Well, once again, energy is back at the front and centre.

You’ll remember last week we left off with European gas prices spiking after Russia announced it was shutting off Nord Stream 1, the largest natural gas pipeline from Russia to Europe, for three days for maintenance.

The pipeline was supposed to come back on late last week, but…

On Friday evening, Russian Gazprom said it would have to suspend supply from Nord Stream 1 ‘indefinitely’ for repairs after finding an oil leak.

And on Monday, Russia said that sanctions made it impossible for them to fix the pipeline and that they would not be restarting their gas supplies to Europe until sanctions were lifted.

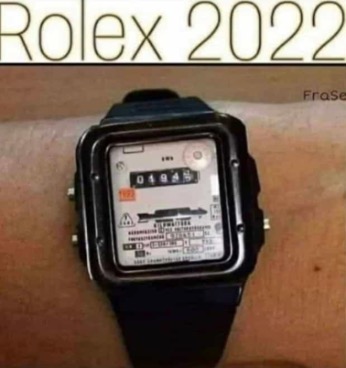

Gas prices rose by 30% just on that day…the euro fell…European stocks dropped…memes started to roll into my WhatsApp…

|

|

| Source: Selva Freigedo |

Of course, it’s likely no coincidence that all this turmoil is happening as the group of seven countries (G7) agreed on imposing a cap on the Russian oil price. Basically, the cap aims to reduce Russian oil revenues from buyers while keeping Russian oil flowing into markets.

So it’s now all a question of who blinks first…

Something interesting is happening in the LNG market…

This is all happening ahead of the European winter, which has sent shivers through the markets.

Still, it’s not all bad in Europe.

European countries have been racing to fill up their natural gas storage sites before the cold hits. Europe uses these gas storages to help during energy shocks, but they also supply about 25–30% of the fuel Europe uses in winter.

The EU had set a goal to fill up 80% of their natural gas tank storages by 1 November. Now, the good news is that Europe hit that goal two months ahead of schedule. At the moment, gas storages are at almost 82%.

So the new objective is to reach 95% by 1 November.

But of course, with flows now stopped from Nord Stream 1, the big concern is not only how Europe will achieve this but also how they can replace natural gas coming from Russia.

Europe has been trying to replace Russian energy with other energy sources such as renewable energy, nuclear energy, and increasing liquid natural gas (LNG) imports.

Now the EU is building several LNG import facilities…which isn’t great news for Russia.

But of course, all this takes time.

According to research from Bloomberg, the EU needs around 118 million tonnes of LNG to replace Russian gas. But their current LNG infrastructure can only take in about half of that.

Not only that, but Europe also faces competition from buyers in Asia. In fact, China has been a big buyer of Russian gas, with their Russian LNG imports rising close to 30% just this year.

And then, of course, there’s the question of where all that LNG being imported is truly coming from…

Here is OilPrice:

‘China has been quietly reselling Russian LNG to the one place that desperately needs it more than anything. Europe… and of course, it is charging a kidney’s worth of markups in the process.

‘As the FT reported recently, “Europe’s fears of gas shortages heading into winter may have been circumvented, thanks to an unexpected white knight: China.” The Nikkei-owned publication further notes that “the world’s largest buyer of liquefied natural gas is reselling some of its surplus LNG cargoes due to weak energy demand at home. This has provided the spot market with an ample supply that Europe has tapped, despite the higher prices.”

‘What the FT ignores, is that it’s not “surplus” — after all, if it was Chinese imports of Russian LNG would collapse. No — the correct word to describe the LNG that China sells to Europe is Russian.’

Not to mention, LNG still makes Europe dependent on gas imports that have to cross long distances.

The best solution is ramping up renewable energy. But there’s lots more we could do.

An overlooked industry that could help with energy security

One big concern for Europe — and the rest of the world — is that energy prices will increase inflation. High energy prices impact the cost of living and household and business spending.

And speaking of the cost of living…

At times like this, when costs of living and inflation are high, it’s crucial to put your money in the right places.

It’s why my colleague Murray Dawes is offering a free presentation tomorrow: ‘The 30% Nest Egg’.

You may already know Murray for his ‘Closing Bell’ videos in Money Weekend. In his presentation, Murray will show you a strategy to build your nest egg while managing risks.

You can find all the details and grab your spot by clicking here.

But one thing we may hear more of as the cost of living starts to bite is energy efficiency.

I know, I know, it sounds like a snooze. You’re probably thinking about insulating doors and windows, carpooling, and turning the heater down.

But trust me, there’s lots of exciting things happening in energy efficiency, in particular as tech begins to play a larger role in this space.

Things like collecting and analysing data, optimising energy use, smart appliances, automation, and using new materials, to name a few…

There is a lot of innovation happening in energy efficiency.

Until next week,

|

Selva Freigedo,

For Money Morning

Selva is also the Editor of New Energy Investor, a newsletter that looks for opportunities in the energy transition. For information on how to subscribe, click here.