It may be Friday the 13th, but markets aren’t spooked.

With US inflation showing signs of finally cooling, investors jumped back into stocks overnight. That is set to push Aussie shares higher, too, despite the already strong performance this week.

So, are we finally past the worst of this inflation/interest rate pandemonium?

Maybe.

It seems as though everyone is expecting a couple more last-minute rate rises and then a possible return to cuts. That’s what markets are trying to anticipate anyway, with their forward-looking nature.

There is plenty of capital on the sidelines waiting for confirmation of a lower-rate future.

But while this optimism is certainly positive for now, I worry that investors are glossing over other factors. After all, you can’t hike rates as fast as the Fed has and not expect consequences for growth.

And when it comes to such consequences, shipping containers are one thing to watch closely.

Because as we’re already seeing, American imports are slowing down dramatically…

Quiet docks

At the height of the pandemic, you may recall the huge delays in freight and shipping.

Not only was COVID causing big headaches, but rampant demand from stuck-at-home consumers led to huge congestion and costs. Even well into 2022, it was hard to see any signs of the shipping boom easing.

But that is finally changing.

Just take a look at this chart for container wait times at Los Angeles’ Long Beach port:

|

|

| Source: Bloomberg |

It’s not just a decline in volumes, either.

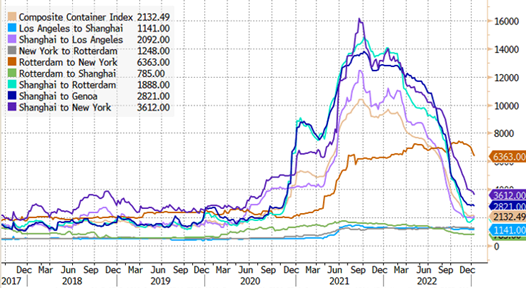

This chart shows that most shipping costs are also cratering back to pre-pandemic levels:

|

|

| Source: Zero Hedge |

In other words, demand is finally catching up with interest rate pressures. It’s the clearest sign yet that the central bankers’ fight against inflation is pushing the global economy into a major slowdown and probably a recession.

Whether markets are prepared for that possibility is hard to tell.

There is plenty of media chatter about easing GDP, but until we see it actually hit corporate bottom lines, it’s hard to tell how severe the reaction in stocks could be. This is particularly troubling when you consider the fact that there are still more hikes, albeit smaller ones, likely on the way.

As an article from ZeroHedge notes:

‘Imports are sliding as major US retailers such as Walmart, Target, and Costco pull back on orders because of high inventories. Management of these retailers noted on recent earnings calls that consumer demand for big-ticket items such as electronics and furniture has waned because of elevated inflation and interest rates, leaving them with an abundance of supply in warehouses.’

If interest rates are still going to go up for the next three or four months, is that abundance going to actually be cleared? Maybe if it becomes heavily discounted, but that’s not going to net the retailer a profit now, is it?

My point is that the damage may already be done, and markets are too fixated on slowing inflation to see the bigger pain to come. But that comes as no surprise to my colleague Vern Gowdie…

Be aware of the ‘Big Loss’

See, if you’ve ever read anything by Vern, you’ll know he’s quite the market sceptic. And he’s certainly earned that right, having guided so many of his clients, as a former financial advisor, through plenty of big market busts in the past.

So, while I’ll say that I don’t necessarily agree with everything Vern has to say, I still respect his opinion. He’s been in this game a lot longer than me — and most of us, for that matter.

But I’ll let Vern speak for himself with this recent quip on the current state of markets:

‘The Fed can only save the day IF investors want to be saved. If markets are no longer seen as a safe store of wealth, then irrespective of the Fed, panicked investors will bail…see ya, I can’t stand this anymore.

‘That’s what happened when market participants were subjected to savage mauling during the GFC.

‘Imbalances — at either end of the valuation scale — are ALWAYS corrected.

‘Cheap markets become expensive. Expensive markets become cheap.

‘That ain’t a news flash, folks.

‘Yet, amid a boom, or the early stages of a boom busting, the very notion of this rather obvious time-honoured truth seems to escape the collective thought process.

‘Markets are going full circle — cheap to expensive to cheap — has been happening for centuries…since Tulip Mania and the South Sea bubble.’

Just something to keep in mind amidst all this short-lived euphoria. Because as Vern is going to tell anyone willing to listen early next week, 2023 may be the year of ‘The Big Loss’.

If you want to hear more about Vern’s cautionary analysis and sign up for a free four-part strategy session starting Monday, go here.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.