On Friday Elon Musk just shot past legendary investor Warren Buffett to claim seventh place on the world’s rich list.

As you’d guess, the top 10 is dominated by tech moguls.

Amazon’s Jeff Bezos remains in poll position looking set to become the world’s first trillionaire. Facebook founder Mark Zuckerberg, Google founder Larry Page, and Microsoft CEO Steve Ballmer are all up there too.

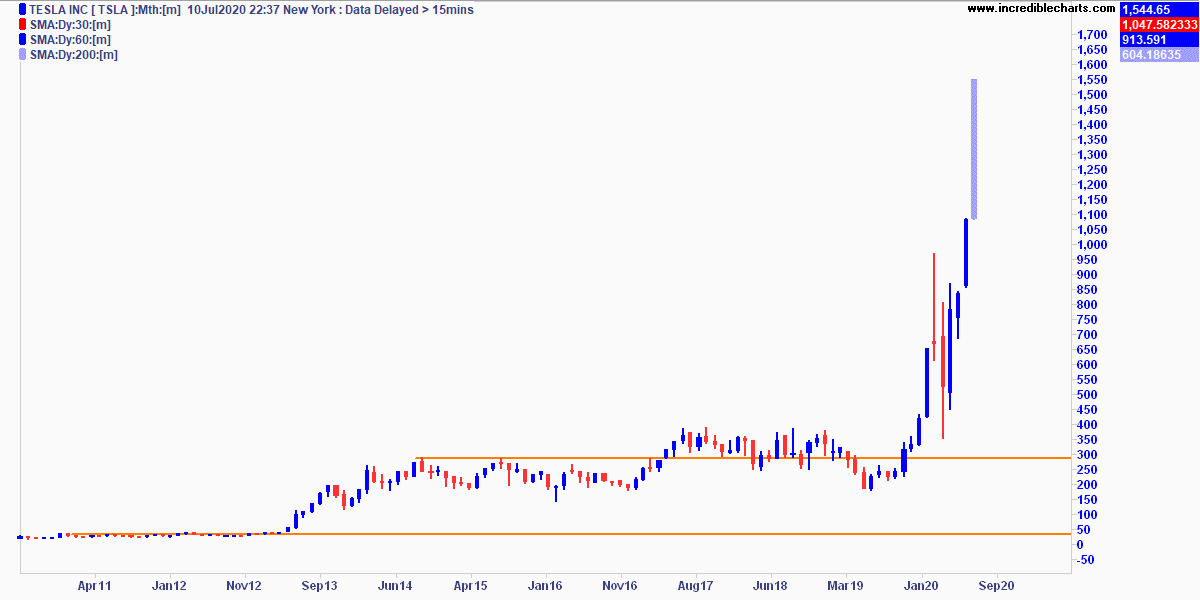

Musk’s ascendency of late was all due to Tesla’s rampant share price which continued to defy the critics.

It just hit new heights of unbelievable-ness, as you can see below:

|

|

|

Source: Incredible Charts |

The price chart looks like a SpaceX rocket launch!

This month has been a big one for Tesla, and Musk’s net worth grew by a staggering US$6.3 billion alone on Friday. And it was this day that took him past Warren Buffett.

Funnily enough, you couldn’t get two more different people than Musk and Buffett…

Musk has spent $100 million dollars over the past seven years doing up, not one, but seven California mansions. He was on the popular Joe Rogan podcast last year smoking weed.

And he’s just had a baby with pop star girlfriend Grimes, which they strangely named X Æ A-12 Musk.

Buffett in comparison lives in the same house he bought for $51,000 back in 1958, has been with wife Astrid since 1978 (though he did have an open marriage with first wife Susan), and his biggest vice seems to be a penchant for Cherry Cola.

Financially speaking, they’re poles apart too.

Elon Musk has always been cavalier with his money and a born risk taker.

Legend has it he blew his first million dollars on a sports car, which he subsequently crashed uninsured.

It’s actually quite an amazing story…

[conversion type=”in_post”]

Musk rising…

Flush from the $22 million sale of his first company Zip in 1999, Musk was showing off to famous investor Peter Thiel, who was in the passenger seat of a newly bought $1 million McLaren sports car.

As reported in the New York Times:

‘“It was a miracle neither of us were hurt,” Thiel told the New York Times in 2017.

‘I wasn’t wearing a seatbelt, which is not advisable. Elon’s first comment was, “Wow, Peter, that was really intense.”

‘And then it was: “You know, I had read all these stories about people who made money and bought sports cars and crashed them. But I knew it would never happen to me, so I didn’t get any insurance.” And then we hitchhiked the rest of the way to the meeting.’

In the same vein, Musk runs Tesla by the seat of his pants.

Always about to crash and burn before miraculously surviving — and thriving — to fight another day.

Buffett on the other hand abhors risk. He’s built his entire career on avoiding it.

In a way the relative success of the two men right now is a reflection of the times we live in…

Buffett has built up a cash pile of US$130 billion waiting for valuations to come down to what he deems an acceptable level.

Meanwhile, Elon Musk’s businesses from Tesla to SpaceX run on a line of never-ending debt ($13 billion at last count) and the hope of brighter prospects down the line, rather than any present-day financial strength.

I know he has his critics, but personally I love what Elon Musk does.

He’s a modern-day Thomas Edison, pushing the boundaries of what’s possible.

I don’t know if you caught the recent SpaceX rocket launch a few weeks back. But for me it brought back the excitement and possibility of space travel in a way I don’t remember since my childhood.

The sheer ambition of the man is unbelievable…

A consequence of cheap money

And yet, even I as a fan, am fairly sceptical of the financial strength of Tesla, in particular.

The fact is, this company wouldn’t be possible in any other era. The bankers would’ve called time long ago.

But in a world where money is almost free, and government bailouts commonplace, there’s an argument to be made that those investors backing Tesla are — in a weird and wacky way — making a rational investing decision.

The fact is, current central bank policies don’t reward the thrift and caution of Buffett.

They don’t reward the careful saver looking to put money away for a rainy day. They don’t reward the cautious businessman making sure growth happens at a sustainable pace.

No, these times reward the risk taker.

The speculator loading up on debt. The businessman who throws caution to the wind. The investor buying into stocks soaring off a hope and a prayer.

When money is cheap and debt unlimited, speculation wins.

And in the extreme monetary policy of the times we live in, it pays to be Elon Musk, rather than Warren Buffett.

This is the reality we all live in.

Perhaps that’ll change one day. Perhaps a day of reckoning is coming. Maybe the next time Musk crashes and burns, he won’t be able to walk away.

But for now, the central banks are backstopping the risk takers.

And until that stops, I say buckle up and enjoy the ride.

Good investing,

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.