Dear Reader,

Movements in the field of transportation are shaping what we can expect to see in the last few years of this cycle.

They’re affecting how land will be utilised in the next.

Remember, infrastructure and the innovation that advances it is part of what gives land its value and turns the real estate cycle.

The energy needed to fuel the new forms of transport, however, is what drives the longer Kondratieff cycle.

Transportation increases the economic rent of land.

But it can also, just as easily, steal some of it back…

Consider the elevator.

It’s the most valuable piece of real estate in a high-rise building.

Without elevators, the fancy penthouses and upper-floor apartments with stunning views would be worth little to nothing.

Before the electric elevator was invented, wealthy folk lived on the lower floors of apartment buildings, leaving the poor to climb stairs to the top floors.

Imagine for a moment that you could purchase the elevator in a building and charge for each trip.

Your ‘elevator tollbooth’ would give you a perfect means of extracting a large proportion of income and, therefore, economic rent (land value) from the site.

Without free access to the elevator, the building would be a walk-up, and rents would fall.

The more you were able to charge for each elevator trip, the less a tenant would be able to pay to rent (or buy) the apartment.

This would reduce the value of the real estate.

It might sound like a crazy concept.

But it will help you understand why ownership of transport infrastructure (as well as the locations that benefit from them) is incredibly profitable.

This is why classical economists (such as Henry George) said that transportation should be a public affair, whether utilities, information, goods, or people.

Except, of course, in our rentier economy, they are not!

I noticed in a recent news article that New South Wales Labor has promised to drastically cut the cost of road tolls and limit them to $60 a week if elected on 25 March.

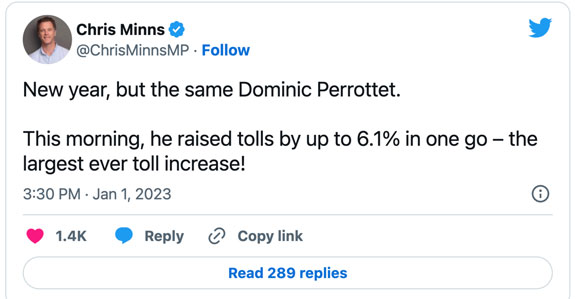

Opposition Leader Chris Minns announced the election commitment on Sunday:

‘Tolls are out of control in NSW. This mess is Dominic Perrottet’s own making — they have signed secret contracts and privatised toll roads. Those deals are driving these record tolls.

‘It’s a secret tax on families across Sydney.’

|

|

| Source: Twitter |

Sydney has the world’s most extensive and expensive urban toll road network.

It’s owned by Australia’s elevator tollbooth — Transurban.

They operate more than 20 roads in Australia and North America, including Sydney’s WestConnex, Melbourne’s CityLink, and 95 Express Lanes in Greater Washington.

The company also wants to plump up its portfolio and buy a stake in EastLink, a toll road in southeast Melbourne.

The company was created in 1995 to bid for Melbourne’s CityLink.

Citylink is the world’s second most valuable privately-owned toll road.

Over recent years, Transurban has extracted the following tolls from motorists using Citylink.

- 2013–14: $535 million

- 2014–15: $577 million

- 2015–16: $660 million

- 2016–17: $687 million

- 2017–18: $780 million

- 2018–19: $813 million

Many of their tolls are also linked to CPI, which is now rocketing.

Since 2012, Transurban’s proportional toll revenue has risen from $520 million to $1.7 billion for the first half of this financial year.

Its tolls are rising at more than three times the annual rate of inflation.

From independent journalist Michael West:

‘The Transurban model too was the brainchild of the Macbankers.

‘Indeed Transurban bought Macquarie’s toll-road assets and its “stapled security” financial model too, where the cash goes into the trust and the costs go into a company and, presto, little or no corporate income tax is paid year upon year.

‘It is hardly the fault of the bankers and toll-road tsars.

‘When public assets are privatised, management acts in the interests of shareholders and executives, not customers and workers….

‘None of this is the fault of Transurban, whose management has the flair to play the corporate rules to the limit, structure its taxes away and make large political donations to both major parties.

‘It is a succession of governments which have failed and now we have a situation where the public will be asked to step in to subsidise workers who simply can’t afford to pay Transurban’s tolls…’

Undoubtedly, Transurban is going to benefit from Australia’s population Ponzi policies in the years to the peak. That will keep land prices elevated with incoming demand while available supply remains constrained.

It makes infrastructure — ASX-listed infrastructure stocks — a space to watch.

And Transurban is not going to stop there.

For a few years now, the company have been lobbying the government for road pricing.

They want to control the mechanism.

Put simply, Transurban would like to collect the economic rent from all of Australia’s road network.

In 2021, the NSW Government examined a plan to replace car registration charges and road tolls with a direct road pricing system that would charge Sydney motorists for every kilometre they travel.

Road pricing will not be popular — but there is growing pressure for it to happen.

It’s been advocated by Infrastructure Australia, Infrastructure Victoria, the Productivity Commission, the Harper Competition Review, the Henry Tax Review, and of course, Transurban.

This is because fuel excise is threatened by the electric vehicle (EV).

Current governments have built their reputation around the myth of the need to deliver a surplus.

And if your car is not using fuel, then you are not contributing.

According to Finland-based charging station group Virta, the global population of EVs rose from two million in 2016 to 16 million in 2021.

Research based on sales data released by the Electric Vehicle Council shows that the number of electric vehicles on Australia’s roads has also seen a significant increase in the past year.

The figure has jumped from 44,000 at the start of 2022 to more than 83,000 today.

It is projected to surpass 100,000 in the near future.

The United Kingdom has brought forward its plans to phase out the sale of new petrol and diesel cars by 2030.

By 2035 all new vehicles will need to be entirely zero emissions.

The US has set a target for 50% of all new car sales to be electric by 2030.

China plans to fully electrify all public vehicles by 2025.

The list goes on…

Indeed, it won’t be long before we have autonomous ride-sharing fleets of EVs.

Uber and Google have already started the process.

Four US states have passed laws to allow them.

Uber plans on launching a fully driverless service in areas of the US in 2023.

Riders will be offered an autonomous vehicle before the trip is confirmed.

But note fully autonomous cars are designed to be shared, not owned!

Vehicles will have no steering wheels and no pedals and drive the network of roads 24 hours a day.

‘You shall own nothing, and you shall be happy,’ (It’s the catchphrase from the World Economic Forum’s vision of a circular economy, where everything is rented/shared/loaned).

The introduction of 5G will accelerate the transition…it will drive us well and truly into another wave of technological innovation.

Younger generations are growing up with a new concept of what is socially unacceptable.

Gas-guzzling cars meet that criterion — as do a host of other things.

It doesn’t matter what your views are regarding the climate change revolution and protests. The transition is underway.

It will have a dynamic effect on the land market in the next cycle — progressing the trends of decentralisation.

It’s also producing a boom in resources needed to fuel the transition that will accelerate us into the peak of the Kondratieff longwave.

I’m talking lithium.

There is no substitute for lithium in the realm of electric vehicle batteries.

The supply of the metal struggles to meet demand.

In a span of just two years, the market capitalisation of Australia’s lithium industry has experienced explosive growth.

Skyrocketing from $15 billion to a staggering $60 billion.

Innovation in this space is developing at breakneck speed.

Researchers at the Illinois Institute of Technology, University of Illinois-Chicago, and Argonne National Labs, for example, have produced a working demonstration of a lithium-air battery that can theoretically deliver an energy density that is comparable to gasoline.

It opens the potential for electric transportation of heavy vehicles such as aeroplanes, trains, and submarines.

‘…Typically, the path from laboratory to production is five years long or more.

‘That being said, just the thought of a battery that has an energy density approaching that of gasoline is cause for celebration. If true, that would move the “electrify everything” movement one giant step forward…’

(h/t Luke Cashmore — a subscriber, not a relative.)

We’re nearing the peak, but we’re not there yet!

There are a few years to go — and plenty of investment opportunities to take advantage of in the interim.

Best Wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments