As you probably saw markets started to get nervous last week.

We saw steep sell-offs on most major indices.

The ASX fell around 2%.

The S&P 500 2.4%.

And the tech-focused NASDAQ Index got hammered even more. It fell nearly 5%.

The reason?

The economy is looking stronger.

(Yes, we realise how crazy this seems but read on…)

A $20 trillion market spikes higher

In last Monday’s update, we discussed how rising copper prices were a sign of good times ahead.

And it wasn’t just copper; it was all sorts of commodities from nickel, iron ore, through to corn and lumber, too.

A general rise in commodity prices like this suggests a sharp increase in demand, relative to supply.

Which is a good sign that economies are getting back on track.

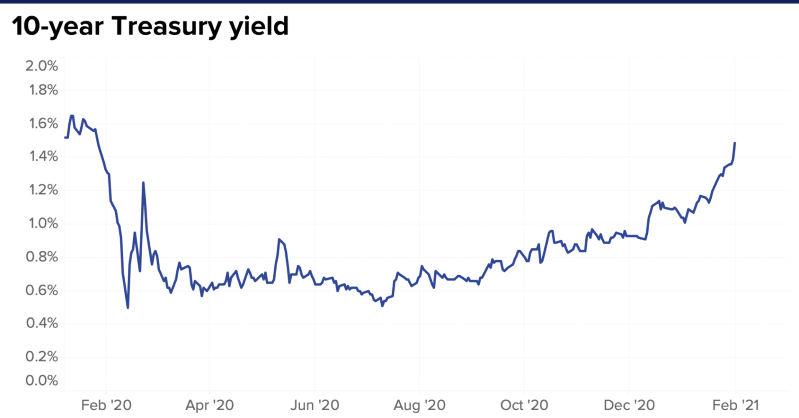

And this week there were signs in the very important bond market that added weight to the argument economic growth was on the rise.

How to Capitalise on the Potential Commodity Boom in 2021. Learn More.

You see, long-term bond yields finally started to tick up last week, a sign that the smart money was starting to see the possibility of inflation ahead.

|

|

| Source: CNBC |

Inflation usually comes about because of increasing demand. In other words, economic growth.

But, of course, rising interest rates are bad news for many stocks too. It increases their borrowing costs for one.

But it could also unwind a speculative frenzy into growth stocks with no earnings, that was premised on a near zero-rate world for a few more years yet.

If this hot money trade starts to reverse course, we could get some huge volatility in coming weeks. So, it’s no surprise the NASDAQ fell harder than other indices.

Anyway, we’ll see if this is the start of a new paradigm or just a blip in the bond market.

We’ve no doubt reserve banks will blink at any signs of market meltdown and swiftly curtail yields if they have to, so I wouldn’t be so quick to dump your tech portfolio.

Not yet anyway…

But it’s definitely something to keep a close eye on.

Putting our sensible economic hat back on, there were some more positive signs that general business confidence was on the rise too.

Let me show you where…

Money talks

Away from the economic meddling of central banks and the hyperbole of frenetic money managers, there’s one area on the ASX I watch to see how business is really going.

And that’s advertising.

Generally speaking, businesses will cut back on ad spending if they think the economy is going to get worse. And vice versa if they see good times ahead. Money talks louder than words.

We saw that to the extreme last year when businesses literally had to shut shop for months due to coronavirus.

At the time ad spend on social media and Google fell by 33%!

More traditional advertising spending fell sharply too.

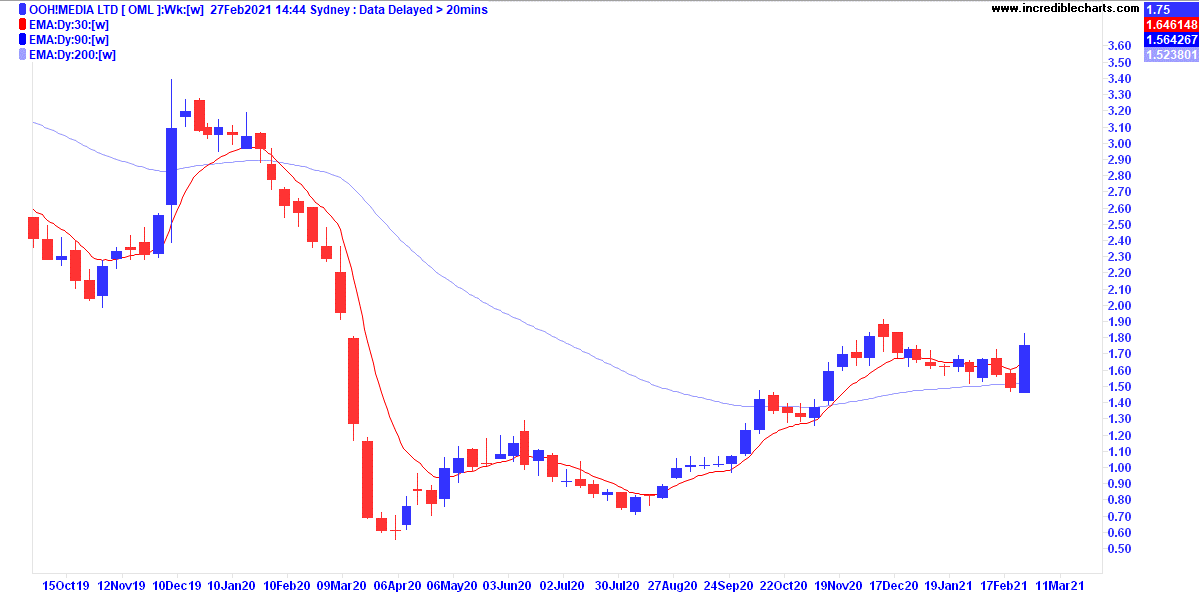

Check out the share price of major billboard owner oOH!Media Ltd [ASX:OML].

|

|

| Source: Incredible Charts |

As you can see, the share price plummeted early last year but has been steadily climbing higher since.

This steady grind higher is encouraging and was borne out of recent earnings results last week.

They reported that, while Q4 revenue in 2020 was still just 70% of Q4 2019, it was a rise from 57% versus 2019 Q3.

And January 2021 is almost back to 100% of 2019 equivalent.

In short, the trend looks good, and points to signs of increasing business confidence as companies advertise more.

The question you’ve got to answer

The general question today’s piece ponders is this:

Can economic growth actually be bad for share markets?

The answer appears to be nuanced. Bad for some stocks, good for others.

We’re definitely in uncharted waters here and I know why some people are getting nervous.

But one man I know is actually getting pretty excited right now. You see, he thinks we’re going to see some big opportunities in this ‘new normal’.

I’m not talking about investing in obscure tech stocks, cryptos, or gold miners here — this is definitely not about the kind of speccy ideas you risk a little on for the hope of big gains.

I’m talking the kind of ideas you can really use to help manage your whole portfolio.

I can pretty much guarantee you won’t find a financial adviser telling you about this stuff (I should know, I was one!), but I highly advise you tune in for a special presentation from my colleague Greg Canavan.

He’s going to dissect the current market conditions and explain how you should look to position your share portfolio.

You can reserve your ‘seat’ and find out more here.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

P.S: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments