The EML Payments Ltd [ASX:EML] share price is up 11% after acquiring Sentential Ltd and its open banking product Nuapay.

EML Payments announced today it entered into a binding share purchase agreement to acquire 100% of Sentential, including Sentential’s wholly-owned subsidiary Nuapay, an open banking product.

EML expects to process ‘in excess of A$90 billion annually’ post-acquisition.

The upfront enterprise value totals A$108.6 million with an additional earn-out component of up to $62.1 million.

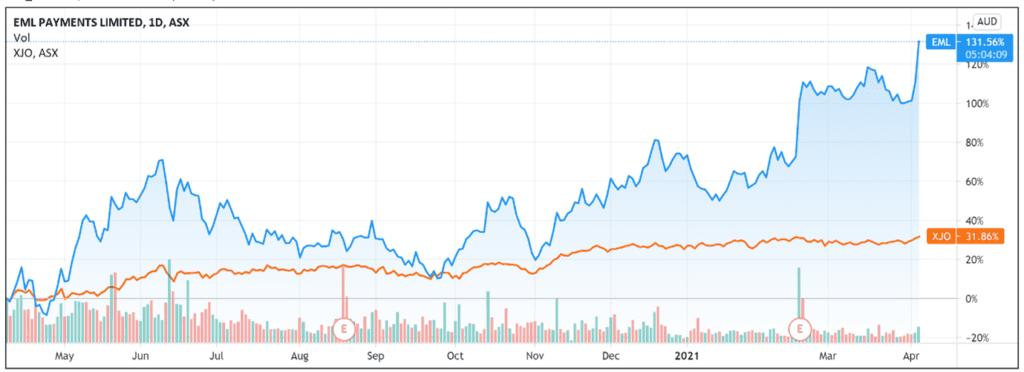

The announcement’s positive market reception continues EML’s strong share price performance, with EML shares up 30% YTD and up 125% over the last 12 months.

Source: Tradingview.com

Source: Tradingview.com

EML Payments background

EML is a gift and prepaid-card provider that is expanding its payment solution offerings.

EML’s payment solutions cover multiple segments.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

One such segment is General Purpose Reloadable cards.

GPR cards are like debit cards but are not linked to a traditional checking account. Unlike a card associated with a bank account, a GPR card is prepaid and does not permit overdrafts.

EML’s GPR offerings include gaming payouts and salary packaging, among others.

For instance, EML’s white label gaming cards allow the likes of Ladbrokes and Neds to immediately deliver winnings to customers.

EML’s other key product line is gift cards.

The company’s gift and incentive options allow businesses to distribute bespoke cards to customers, covering such things as gift cards, cashbacks, rewards, corporate gifts, and prizes.

EML also provides virtual account numbers.

Virtual account numbers facilitate payments between business clients and their suppliers with the use of a unique, single-use card number.

EML enters Europe’s open banking market with Sentential acquisition

Aiming to broaden its payment offerings to include alternate (non-card, non-scheme) payment products, EML chose Sentential as its entry into the open banking sector.

EML describes Sentential as a leading European open banking and account-to-account payments provider that uses a cloud-native, API-first, full stack enterprise grade payment platform.

The Australian Banking Association explained that open banking lets you share your banking data with accredited third parties.

This can get you more tailored banking products and help you switch products or banks more easily.

Sentenial serves four of the top seven banks in the UK, including Barclays, Lloyds, and Citibank and ‘some of the largest merchant acquirers in Europe.’

The majority of Sentenial’s business is providing direct debit, credit transfers and real-time payments for major European banks.

EML stated that Sentenial has connected with over 1,750 banks and financial institutions across Europe, servicing key customers like Worldpay and CyberSource.

Sentenial’s subsidiary Nuapay is, according to EML’s release, ‘one of only a few open banking products in the marketplace.’

Nuapay provides merchants and payment service providers with ‘interwoven money movement capabilities, reconciliation and batch settlement of transactions.’

How will EML fund the acquisition?

The acquisition will be funded by a $60.3 million cash on hand and multicurrency debt facility as well as $48.2 million in scrip consideration.

New EML shares will be issued to vendors at a 10-day VWAP to signing the agreement. The company estimates this equates to about 9.6 million shares or 2.9% of the issued shares in EML.

Further, there will be a $62.1 million earn-out consideration, contingent on achieving earn-out targets correlating to incremental open banking revenue of $41.9 million in the 12-month period ending 31 December 2023.

EML’s strategic rationale

EML wishes to expand the international reach of Nuapau’s open banking products and in turn ‘create a world-first platform of Card Issuance, Open Banking and Program Management products.’

EML stated that the acquisition can make the company the ‘leading global player and one of the largest independent fintech enablers in open banking and prepaid anywhere in the world.’

EML Managing Director and Group CEO Tom Cregan commented that acquiring Sentenial allows ‘EML to increase our Total Addressable Market by expanding our product suite, and we see a number of opportunities to cross-sell Account to Account payments into existing EML customers.’

EML Payments share price outlook

With this acquisition, EML thinks it has obtained the critical piece of the fintech offerings puzzle.

With Sentenial’s customer base and Nuapay’s open banking footprint, EML believes it now leads the race to mass market an API-based platform that serves as a single, one-stop shop for ‘all dominant account-to-account payment types.’

This includes direct debits, open banking, credit transfers, virtual account products, international bank account numbers, faster payments service and instant payments.

EML’s ambition has impressed many investors, with the stock up 123% over the last 12 months.

And today’s announced acquisition saw investor support for EML’s stock continue.

I think investors bid up EML’s shares today in part because of EML’s past acquisition success.

For instance, EML’s $265 million acquisition of fintech company Prepaid Financial Services in 2019 saw EML post record levels of revenue, transaction value, EBITDA, and net profit for the full year 2020.

The acquisition approach reflects EML’s diversification strategy as it seeks to go beyond gift cards in malls.

As EML Managing Director and Group CEO Tom Cregan told the Australian Financial Review:

‘We did not want to come out of COVID as the largest mall card provider in the world.

‘We have taken the opportunity to reimage what the business will look like in three years and we have hit the ground running.’

EML’s announcement today also revealed that the company secured a total facility of up to $225 million that will ‘provide the Group with flexibility for future M&A opportunities as they arise.’

With EML stating today that it expects to extend Sentenial’s platform to other regions beyond Europe in the ‘coming 12-18 months’, EML’s potential as a leading fintech may take some time to materialise.

The fintech sector is certainly hotly discussed at the moment as is its implications on society.

If you are excited by the possibilities of fintech and want to read ideas on potential fitench investment opportunities, then I suggest reading this free report. The report discusses three innovative Aussie fintech stocks with exciting growth potential.

Regards,

Ryan Clarkson-Ledward,

For Money Morning