In today’s Money Morning…price pressure bodes for a chilly winter in the north…the real gas crisis and opportunities ahead…keep an eye on this matter…and more…

Dear reader,

By now it is becoming crystal clear that inflation is a very real issue for the global economy.

The ‘transitory’ sentiment that underpinned the Fed’s comments earlier this year are looking more and more out of touch. Particularly as the Delta strain has thrown a wrench into a speedy recovery.

Globally, the story is much the same.

Inflation is cropping up in plenty of areas across numerous economies. But the place where it is likely to hurt most is in energy demand and supply.

For example, in China, the government has just done something unprecedented. They’re actually selling a portion of their vast oil reserves to try and influence prices. A move that is clearly aimed at trying to lower energy costs in order to keep their bumpy recovery on track.

And this isn’t just a China issue either.

Demand for petroleum products recently hit a record high in the US, while Europe saw the highest level of monthly demand (for August) in 10 years for gasoline.

But, fortunately for oil, OPEC is still grappling with infighting. Meaning that, for now at least, greater supply is helping keep prices in check.

When it comes to natural gas, though, it is a very different story…

Price pressure bodes for a chilly winter in the north

In the Northern Hemisphere, after a warm summer of lockdowns and air conditioning, natural gas demand has soared.

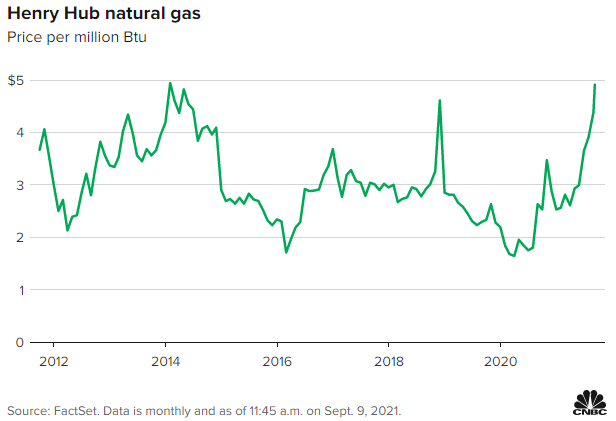

On Wednesday, prices briefly reached the key US$5 per million British thermal units (BTUs) mark. Putting this vital energy commodity at a seven-year high, after almost doubling in the past year alone.

Take a look at this rapid appreciation for yourself:

|

|

|

Source: CNBC, FactSet |

More worrying than this huge spike, though, is the fact that storage levels are also falling.

US estimates suggest that there is 17% less gas in storage compared to a year ago. Meanwhile, the five-year average too, was down 7%, showcasing the increased usage in recent months.

And, as the US and Europe head into winter, prices are likely to only keep climbing ever-higher…

For Europe, in particular, where businesses are only just starting to reopen, this huge uptick in energy prices could put a halt to any sort of recovery. Particularly as natural gas isn’t just needed for electricity, but also as a feedstock for industries such as fertilisers and steel.

But while things may be bad in Europe and the US, they are nowhere near as dire as the outlook is for Asia and Australia.

How to Find Promising Energy Stocks — Discover why the energy market is ripe for massive disruption and how to identify innovative energy stocks. Click here to learn more.

The real gas crisis and opportunities ahead

In the Southern Hemisphere, where gas prices are traditionally higher, things are even worse.

East coast Australians will be well aware of this, having seen gas prices more than quadruple.

In July last year we were averaging about $4.66 per gigajoule of natural gas. A figure that has risen by 310% to $14.45 a Gj this July…

Across the Asian export market, things are even more startling, however.

From $3.06 per Gj recorded last July, prices have soared to $20.30 a Gj!

A 563% increase in just 12 months. Driven higher by warmer weather and increased use of air cons.

So if prices only continue to rise from here as global demand climbs, we are likely in the midst of a growing energy crisis. An event that could be far more damaging for the overall economy than the threat of Delta.

All of which bodes for an uncomfortable outlook in terms of energy use and costs.

But it also opens up the possibility for investment opportunities across the energy sector.

For example, the obvious conclusion is to jump into local gas stocks. Companies that, as a whole, haven’t really been booming recently. Perhaps suggesting that a rerating and revitalisation of this energy sector may be on the cards in the near future.

Or for a more convoluted take, I believe this gas crisis may actually spur further interest in alternative energy solutions. With interest in hydrogen, battery storage, solar, and plenty more novel energy solutions likely to keep rising.

Whatever the outcome may be, though, it is clear that a solution is needed. Because the prices we’re seeing across the gas market just aren’t sustainable as is.

For that reason, as economies continue to look for ways to support their recovery, I expect we’ll see some interesting developments. All of which may open up the door for further gains in green energy and new energy investments.

So keep an eye on this matter.

Because if there is one industry that will have the most impact on the global economy in the next 12 months, I expect it to be energy markets.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.