The EcoGraf Ltd [ASX:EGR] share price rose 5.8% in early trade after EGR’s successful purification of a lithium-ion anode cell scrap sample.

EcoGraf called the result a ‘significant achievement,’ with the purification process upgrading the test material to 99.98% carbon.

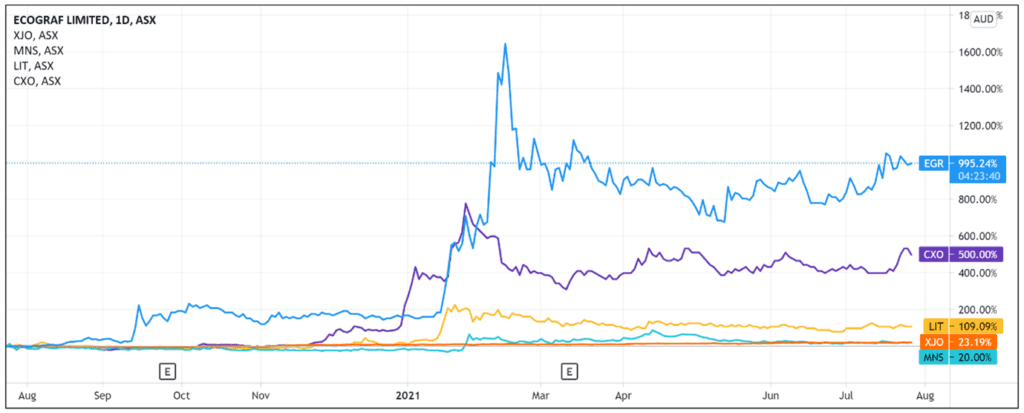

The hot interest in stocks operating in the lithium-ion battery supply chain propelled EGR shares 300% year-to-date.

Battery cell performance tests underway

Battery anode materials company EcoGraf announced positive results for its patented purification process today.

The purification test was conducted on a lithium-ion anode cell scrap sample from SungEel HiTech (SungEel).

As we reported earlier this year, EcoGraf and SungEel agreed to collaborate on battery recycling in SungEel’s European and South Korean recycling plants.

The collaboration will allow SungEel to use a tailored EcoGraf recycling process across its plants.

According to EcoGraf, today’s announced result is a ‘significant achievement’ as the purifying upgraded the material to 99.98% carbon, reducing impurities to ‘minimal levels whilst retaining the original physical characteristics.’

Importantly, the company said the results were in line with major lithium-ion battery manufacturer specifications.

What are the next steps for the EcoGraf Share Price?

SungEel will now send the purified sample for further battery cell tests to assess the potential to recycle such material back into the supply chain.

EcoGraf is hopeful, describing the sample material as a ‘high value finished product.’

Not only that, EGR believes the recycling and recovery demonstrated by the test purification can provide ‘significant benefits to battery manufacturers, including lowering of battery unit costs and a reduction in carbon emissions.’

A reduction of environmental impact is a trending topic for the lithium-ion battery industry right now.

As we reported last week, Piedmont Lithium Inc [ASX:PLL] is encountering problems from local residents worried about the environmental impact on its community from PLL’s proposed mine and processing plant.

EGR ASX Outlook

Today’s news puts EcoGraf closer to its goal of operating a battery recycling program that can help it secure a piece of the whole battery supply chain — from mine to battery parts to end-of-life recycling.

That said, while today’s successful purification test validates EGR’s technology, the company is yet to record any receipts from customers.

So today’s news may prompt investors to look ahead to how EcoGraf can commercialise its technology.

How long will it take for EGR to start generating cash from its operations? And does it have enough money in the meantime?

Regarding the last question, EcoGraf doesn’t have too much to worry about.

The company ended the March quarter with $52.4 million in cash and cash equivalents after reporting net cash losses from operating activities totalling $806,000.

So it’s cash burn is manageable given its cash reserves and its key technology is yielding positive test results.

The key now for investors is seeing how EcoGraf can ramp-up and scale this technology.

If you’re interested in renewable energy, check out our free report — ‘Renewables Revolution’ — where we show you how to take advantage of the renewables boom. The report is free to access right now, here.

If you’re interested in lithium stocks specifically, we’ve got you covered too. Here’s our free lithium report revealing three stocks that could benefit on the back of renewed demand for lithium in 2021.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report