sovereign debt crisis in Europe is reaching breaking point. And it’s peaking again right now. But nobody seems to be heeding the warning, yet. Because nobody knows what Target2 is, yet.

Today, you stop ignoring Target2 balances and begin to understand what they mean. A few months before everyone else cottons on.

Let’s dig in…

REVEALED: The Pandemic Market Crash Is Far from Over. Find out more.

What is Target2

When a number of countries share a currency, this creates an odd problem. If the Greeks buy a German car, their euros go to Germany. Over time, a nation with a trade deficit faces a shortage of money because of this. Which is very bad for the economy.

Target2 is the eurozone’s solution to this problem. Each time money moves internationally within the eurozone, Target2 is the mechanism by which the money is sent back again. The aim being to keep the amount of euros in each nation stable.

Over time, Target2 balances build up, reflecting how much trade flowed between eurozone nations in the past. How many more German cars the Greeks bought than the Germans bought Greek olive oil. It’s a bit like a trade balance debt.

So far, so good. But it isn’t just trade which makes Target2 balances grow. Target2 also records capital flight — a sort of bank run which takes place on a national level.

When money is escaping the dodgy banking systems of southern Europe for safer havens to the north, Target2 is the mechanism by which central banks send money back south.

It’s important to note that the Target2 transfer happens automatically. It’s a rule, or bug, of the system. The idea is to keep the amount of money in each nation stable, remember.

This means that watching those Target2 balances reveals whether capital flight is happening inside the eurozone. And capital flight precedes a national banking and sovereign debt crisis.

That’s what the Bank for International Settlements concluded, with my emphasis added:

‘In the period leading up to mid-2012, T2 [Target2] balances grew strongly due to intra-euro area capital flight. At the time, sovereign market strains spiked and redenomination risk came to the fore in parts of the euro area. Private capital fled from Ireland, Italy, Greece, Portugal and Spain into markets perceived to be safer, such as Germany, Luxembourg and the Netherlands.

‘Indeed, during that period, the rise in T2 balances seemed related to concerns about sovereign risk.’

Keep in mind that the BIS is one of the very few major institutions to warn about the 2008 financial crisis in advance.

The BIS research studied the link between the debt default risk of southern European national governments, the risk of them leaving the euro (redenomination risk), and their nation’s Target2 imbalances.

But it didn’t use logic or sequential arguments. It used observation of financial market prices and statistical analysis instead. And found the three indicators are closely related: a country’s growing Target2 imbalances signal the growing risk of a default and departure from the euro.

This is evidence that, no matter what European officials say, the market believes Target2 reveals capital flight and strain on the euro. The statistical analysis of observations of real financial market action confirm it.

That’s why I’m telling you about this obscure Target2 thing, which is even harder to explain than it is to understand. And I’m doing it now because the BIS’ views about what happened in 2012 suggests that Target2 is signalling a rerun of the 2012 European sovereign debt crisis. Target balances are hitting records once more.

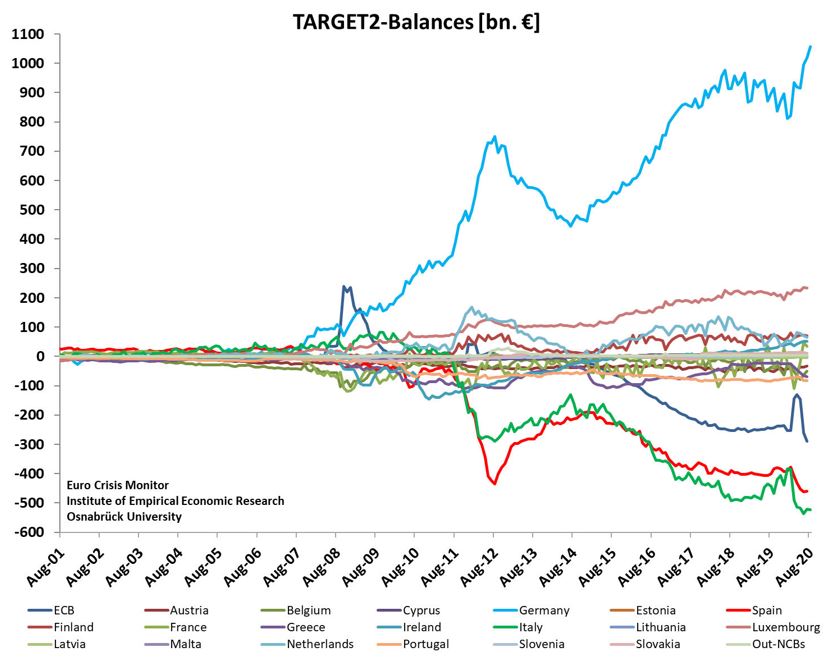

We’re back to 2012. But this time, far bigger nations than Greece are in trouble. It’s Italy and Spain with record Target2 balance deficits. As you can see in this chart.

|

|

| Source: Euro Crisis Monitor |

Professor Marcello Minenna, a Target2 expert at Bocconi University in Milan, explained what it all means:

‘The Target2 imbalances show there is something fundamentally wrong with the construction of the euro. It is a measure of pressure, and if you keep adding pressure, the glass will break at some point.’

When Target2 balances are spiking fast, watching those balances rise is like looking at Europe’s capital flight in a mirror. Why a mirror? Technically, the Target2 imbalances are a measure of the euro system’s automatic response to capital flight, not the capital flight itself.

Failing to make this distinction allows people to talk past each other when they argue about Target2 endlessly. One side is horrified by what it sees in the mirror. The other side reassures us that it’s only a mirror, so it doesn’t matter.

Who do you believe?

But that is what made the BIS study so important. By watching real financial markets, it linked the default risks of national governments, and their risk of leaving the euro, with surging Target2 balances. This suggests it really was capital flight in 2012. Capital flight bad enough to increase the probability of a default and a departure from the euro.

And now, in 2020, it’s worse.

Until next time,

|

Nickolai Hubble,

Editor, The Daily Reckoning Australia

PS: Discover why this gold expert is predicting a HUGE spike in Aussie gold stock prices. Download your free report now.