The Apollo Consolidated Ltd’s [ASX:AOP] share price is up 5.5% today. At time of writing, shares are trading at $0.285.

Apollo Consolidated is an exploration company listed on the ASX. The company has gold mining projects in Western Australia and the Ivory Coast.

What happened with Apollo Consolidated today?

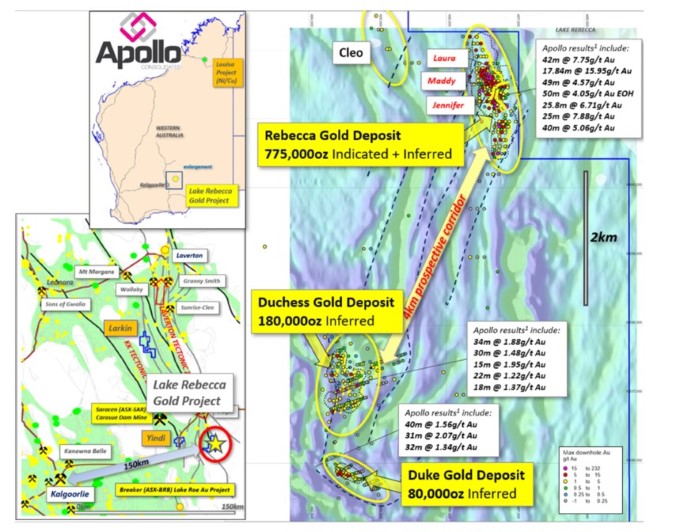

Today, the company released the results of their drilling at the Lake Rebecca Gold Project. The company owns 100% of the project, which is located 150km from Kalgoorlie in Western Australia.

The drill hole tested a target below the Maddy structure and hit 22m at 3.44 grams per tonne of gold. This included a central high-grade zone of 13m at 5.19 grams per tonne Au including one metre at 32.26 grams per tonne Au.

The intercept is located approximately 120m below the Maddy mineralised structure. The company said this ‘adds to the interpretation that higher-grade zones continue below current Mineral Resources.’

The same intercept also went through the Laura structure, intersecting eight metres at 2.84 grams per tonne gold.

Rebecca has three advanced and growing gold discoveries: Rebecca, Duke, and Duchess, with the company stating a maiden resource estimate of 1.035 million ounces.

Source: Apollo Consolidated

What’s next?

The company continues to explore Rebecca and has more follow-up drilling planned.

As at 31 March 2020, they had $16.66 million in consolidated cash. The company will also receive US$4.5 million from the recent sales of the Bagoe and Liberty projects in West Africa.

In addition, Apollo Consolidated holds a 1.2% royalty interest over the Seguela gold project in Cote d’Ivoire.

With gold trading at over US$1,700, it is attracting a lot of attention. One way to get exposure to gold is through gold explorers. Another is to own physical gold.

If you are interested in knowing more about how to invest in gold, check out Shae Russell’s step-by-step guide on the ‘Best Way to Buy, Sell and Store Gold’.

To read this FREE report, click here.

Regards,

Selva Freigedo,

For The Daily Reckoning Australia