In today’s Money Morning… a commodity boom with legs… how does the debt bomb explode?… a trillion here, a trillion there… and more…

An old market saying says that ‘bull markets climb a wall of worry.’

Investopedia’s Will Kenton explains the idea like this:

‘A bull market isn’t a peaceful place. When times are good, investors are constantly tense, wondering how long they will keep rolling, fretting about when a seemingly inevitable correction will finally put a stop to the market elation. As a market continues ascending, the decision can become increasingly agonizing whether to take profits in a position or let it ride.’

While you couldn’t say markets look worried — after all most assets from stocks to property, even to bitcoin are still moving higher — you could certainly say there’s a general angst around that the good times can’t last much longer.

This tweet I saw on Bloomberg over the weekend probably sums it up best:

|

|

|

Source: Twitter |

Everyone thinks we’re in a bubble, but no one is sure how long it is going to last.

It becomes like a game of investing chicken between investors to see who blinks first and who holds on for further gains.

Of course, we might not be in a bubble at all. Just because ‘everyone’ thinks we’re in one, doesn’t make it so.

That’s the problem with markets I’m afraid. You’re always filled with doubts on what’s coming next.

And as I wrote to my subscribers recently, although bear markets are hard on your emotions, unfortunately bull markets are too!

However, the best antidote to all this emotional angst is to forget what you read or think and simply follow the money.

What are the cold, hard facts telling you?

One of the best predictors of future economic growth is the price of copper because it is widely used in many different sectors.

How to Capitalise on the Potential Commodity Boom in 2021. Learn More.

It’s used in electrical goods (65%), it has industrial uses (25%), and it’s also used heavily in transportation (10%).

There’s also a new fast-growing use case for copper in electric cars, which use around four times as much copper as conventional petrol cars.

Anyway, because it gauges the health of the economy pretty well, many refer to it as Dr Copper.

So today, let’s have a quick look at what’s happening with copper and what that could mean for the months ahead…

A commodity boom with legs — Copper

Regular readers of Money Morning will know myself and co-editor Lachlann Tierney have been of the view that we’re heading into a new commodity boom for quite a while now.

It’s an idea we shared with our subscribers last year over at our Exponential stock Investor newsletter.

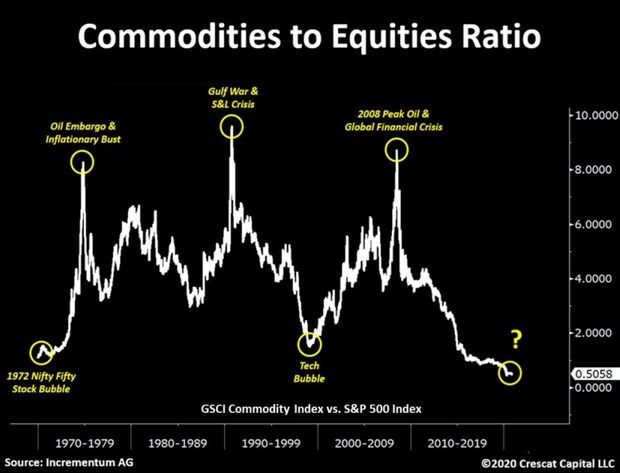

And one of our main rationales for this idea is shown in the below chart:

|

|

|

Source: Incrementum AG |

This chart shows that commodities haven’t been this cheap, relative to stocks, for at least 50 years.

And if you look closely, you can usually see such moments of extreme relative undervaluation soon results in a surge back to commodities.

That’s what we think is starting to play out now.

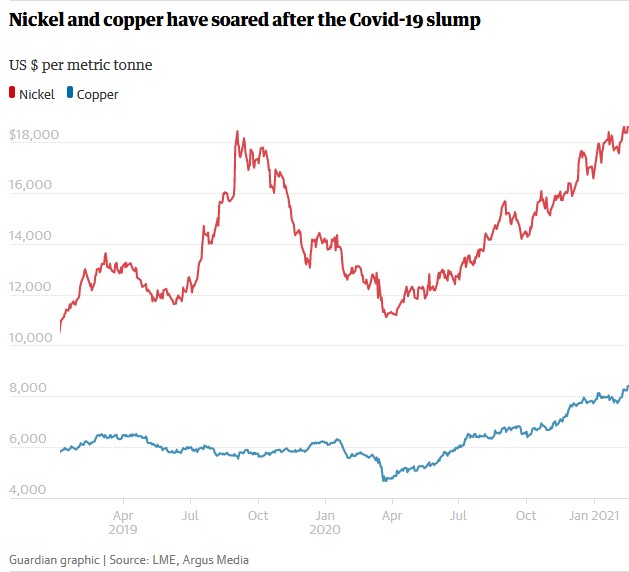

Check out the price of nickel and Dr copper, for example:

|

|

|

Source: Guardian |

Both these metals — which are key to the growing clean energy trend — have surged back in price since the lows of April last year.

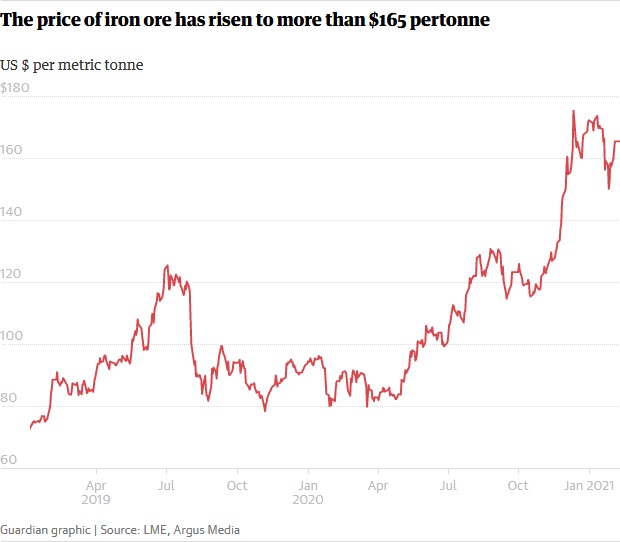

The price of the key infrastructure metal iron ore continues to defy the naysayers also.

Check out its rise here:

|

|

|

Source: Guardian |

Sure, it’s retraced slightly in the past week or two, but it’s still near record highs, and mining powerhouse BHP Group Ltd [ASX:BHP] just paid a record half-year dividend of $5.1 billion to shareholders last week on the back of this.

The usual reason for this high demand for iron ore is of course China.

Despite our turbulent relationship of late, it’s clear the Chinese are still happy to buy our iron ore in bulk.

But it’s not just China who are planning to ramp up infrastructure spending.

Europe has its big ‘Green New Deal’ and new US President Joe Biden is working out a huge infrastructure and clean energy plan too, which will come on top of the US$1.9 trillion coronavirus relief plan now in Congress.

In short, the price charts, the financial results, and the governments of the world are telling us to expect this commodities bull run to continue.

But how do we pay for all this spending, you might be thinking?

Well, that’s the elephant in the room…

How does the debt bomb explode?

JobKeeper, JobSeeker, handouts, bailouts, bail-ins…

A trillion here, a trillion there.

It seems there’s no limit to how much money we can create out of thin air.

This accumulation of debt — an issue that has previously been a source of fierce political debate — seems to have been kicked down the road by both sides of politics these days.

But it’s not going away.

And while I think a bull run in commodities will continue for this year, I am concerned about the long-run effects of all this debt.

One day it could collapse in on us.

It’s one of the reasons I’m a big proponent of cryptocurrencies and the creation of an alternative financial system outside the current system.

Because I think we’re going to need an alternative one day!

But my colleague and internationally acclaimed author Jim Rickards sees a different future playing out.

He thinks the fallout from the post-COVID money printing era will lead to rampant inflation and a new battle for monetary supremacy.

Agree with Jim or not, he’s always a riveting read and definitely gives you food for thought.

You can check out what he has to say here.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.