EcoGraf Ltd [ASX:EGR] and SungEel will collaborate on battery recycling in SungEel’s European and South Korean recycling plants.

The share price of EcoGraf Ltd [ASX:EGR] is slightly down (-0.7%) as of 12.30pm today, after rising as much as 6% in early trading.

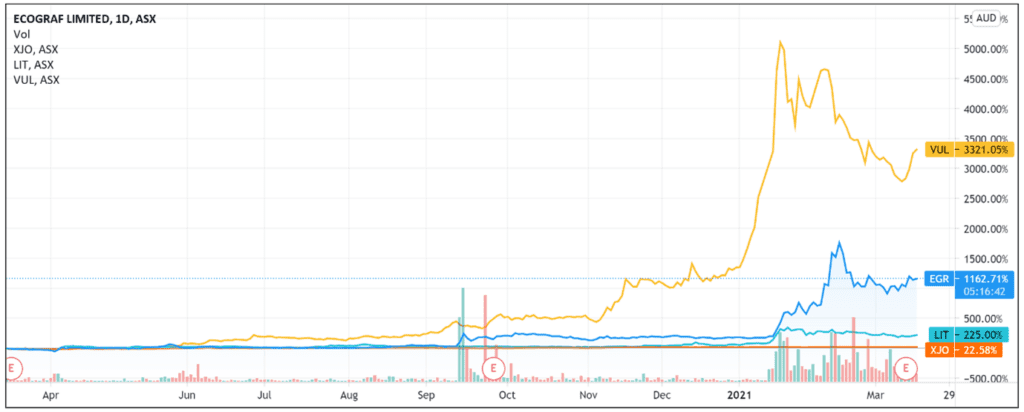

Whether one thinks governments are slow to embrace sustainable energy or not, markets have certainly shown their support for companies with clean energy projects.

As we’ve covered recently, lithium stocks like Vulcan Energy Resources Ltd [ASX:VUL] and Lithium Australia NL [ASX:LIT] are up over the past year as investors seek exposure to sustainable energy markets.

EcoGraf is no exception.

The company, which seeks to grow a vertically integrated business supplying graphite for lithium-ion batteries, rode positive investor sentiment over the past year.

Three Ways to Invest in the Renewable Energy Boom

The EcoGraf share price is up over 330% YTD and is up over 1,200% over the last year.

Source: Tradingview.com

Source: Tradingview.com

EcoGraf lithium battery collaboration update

EcoGraf’s ASX announcement revealed positive developments regarding its recent work with SungEel HiTech (SungEel).

SungEel was evaluating the viability of EcoGraf’s proprietary process to recover and re-use battery material from production scrap and ‘black mass’ from lithium-ion battery materials produced at SungEel’s South Korean plant.

EcoGraf’s process performance was sufficient for SungEel to agree to a collaboration with EcoGraf on battery recycling.

The collaboration will allow SungEel to use a tailored EcoGraf recycling process across plants in Europe and South Korea.

EcoGraf and SungEel will both co-market and co-promote their collaborative venture by ‘continuing to introduce battery partners to collaborate and support the evaluation’ of the recovered materials.

EcoGraf share price outlook

EcoGraf’s goal is to operate a ‘diversified graphite portfolio’ by supplying graphite products to Asian and European markets through its project in Tanzania, while consolidating its Western Australian multi-hub development to provide a ‘global new supply of environmentally responsible’ battery graphite.

How does today’s update inform that goal?

EcoGraf’s process, according to the company’s release, ‘will enable SungEel to close the loop on battery recycling and contribute to a Circular Economy Solution.’

According to EcoGraf, today’s update ‘provides a clear path for the company to commercialise its Ecograf recycling process with a major Asian lithium-ion battery recycling company.’

But while this could mean great news for SungEel, EcoGraf investors will want to know exactly how this will translate to improved operational performance for EcoGraf.

For instance, if EcoGraf’s proprietary process significantly improves SungEel’s performance, will other plant operators seek out collaborations with EcoGraf?

Today’s update follows news the Australian government approved major project status for EcoGraf’s battery anode material facility in WA.

EcoGraf’s share price settled flat in midday trade after jumping as much as 6% in morning trade, with profit-taking a potential explanation for the shares tapering off.

Additionally, investors may have been largely unmoved by the update as it concerned early-stage developments.

EcoGraf’s ASX update noted that SungEel will ‘review its co-investment in the piloting process once the initial engineering design is completed and costing estimates made available.’

So there is still a fair bit of uncertainty here.

If you are interested in renewable energy, check out our free report — ‘Renewables Revolution’ — where we show you how to take advantage of the renewables boom. The report is free to access right now, here.

If you’re interested in lithium stocks specifically, we’ve got you covered, too. Here’s our free lithium report revealing three stocks that could benefit on the back of renewed demand for lithium in 2021.

Regards,

Lachlann Tierney,

For Money Morning

Comments