The Douugh Ltd’s [ASX:DOU] share price is up 5% today after completing the acquisition of Goodments, a millennial and Gen-Z investing app.

The DOU share price is up as much as 9% in early trade.

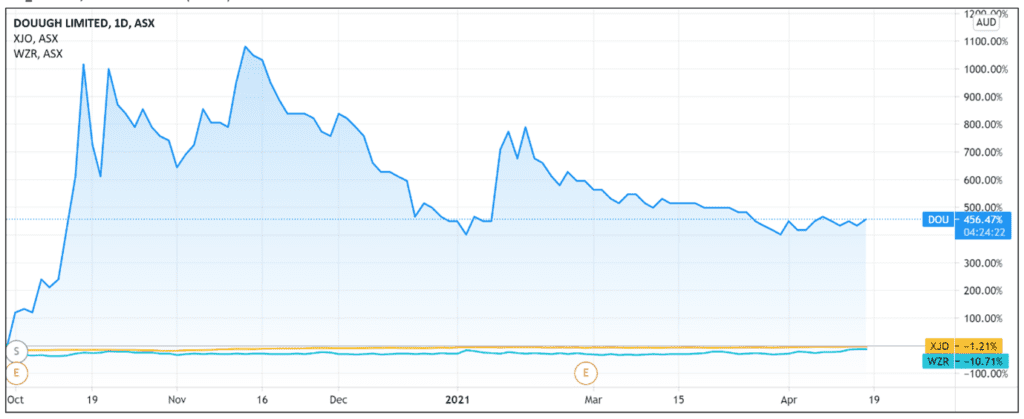

The AI-driven financial wellness app is trading well below its 52-week high of 49 cents, currently exchanging hands at 17.2 cents a share.

Nonetheless, the DOU share price is up 250% over the last 12 months.

Douugh completes Goodments acquisition to continue expansion

DOU today confirmed that the acquisition of investing app Goodments first announced on 26 February is now complete.

Douugh believes the acquisition will further accelerate its development pathways and customer growth in the US and Australian markets.

We reveal four little-known small-cap stocks that cannot be ignored…Download your free report now.

Back in February, DOU reported that the acquisition would expand Douugh’s Wealth Jars feature, allowing customers to ‘accelerate their savings goals by investing in custom-built portfolios and fractionalised single stocks.’

Importantly, the incorporation of Goodments is a ‘final major feature’ required for DOU to ‘justify introducing a monthly subscription fee.’

Douugh’s founder and CEO Andy Taylor commented:

‘In the current climate, many millennials and Gen Z’s are gravitating in record numbers to the share market to help them grow their savings and build wealth.

‘We are well positioned to give them the holistic platform they are looking for.’

As part of the acquisition, Douugh issued 8,203,542 DOU shares to the vendors of Goodments.

Who is Goodments?

Douugh described Goodments as a leader in the responsible investing space that offers ‘sustainability-minded people’ a range of managed portfolios and fractionalised US stocks like Tesla, Nike, Square and Apple.

Goodments also offers access to ETFs from companies like Ark Invest, Vanguard and Blackrock.

As of January 2021, Goodments had 12,700 app users in Australia, with 80% of users classed as first-time investors.

The average fund under management per active investor was $6,000 and the average investment value per month was $508.

Mr Taylor also noted that Goodments’ average customer age is 24 with even representation across men and women.

DOU share price outlook

Douugh aims to achieve a few things in the new 12 months.

It plans to update more features before introducing a monthly subscription fee, launch the automated money management assistant Autopilot, and introduce the managed investment portfolios Wealth Jars.

DOU stated that its focus would be ‘solely on the growth of its customer base and monthly recurring revenue.’

Mr Taylor outlined that with the Goodments acquisition complete DOU can now target customers who are currently using platforms like Betterment, Acorns, and Stash.

In Mr Taylor’s view, this should result in ‘larger average deposit balances being received and ultimately a higher penetration of customers paying in their salaries, which is our north star metric.’

Mr Taylor did not elaborate on how these customers will be acquired from DOU’s rivals.

All up, Douugh has a clear strategy and a solid product offering.

But the fintech space is heating up.

As Douugh itself noted, there are already established players like Betterment, Acorns, and Stash.

And there is always the risk of old-timers entering the fray.

For instance, Commonwealth Bank of Australia [ASX:CBA] already has micro-investing app Pocket, which offers first-time investors a list of ETFs.

As I’ve said when covering DOU’s Q3FY21 update, capturing enough of the emerging fintech market will be important.

But Douugh must also remember the importance of successfully satisfying the demands of a new generation of investors and savers.

If fintech has you excited, then I recommend reading this report on three small-cap fintechs.

Each offers a niche product that could help reorder the current financial system.

You can get the full rundown on these companies here.

Regards,

Lachlann Tierney

For Money Morning