This is a bullshit rally.

So said Greg Canavan in an internal group chat.

Gruff, blunt, direct.

To him, the recent melt-up makes little sense.

The ASX 200 recording its biggest one-day gain in a year following weak GDP figures only confirmed Greg’s suspicions.

Real GDP per capita growth is negative year on year.

Households saved only 1% of their income in the September quarter.

And more of our disposable income is going to taxes than it has in years.

Market saw all this, shrugged, then bid stocks higher.

Some may be revelling in the Santa rally (like my colleague Callum Newman). Cal’s long said pessimism is misplaced.

But not Greg.

Like the Grinch, he doesn’t buy the festive exuberance. More on that in a bit.

But first, in this jam-packed episode of What’s Not Priced In, Greg and I covered:

- Dubious nature of recent stock rally

- Market’s new rate narrative: but is a soft landing really the most likely outcome?

- Greg’s ‘lower and sooner’ September call

- Big moves in gold and Bitcoin

- Is gold looking to march higher from here as real rates fall?

- Is appetite for riskier assets growing?

- Lithium stocks and the EV adoption paradox

- Are coal stocks cheap?

- Washington Soul Pattinson’s bid for Perpetual a sign of emerging value on ASX

Markets and narratives

Markets abhor a narrative vacuum.

Events quickly beget explanations. Whether an explanation is accurate often matters less than the fact an explanation exists.

The 24/7 news cycle worsens this.

Journalists feel pressured to contextualise daily fluctuations in stocks or tiny changes in yields.

Market commentators feel pressured to give smart answers to the same gyrations.

Everyone feels pressured to reach for the popular narrative.

Easier to parrot the prevailing explanation than stick your neck out.

Better the collective failure than individual embarrassment.

If the narrative proves false, no matter. Since everyone espoused it, no one was really wrong. It was simply a surprise, a shock, not an error.

With the Internet, narratives now run at hyper speed. They coalesce quickly…and collapse just as fast.

Look at how the ‘higher for longer’ theme is playing out.

It was the explanation du jour a few months ago. Bonds plummeted. Yields soared.

Now markets are all about rate cuts.

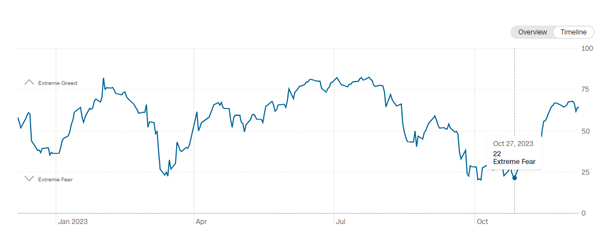

The CNN Fear and Greed index was at extreme fear at the start of November. It’s now flashing greed.

Not even the fashion industry has a turnover this quick.

| |

| Source: CNN |

Revisiting September

Consider our mid-September episode.

There, Greg argued the ‘higher for longer’ narrative will change to ‘lower and sooner’ as markets catch on to the economic reality.

Greg said (my paraphrase):

‘If I’m right about this — lack of fiscal stimulus, tight monetary policy and its lagged impacts — it will send inflation lower. And it will force central banks like the Fed to cut sooner than the market currently thinks. So the ‘higher for longer’ crowd will realise rates have to come down, and quickly. We’re at mid-September now. Let’s give it 2–3 months and see whether that view starts to shift. Because these things do take time.

‘But that would be one non-consensus that I think people should begin considering. How to take advantage? Look at gold. Gold often moves in ways opposite to real interest rates … Gold’s in a bit of a stealth bull market … No one’s really interest in gold at the moment, you hardly hear about it.’

The view did shift (and gold did move).

But it didn’t take time. And it shifted for different reasons.

Greg thought consensus would switch because of predicted economic weakness. It switched because of a predicted soft landing.

Consider this.

Last month, Goldman Sachs’s US financial conditions index recorded its biggest monthly drop in four decades.

Benign disinflation

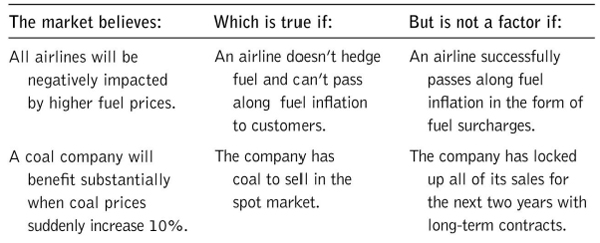

Recently, I came across a good book by James Valentine.

In it, Valentine wrote how investors go wrong by focusing on immaterial factors. Factors that don’t move the needle.

He had a great table summarising how investors can mistake irrelevant factors for critical ones:

| |

| Source: Valentine |

Now, let’s do an exercise along these lines.

The market currently believes lower interest rates are coming soon and this is good for stocks.

This is true if disinflation is benign and the economy remains resilient.

This is not true if interest rates fall because the economy is deteriorating. This is not true either if inflation remains sticky, prolonging tight monetary policy.

As Greg said, quicker than expected rate cuts follow worse than expected economic performance.

The market is positioning for rate cuts and growth. For instance, consensus forecasts have S&P500 earnings lifting 11%, with the benchmark US index trading at 18.6x those earnings.

But can you really have rate cuts and growth?

Watch the episode for the answer.

In the meantime,beware the bullshit rally.

PS: In the countdown to Christmas, Fat Tail’s awesome design team mocked up Fat Tail’s version of an advent calendar. Today was my turn. Keep sending your questions, and maybe I’ll keep wearing hats!

| |

Regards,

|

Kiryll Prakapenka is a research analyst with a passion and focus on investigating the big trends in the investment market. Kiryll brings sound analytical skills to his work, courtesy of his Philosophy degree from the University of Melbourne. A student of legendary investors and their strategies, Kiryll likes to synthesise macroeconomic narratives with a keen understanding of the fundamentals behind companies. He’s the host of our weekly podcast What’s Not Priced In where he and a new guest week figure out the story (and risks and opportunities) the market is missing to give you an advantage. Follow via your preferred channel and check it out!

Comments