Ethereum [ETH] is sneaking up on Bitcoin [BTC].

Well, not quite.

It’s all happening in plain view.

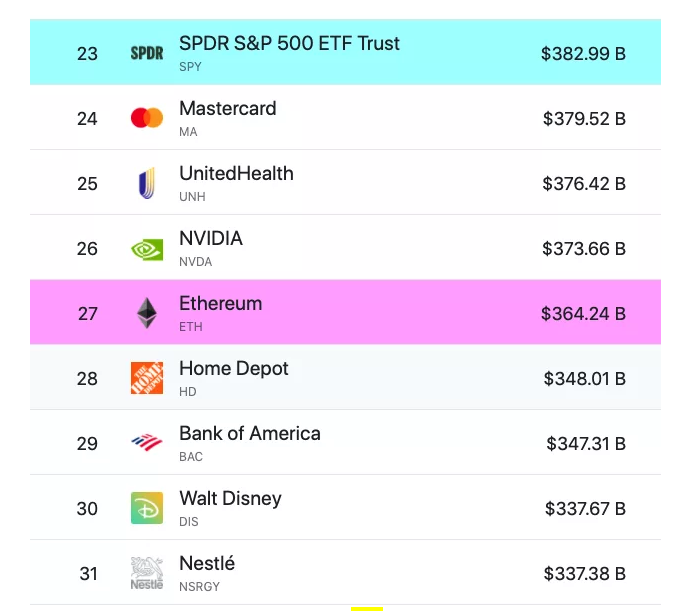

But it’s also worth keeping an eye on how ETH’s market cap stacks up against some of the biggest companies going.

For example, in the last 24 hours, ETH’s market cap in USD just moved past that of the largest bank in the US, Bank of America Corporation [NYSE:BAC].

You can see the scoreboard below:

|

|

|

Source: CoinDesk |

This move happened on the back of recent comments by Charlie Munger and Warren Buffett, which got the crypto-Twittersphere all worked up.

Buffett via his company Berkshire Hathaway has backed Bank of America for around a decade.

In 2011 when BoA was strapped for cash, Buffett plowed US$5 billion into the struggling bank in exchange for ‘$US5 billion worth of preferred shares, redeemable at a 5% premium and paying a 5% annual dividend.’

Buffett also got ‘stock warrants giving it the right to buy 700 million of the bank’s common shares at a price of $US7.14 per share. The warrants could be exercised at any point over the next 10 years.’

Not bad, considering BoA shares are going for more than US$40 a pop right now.

It was one of Buffett’s greatest deals.

So, I’m not going to sit here and get bogged down in Buffett bashing fuelled by crypto evangelism.

The man is one of the all-time greatest investors.

The more important thing is that the crypto explosion is forcing investors of all stripes to adapt and learn quickly.

Traditional finance can see the dollar signs, but will they be nimble enough?

The number of big financial players that are piling into the crypto space over the last few months is heartening for early crypto investors.

For once, the retail punter is benefiting from institutional interest.

Rather than institutions leveraging their incumbency to undermine the interests of retail investors — à la the GameStop/Robinhood debacle.

These institutions are clumsy though.

They will be scouring all sorts of niche parts of the cryptosphere for talented individuals who can help them navigate a new financial paradigm.

Just as BNPL (buy now, pay later) companies are poaching bankers to help them with regulatory and compliance issues, the big banks will be looking for crypto gurus to guide them through the changes at their doorstep.

This is borne out in coverage on bank hiring binges:

‘The US investment bank [JPMorgan] launched Onyx in October, after working on its construction for five years. It has more than 100 employees already hired within the division, working on its digital asset JPM Coin as well as Liink and other projects.

‘Meanwhile BNY Mellon, a fellow cryptocurrency bull that recently announced that it would be expanding its interest in the sector, has eight positions open for blockchain development and related services. The bank’s principal lead for blockchain and digital assets is to be based in Dublin, while other senior roles are located in Poland, New York and Tel Aviv.

‘Citigroup is similarly active, hiring for 16 roles across Israel, the US and the UK. The bank’s Innovation Lab in Tel Aviv is on the hunt for a chief technology officer, while its London office is seeking a senior vice president for the same division.’

Not all banks are as bullish on the space as the ones profiled here.

They will probably be left behind.

The big, big schism in the offing, however, is what governments do in the next three years.

Do banks that back crypto get enough of the pie to lobby governments for preferential treatment in new CBDC arrangements?

Or does the government torch the entire banking establishment for insubordination?

Whatever happens there will be a lot of competition, and established players will scramble to maintain their incumbent status.

Our Editorial Director Greg recently had his crypto epiphany and he provides a sceptical counterbalance to the relentless crypto enthusiasm of Ryan Dinse.

It’s a great watch and provides some killer insights into a rapidly evolving monetary landscape.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: These five AI stocks could potentially follow in the footsteps of BrainChip’s meteoric 3,133% price spike. Click here to learn why.