In May last year, four major high-rise developments in Melbourne were fast-tracked for approval by the ‘Building Victoria’s Recovery Taskforce’.

That alone is a strong indication that we’re entering an unprecedented building boom for the second half of this cycle.

One of the buildings was STH BNK by Beulah.

The $2 billion development of residential, retail, and office spaces will soar 365 metres skyward.

Once completed, it’s going to be Australia’s tallest residential building.

Needless to say, the drawings look pretty impressive.

| |

| Source: Wikipedia |

It’s similar to One Central Park in Sydney.

One Central Park won the Council on Tall Buildings and Urban Habitat’s ‘Best Tall Tower’ award in 2014, due to its vertical garden that covers 50% of the building.

| |

| Source: Wikipedia |

STH BNK By Beulah received approval for a similar garden design.

Except, when completed, it will be ‘the world’s tallest’ vertical garden.

Think 5.5 kilometres of greenery twisting around the two spines of the tower.

The plants will be locked into planter beds so they can be managed by abseiling down the side of the building.

The owners will pay for it via hefty owners corporation fees, no doubt.

However, don’t be fooled by the flashy mock-up photos.

These types of developments don’t make good investments.

I’ve walked through more than a few high-rise apartment blocks that are showing serious signs of wear and tear just a few years post-construction.

Rarely do they look exactly as envisioned on the mock-ups.

Still, construction on this development starts next year (2022) and will be completed in 2027.

This is significant, of course.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

The timing of the tallest residential buildings opening to the public always and unequivocally gives the timing of the next economic recession.

We used this as one of our indicators to forewarn subscribers of Cycles, Trends & Forecasts of the 2020 recession — just as Australia’s last tallest building (Australia 108) opened at the end of 2019.

The pattern is easy to understand.

The tallest buildings are approved when times are good and easy money is sloshing around.

Usually, at the start of the real estate cycle.

However, because of the extended construction timeline, they typically open at the end of the cycle, when times are not quite so sunny.

High-rise blocks also tend to go up in clusters.

It leads to a lot of units hitting the market at one time.

It’s one reason why in downturns, you’ll see a capital city’s vacancy rates rise suddenly and disproportionally.

(Just as we saw during the COVID panic where an oversupply of small one- and two-bedroom apartments flooded the market, as vacancy rates soared in some areas to around 18%).

Because the ‘tallest’ is a much-publicised event, the pattern above has become known as ‘The Skyscraper Curse’.

The theory has been around as long as skyscrapers have been around.

A modern-day story of the Tower of Babel.

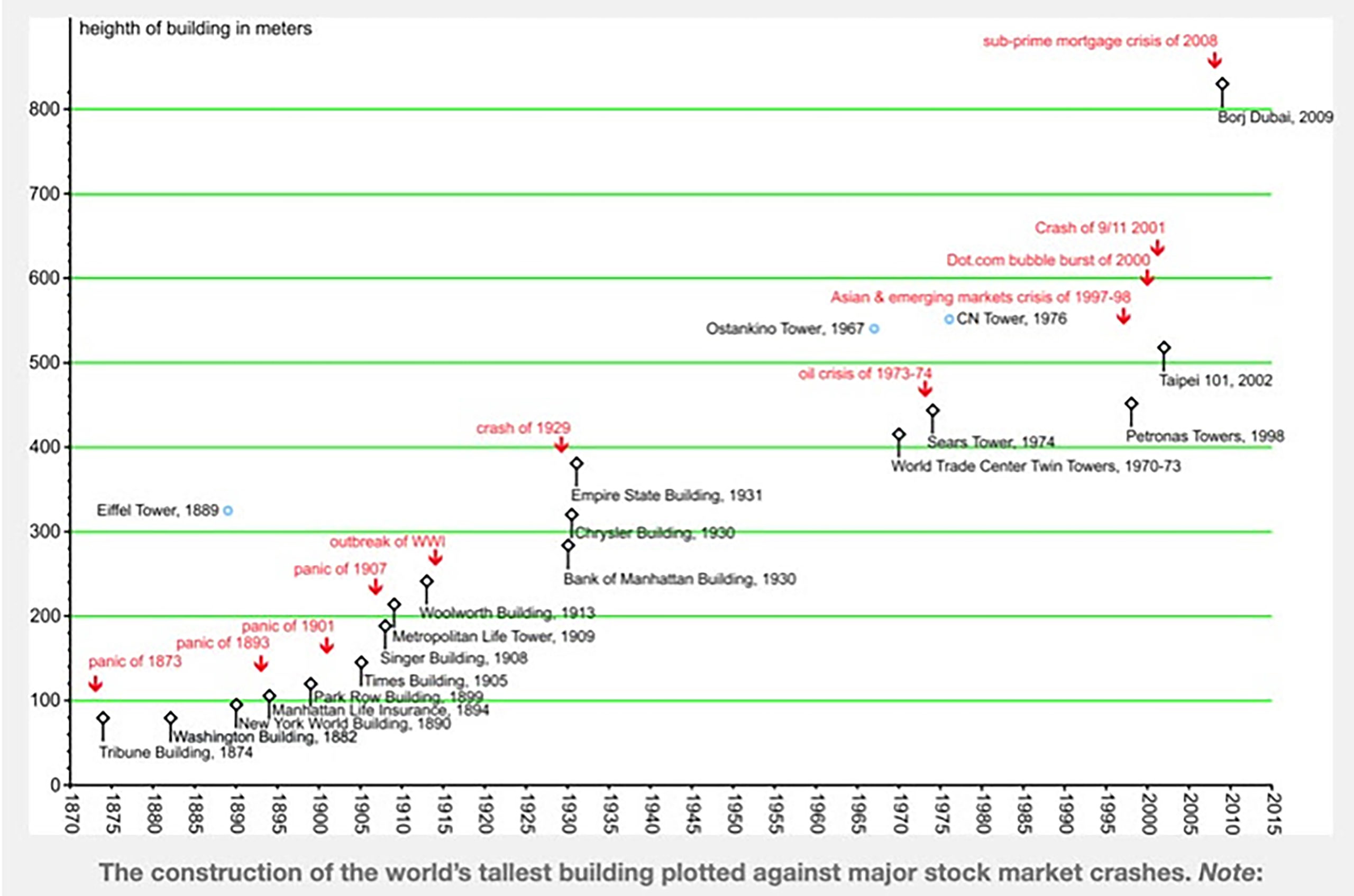

It was first (seriously) investigated by British financial researcher Andrew Lawrence.

Andrew was working in Hong Kong when he observed the simultaneous crash of the Asia Pacific stock markets (triggered by the real estate bubble bursting in Bangkok) and the completion of the Petronas Towers in Kuala Lumpur.

His research showed, empirically, that the opening of ‘the world’s tallest building’ corresponded with significant stock market crashes and major economic recessions.

The graph below, put together by Professor Eric Ross of Al Akhawayn University in Morocco, gives a good visual representation of the phenomenon:

| |

| Source: Eric Ross, Professor of Geography at Al Akhawayn University |

The ones to watch this cycle include Merdeka 118 in Malaysia.

The mega-tall structure — currently under construction — is expected to have a height of nearly 700 metres above sea level.

It will be the world’s second-tallest tower when finished and is part of a project being developed in three phases on a 19-acre site in downtown Kuala Lumpur’s historical enclave.

The completion date for the entire project is 2025/26.

That’s right at the peak of our forecast real estate cycle at Cycles, Trends & Forecasts — giving a good indication that we’re on the precipice of a downturn.

The current world’s tallest tower — which is also still under construction — is the Jeddah Tower in Saudi Arabia (formerly known as the Kingdom Tower).

| |

| Source: Wikipedia |

It’s part of the Jeddah Economic City development, which consists of 210 towers — all over 30 floors high.

If and when this is completed, the Jeddah Tower will be the centrepiece.

It will stand at a monumental 1 kilometre tall and take the title of world’s tallest building from Dubai’s Burj Khalifa.

It was supposed to open in 2020 — marking the time of recession, as per the Skyscraper Curse.

However, problems with financing and the economic hit from the pandemic halted the development.

Now, it’s back on track.

Reports are that 90% of the work on the Jeddah Economic City’s road construction and landscaping are done.

In a talk hosted by the Skyscraper Museum in March this year, architect Adrian Smith confirmed construction of the tower ‘…is going to happen. It is just a matter of time and circumstances.’

All being well, the estimated year of completion for the project is now 2025.

No surprise then that it also correlates close to our forecast peak of this real estate cycle and therefore, will likely open on the precipice of the downturn.

However, until then, it’s boom times ahead for the real estate market.

If you want to learn more about how you can advantage from it, sign up to Cycles, Trends & Forecasts here!

Best Wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.