In today’s Money Morning…a rude reminder of the year we’ve just had…an economic time bomb is ticking…is this the only escape?…and more…

We’re back in a snap lockdown here in Victoria.

Just the five days…we hope!

The five-kilometre rule is back in place, schools are closed, gatherings are banned, masks are compulsory…just when it felt like things were getting back to normal too.

It’s frustrating.

And a rude reminder of the year we’ve just had.

But luckily a vaccine is on the near horizon and I’m confident life will get back to normal fairly soon.

You see, I did a lot of research into the technology behind the new vaccines that are being rolled out worldwide and let me tell you, it’s powerful stuff.

This is no fly-by-night quick fix. It’s the culmination of three decades of research into the field of mRNA science. And it’s a game changer.

As reported in msn.com:

‘The promise of mRNA vaccines and therapeutics for other diseases could be explosive.

‘“We have five clinical trials set up ready to do, and they’ve been delayed [by] the coronavirus,” Professor Weissman said.

‘“We’ve probably made 30 different vaccines against different pathogens.

‘“Influenza, HIV, malaria, norovirus … a whole bunch.

‘“In just about every animal model, we had 100 percent efficacy. The vaccine is incredibly potent, and it gives very strong protective responses.”’

It basically uses the same system your body already uses — that is, using mRNA molecules to deliver instructions to your genes to produce what’s needed.

Think of mRNA like software delivered to your internal ‘computer’ — your genes — in the case of COVID, to overwrite ‘bad code’.

German company BioNTech SE [NASDAQ:BNTX] — who incidentally was my pick of the vaccine stocks back in June last year — is even working on using this tech against various cancers.

This groundbreaking field is referred to as synthetic biology, or synbio for short.

You really should delve into the wonderful world of synbio if you’re keen on finding the next big thing in biotech.

But that’s not what I want to talk about today.

I want to talk about the economic ramifications of the COVID crisis and what a post-COVID world will look like.

What type of life will emerge from the rubble of COVID?

One man has put a lot of thought into this and he sees only one way out…

An economic time bomb is ticking

I first met Jim Rickards in the office at work back in 2017 when I was fairly new to this company.

Well, I say ‘met’ but I should probably say ‘saw’.

At the time I was too new and too nervous to go up and speak to him — this was the Jim Rickards for goodness sake — so the opportunity to have a chat went abegging.

As you might already know, Jim Rickards is something of a legend in the investing industry. He tends to join the dots better than most.

And he’s recently put a lot of thought into what comes after COVID.

The big problem we’ll all have to worry about now he says is debt.

Advertisement:

WATCH NOW: Australia’s ‘abandoned gold’

A revolution is taking place in Australia’s mining sector.

A new type of miner is bringing old gold and critical minerals back to life…and already sending some stocks soaring.

Our in-house mining expert — a former industry geologist — has tapped his industry contacts to uncover four of these stocks that could be next…

This from a recent article by Jim:

‘I’ve said the US is caught in a debt death trap.

‘Monetary policy won’t get us out because the velocity of money, the rate at which money changes hands, is dropping.

‘Fiscal policy won’t work either because of high debt ratios. At current debt-to-GDP ratios, each additional dollar spent yields less than a dollar of growth. But because it must be borrowed, it does add a dollar to the debt. Debt becomes an actual drag on growth.

‘The ratio gets higher, and the situation grows more desperate. The economy barely grows at all while the debt mounts. You basically become Japan.

‘The national debt is $27.8 trillion. A $27.8 trillion debt would not be an issue if we had a $50 trillion economy.

‘But we don’t have a $50 trillion economy. We have about a $21 trillion economy, which means our debt is bigger than our economy.’

The COVID situation has exacerbated what was already a huge debt problem the world over.

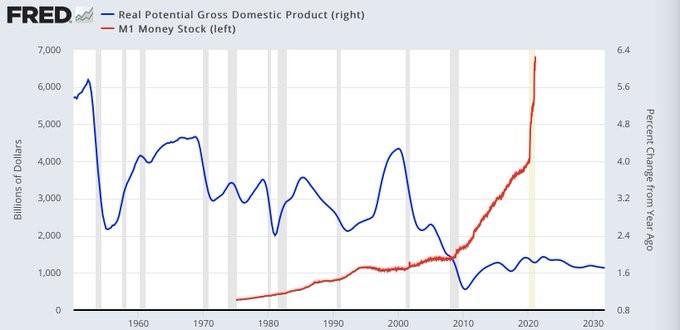

And as you can see from this chart, this exercise in money printing has proven to be a futile effort:

|

|

| Source: Federal Reserve |

That red line is the growth in money and the blue line is the rate of economic growth.

Most governments — including here in Australia — have churned out the cash, in an effort to keep the economy ticking over through COVID, but it’s barely keeping us going.

And as Jim argues we’re running out of time. An economic time bomb is ticking.

He says we’re in a debt trap with just one way out…

Is this the only escape?

Inflation…it’s the only solution.

Jim again:

‘Deflation increases the real value of debt. With deflation, the value of money increases, making it more burdensome to pay off debt. This is why debtors hate deflation.

‘And guess who is the world’s largest debtor nation? That’s right, the U.S.

‘On the other hand, inflation decreases the real value of debt. It’s easier to pay down debt because you’re paying back debt with dollars that are less valuable than when you originally borrowed them.

‘But the Fed has failed to produce inflation for over a decade now, despite all the trillions of dollars it’s fabricated.

‘Then how can the government and the Fed produce inflation now?

‘The solution is to increase the price of gold in order to change inflationary expectations. That will increase money velocity and get the growth engine running again. The Fed could actually cause inflation in about 15 minutes if it used this method.’

Maybe we’re seeing the beginnings of this happen already?

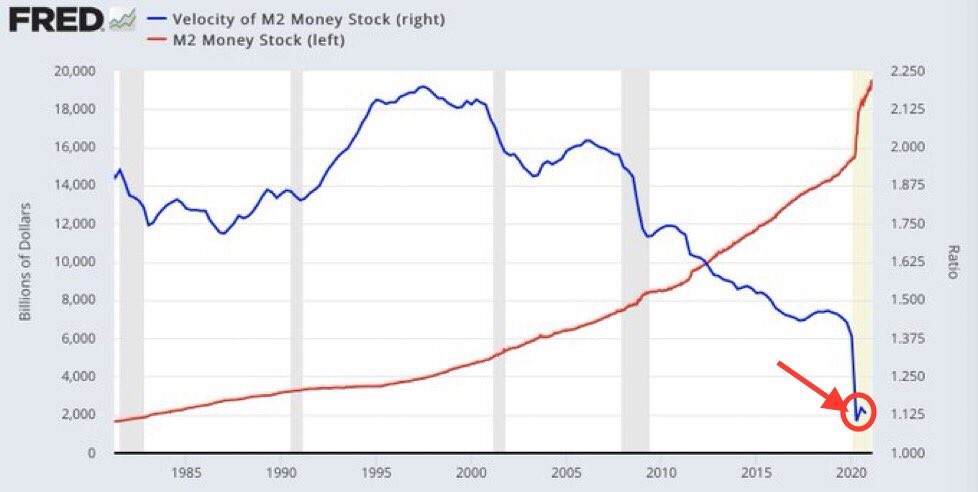

Check out this chart:

|

|

| Source: Federal Reserve |

See that blip on the far right turning up for the first time in a while?

That’s the velocity of money — or how fast money is passed through an economy.

The red line is the growing supply of money, which hasn’t done much for economic growth because as you can see the velocity of money has just fallen inverse to the growing debt.

Basically, this new money isn’t being spent quickly, it’s just contributing to various asset bubbles or idling away on bank balance sheets.

However…

If money supply is increasing as it is, all one needs for inflation to get moving is for velocity to ‘stop falling’.

We don’t need velocity to increase greatly or even in a meaningful way.

If inflations comes back in a meaningful way, that changes the game in a number of ways.

For example, interest rates could start to go back up. What would that do to property prices or stock market valuations?

You can see why this recent upturn at the far right of that chart is interesting.

But there’s a lot more to this story than meets the eye and Jim has a number of telling observations that could very well play out over the next few years.

Look out for more from Jim this week as he lays out his economic road map out of COVID.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.

Comments