In today’s Money Morning…the cost of energy is intrinsic to the cost of everything else…bad karma…imagine my surprise…egg or chicken?…and more…

There’s been lots of discussion about inflation recently. I just read through the last couple of weeks of Money Morning titles, and you can see how often it’s mentioned.

One of the main drivers of inflation that’s often cited is commodity prices. Energy is the most obvious one. If the price of oil goes up and stays up, then the price of petrol goes up.

Every physical product requires petrol to move it on planes, ships, trucks, cars, etc. The cost of energy is intrinsic to the cost of everything else.

Check out the following chart of Brent crude oil futures since the 1990s:

|

|

|

Source: TradingView |

The moves are pretty wild since the late 2000s. Notice the double top forming from late 2018 to now? I’ll talk about that a bit more in a minute.

There’s currently a lot of expectation from market commentators that commodity prices will continue to go up. There are several solid arguments for that.

Bad karma

Firstly, fossil fuels are bad karma right now. No one wants to touch them. The electric car-renewable energy future writing is on the wall. So who wants to be involved in dirty old fossil fuels?

Not investors. They want shiny new electric cars, digital currencies, and anything cloud-related. And GameStop Corp [NYSE:GME] for some reason. GameStop aside, I don’t blame them. I want to invest in new and exciting technology and things with amazing growth potential as well.

Not banks. They already have a hard time creating a positive image. There are only so many dirty things you can pull off without earning some hate. Signing up customers for products they didn’t ask for and charging them fees for services never provided is one thing. But funding dirty fossil fuels is going too far.

Certainly not governments. Well except for Australia that is. Our government doesn’t seem to be able to read the room when it comes to fossil fuels. Just look at all the controversy surrounding the Adani coal mine in Queensland. Federal and Queensland governments were criticised for providing financial and regulatory support for the project.

So all this bad karma around fossil fuels has led to less future supply capacity. Having lower supply can of course lead to higher prices. Especially if there is a surge in demand. The kind of surge that might happen as the world economy reopens and experiences dramatic catch-up growth.

This all makes sense right? Constrained supply from underinvestment plus a global reopening demand surge should lead to higher commodity prices.

So I was a bit surprised when…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Imagine my surprise

I was talking to a friend of mine who is an oil trader and they told me they believe strongly that the price of oil will fall. When I asked why they thought oil should fall, part of their response was as follows:

‘Oil price is driven by many factors, geopolitics is certainly one big one, a lot depends on OPEC+ (Organization of the Petroleum Exporting Countries) and Russia’s mood, whether they want to pump more or less. At this juncture there seems to be a concerted effort by major oil consuming countries like US, China, and Japan to counter OPEC+ producers’ cartel though.

‘China government’s intervention also affects market significantly, apart from releasing strategic reserves they recently have tried to clamp down commodities speculation in domestic market, this helps to prevent prices running too far away from fundamentals.

‘The rising of oil, gas, and coal prices to record highs during the first 9 months of the calendar year has lent support to the production ramp up, we might see price easing down in the short term, 3-6 months. At the same time, we are seeing seaborne freight starting to decline, port congestion is being resolved and trade flow might be slowing down, markets are showing signs of trending down.’

They also shared an interesting Bloomberg article that suggests that China, Japan, and the US may coordinate to push oil prices lower by releasing their strategic reserves into the market.

If I wanted to push a market in a certain direction, I would look for a way to get the most impact from the smallest amount of money spent — bang for buck. One way to do that, which governments and central banks use often, is to talk.

Tell everyone that you will ‘do whatever it takes’. I don’t even know who to credit ‘do whatever it takes’ to anymore. Was it former Fed Chair Ben Bernanke or former president of the European Central Bank (not to mention current prime minister of Italy) Mario Draghi, or Bank of Japan’s Governor Haruhiko Kuroda?

The other thing I would do is look for a place where traders will follow me. Such as a double top, as seen in the chart above. A double top is a technical signal of a potential change in market direction.

It’s an obvious setup that traders will use to get short with a tight stop. The benefit of this type of setup is that it’s so obvious that you know others are taking the same trade. Also, it’s easy to see when the trade has failed, which happens if the price continues up above the two highs.

So if the US and China can successfully push oil lower…

Egg or chicken?

Will we still get inflation?

Is oil really the answer to halting inflation? Not the trillions upon trillions of stimulus money?

In my early trading days, I used to joke that Ben Bernanke should get ‘QE 4 Life’ tattooed across his chest. QE is short for Quantitative Easing. Or printing heaps of money in the hopes that rich people don’t get nervous.

Since the financial crisis in 2008, central banks around the world have had both hands on the QE button most of the time. A symptom of interest rates being pinned at zero.

Often the fiscal policy — which you can think of as how much governments spend and save — has seemed oddly out of tune with the QE of central banks. Perhaps that’s just politicians being politicians and acting in self-interest more than common good.

But it seems as late that fiscal spending has ramped up in general. Biden has been pushing substantial government spending and handouts. We have seen stories of employers unable to get staff as there’s no incentive to work low-paying jobs when the government is paying the unemployed so well.

So how much exactly is a recently elevated oil price the cause of inflation, and how much is it just a symptom of inflation itself, and of course, good old fashioned market manipulation?

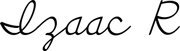

We didn’t have runaway inflation in 2012–14 when the price of oil was higher. You can plainly see that in the following chart of US inflation (Consumer Price Index) data:

|

|

|

Source: Trading Economics |

Is it possible that oil is an easy target to blame inflation on? After all, oil is being manipulated by the Russians and the Saudis. So why focus on all the stimulus cheque writing and money printing when there’s an easier target. A conveniently external target.

Is it possible that breaking the price of oil right now serves some other political purpose, that has nothing to do with inflation?

Check out this Money Morning article by Ryan Clarkson-Ledward about the ugly marriage (my words) of energy and politics. I tend to agree with him.

Until next week,

|

Izaac Ronay,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here